Consistent revenue stream from services and value derived from data analytics key motivations to hold larger pie of the installed base capacities.

Gurugram – Thursday, January 30, 2020: As per the latest techINSIGHT released today by techARC, India had 502.2 million Smartphone users as of December end 2019. This means over 77% of Indians are accessing wireless broadband through Smartphones. Compared to 2018, there has been an increase of 15% in the Smartphone installed base, primarily due to brands like Xiaomi and Realme which continue to bring new users to the Smartphone ecosystem. Though the market does have options in the Entry segment (sub Rs 5,000) for Smartphones, users are preferring to start their Smartphone journey with Basic segment (Rs 5,001 to Rs 10,000) Smartphones.

Sharing the techINSIGHT, Faisal Kawoosa, Founder & Chief Analyst, techARC said, “After a slow migration rate from featurephones to smartphones for a couple of years, it’s good to see that the market has started to expand again. This is very critical enabler for the digital economy to grow and leveraging the Smartphones as the default platform for any kind of digital engagement.”

“Factors like availability of good quality affordable smartphones, expansion of online as well as offline channels, expansion of 4G/LTE networks by the operators are among the key reasons driving the Smartphone user growth. However, it’s going to be challenging hereon as the market is saturating in terms of addressable market,” added Faisal.

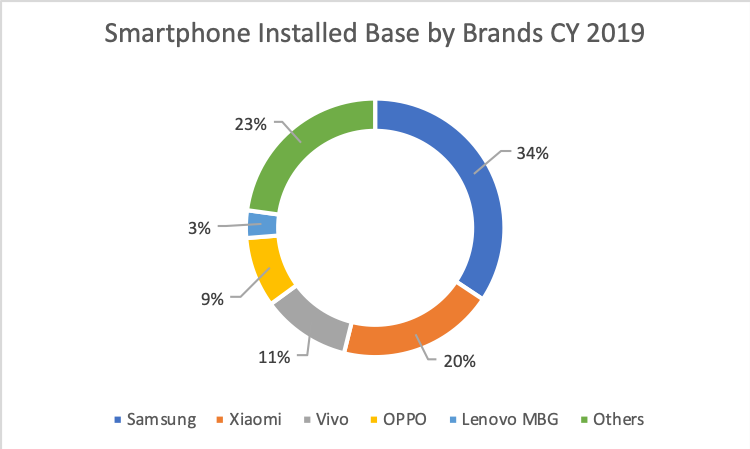

Realme, Vivo and OnePlus led Smartphone brands in terms of percentage net addition to the user base in 2019. Realme added its user base by 49%, Vivo 44% and OnePlus by 41%. Other major brands including Samsung, Xiaomi and OPPO added 9%, 25% and 36% respectively to their user base in 2019.

As smartphone brands are ramping up as services company where they could consistently generate revenue from the existing customers, active user base becomes very important measure to estimate the potential. At present, Smartphone brands are able to generate $0.5-$1.5 a month from users depending on what all services they offer including advertising. Even if a brand is able to generate $1 revenue per user per month, with a base of 50 million users to be there for average 3 years, this means a revenue potential of $1.8 billion from services alone. This will not happen in one go for any brand and they will ramp up to this level over a period of time.

At a time when user base expansion is difficult as India already surpasses 500 million smartphone users, brands have a great case of riding services on top of the active user base to generate consistent revenues. The other strategy being offering accessories and other connected electronic devices like Smart TVs and Smart Speakers. This is what can be seen from the recent (1st quarter fiscal 2020) Apple results as well, where iPhone sales have increased by 7% as against 36% and 17% for accessories and services respectively.

Outlook for 2020: techARC expects Vivo, OPPO and Realme to be the three main gainers for 2020 in terms of additions to the net user base. Realme could enter in top 5 brands by installed user base displacing Lenovo MBG (Lenovo + Motorola) brands. Xiaomi will continue to exhibit growth in user base while Samsung could start showing off decline in its user base or grow with a low percentile.