Your cart is currently empty!

techINSIGHT – Worst is over for Smartphones, however the market expected to settle at 127 million units sale in 2020

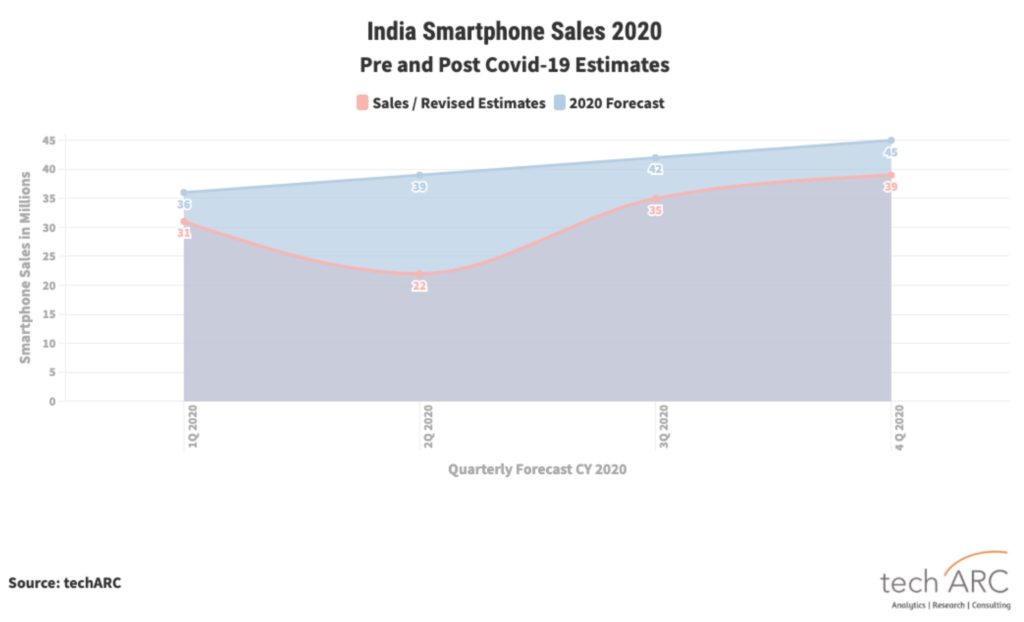

Against earlier projection of 162 million smartphones to be sold in 2020, techARC revises the estimates to 127 million for the calendar year due to impact of Covid-19 on the market impacting supply as well as demand generation.

Gurugram – Tuesday, June 9, 2020: In its revised market forecast for India Smartphone sales for the calendar year 2020, techARC today said that it estimates India to sell 127 million Smartphones compared to projected 162 million. This impact due to Covid-19, means a 21.6% less than the sales estimated at the beginning of year 2020. In terms of actual decrease compared to 2019, it will be 12.5% (down from 2020 sales of 145 million).

Segments

The contribution will remain more or less the same with Basic and Mid segments (Rs 5,001 – 25,000) constituting over 92% of the total sales. Similarly, the entry segment (upto Rs 5,000) will continue witness decline and the luxe segment (Rs 50,000 and above) will be least impacted as the propensity to spend will still remain high in that segment.

However, potential buyers will look for buying in a segment lesser than their intended segment. This is as every user would want to save as much as possible owing to uncertainties around. There will be some shift of demand from upper segments to lower ones due to this.

Brands

Since the emergence of Covid-19 situation, main OEMs (top 5) have been quickly reacting and responding to the changing market situations. This agility in brands is becoming their strength and shall play a vital role in their business continuity going forward. Due to the reason, techARC expects mild impact on market shares of top 5 brands in the Smartphone industry. Other smaller brands including the ones ranking 6-10 will be impacted the most. The niche players, however, will also be mildly impacted.

For the brands the only strategy to sustain revenues is to diversify into other categories, which they have been already doing. There are clearly product lines emerging which can be termed as ‘essential electronics’, ‘pandemic electronics’, ‘safety electronics’, etc. OEMs can diversify in such segments to leverage the consumer sentiments of leveraging from such gadgets to keep themselves safe, secure, productive as well as social.

Retail Channel

Recently, brands have introduced hyper-local O2O (Online to Offline) medium where demand is aggregated online and fulfilled through offline retail network in the catchment area of a potential customer. This could pick up well and contribute 5-7% of the total sales in coming months as the sales can be fulfilled in less than a day while reaping the benefits of buying online.

techARC estimates that the existing form of online selling through 3rd party ecommerce platforms will see some impact due to this as customers will continue to get same benefits with an addition of rapid delivery. In contrast to the online selling, which introduced the concept of flash sales, the O2O model launched can lead to ‘flash deliveries’. As customers would be wanting to buy a Smartphone out of exigency, the channel which can deliver fast will be seen adding greater value.

Conclusion

The worst period for the Smartphone industry in India seems over as both the production and sale fulfilment has started. It may still not be at its optimal, but does commensurate the demand in the market. Smartphone brands will endeavour this year to stay on track and safeguard their achievements of last year and the years before. This means there will be less of experiments and more about relevancy for the consumers. The focus will be more on being able to cater to the demand and offer the after sale support in terms of service/repair as well as continuous enhancements and improvements through software updates, etc.