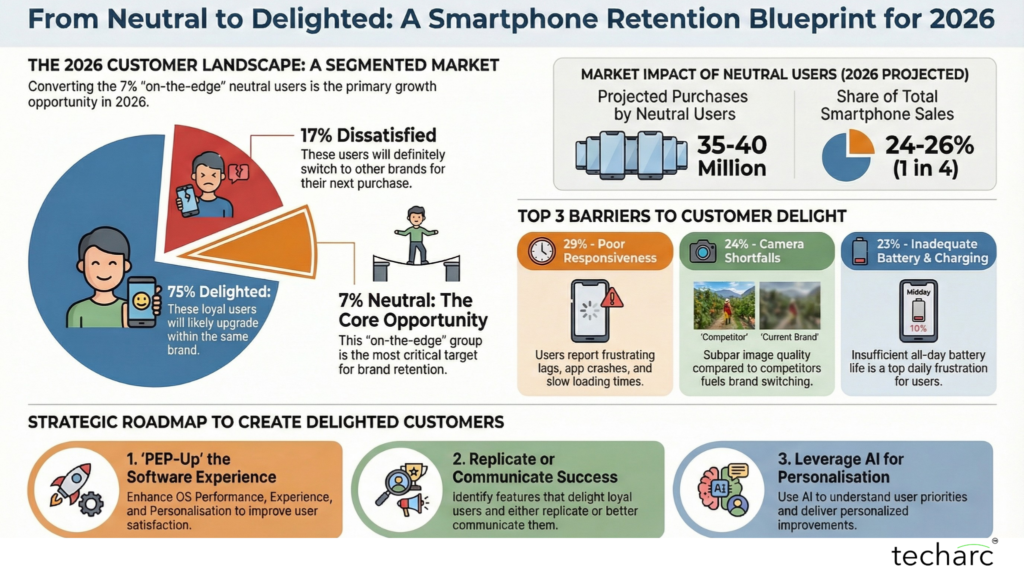

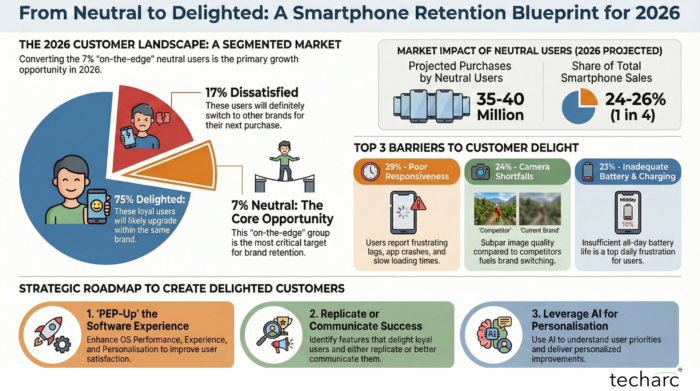

In 2026, one of the major challenges for all smartphone OEMs is finding new customers. In our recent series of RaRe Quadrant reports (check out RaRe Quadrant Report links at the end of this InsightsPro) for all key OEMs, the majority of customers fall in the ‘Delight’ quadrant, implying their high satisfaction and acceptance levels with the brands they are with. Their chances of inter-switch to other brands stand less. Equally, the new subscriber addition rate is consistently dropping, with people who could try out any brand becoming their first-time users.

The dissatisfied customers, 17% of the existing smartphone users, are definitely going to switch over to other brands when they intend to purchase their next smartphone. The satisfied customers, 75%, will intra-switch within the brand to the next segments for upgrade and replacement. In simpler terms, the industry average NPS stands at 75, meaning 75 out of 100 smartphone users are likely to stay with their own brand as well as recommend it to others. These users are not going to switch to competition brands and convincing them would need a disruption coming from brands to trigger their switchover. This isn’t happening as per present trends, where innovation has hit its lowest in the smartphone industry.

In this scenario, the low-hanging customers for smartphone brands are neutral opinion users who are on-the-edge of delight, and some focused attention from smartphone OEMs can convert them into delighted customers and secure them for the future by retaining them within the brand and improving their NPS. This will translate into better intra-switch for brands, where customers will be stepping up to the next segments/series of smartphones, and brands are offering improving their margins as well as profitability.

In 2026, our estimates are that 35-40 million smartphones will be purchased by such neutral sentiment customers. This is approximately 24-26% of the total smartphones expected to be sold in 2026, effectively 1 out of 4 smartphones will be purchased by a neutral sentiment customer. This makes it a critical cohort of smartphone users influencing the overall market standing and market shares of all the smartphone OEMs.

Smartphone OEMs don’t just need customers in 2026; they need delighted customers because these are the ones who can be sold services as well, improving the LTV or lifetime value of the customer base brands enjoy in India. Even from a hardware upsell perspective, where some of the brands like Vivo and Oppo have introduced telephoto extenders, etc., which have a higher chance of purchase by customers if they are delighted.

Recommendations to Improve the User Experiences

1. Prioritise Responsiveness (29% Impact): Fluid OS and optimizations convert 1 in 3 neutral users to advocates. While all the major smartphone OEMs have charted out their OS strategy in 2025, it’s now time to focus on improvements to minimise the lag, improve the responsiveness of touch, and deliver effortless interaction with the smartphones.

2. AI-Powered Cameras Are Non-Negotiable (24% Impact): Superior imaging at competitive prices combats churn against rivals. The camera still is not losing the spotlight. Users are still highlighting areas of improvement in cameras that require fine-tuning for them to get the desired results. AI can be extremely beneficial in fine-tuning the camera performance.

3. Battery and Charging Overhaul (23% Impact): All-day endurance with 65W+ charging addresses the top daily frustration. With the daily usage span increasing, the richness and immersive experiences being delivered and the compute and performance focus in smartphones, the battery management needs to be efficient on both the ends – charging of battery as well as the actual usage.

- Primary concerns of users keeping them short of delightful experiences

Neutral sentiment users consistently highlight three dominant issues, accounting for over 75% of their concerns. These barriers erode perceived value and hinder word-of-mouth advocacy.

- Responsiveness and Device Interaction (29%): Users frequently report lag, hanging, app crashes, software bugs, and slow loading times. These issues disrupt daily workflows, from multitasking to gaming, making the device feel unreliable despite competitive hardware specs.

- Photography and Videography Shortfalls (24%): Nearly a quarter complain about subpar image quality, unmet expectations at the price point, poor video stabilisation, and absent OIS/EIS. Comments like “competitor offers better cameras for less” underscore how imaging lags fuel brand switches.

- Power Efficiency and Battery Life (23%): Battery drain falls short of expectations, with slow charging, overheating during top-ups, and insufficient all-day backup for moderate use. This frustrates on-the-go users reliant on their devices for productivity and entertainment.

2.0 Secondary issues impacting user satisfaction

Beyond the top trio, two areas emerge as notable friction points:

- Audio-Visual Experience (8.5%): Complaints centre on weak sound output, insufficient speakers, lack of Dolby Atmos support, and poor microphone clarity, diminishing media consumption and calls.

- Longevity and Sustained Performance (6.7%): Users question build durability, long-term value, and display resilience (e.g., fading in sunlight or lacking robust protection like Corning Gorilla Glass).

3.0 Strategic Path from on-the-edge to Delight

Techarc proposes a three-pronged roadmap for smartphone OEMs to increase the satisfaction levels of smartphone users from a neutral sentiment to a delightful sentiment. By adopting these measures, smartphone OEMs will be able to increase their NPS, widen the feeder base for intra-brand upgrades and replacements, and open up avenues of revenue from services.

3.1 PEP-UP the software experiences

Using Techarc’s P-E-P framework for benchmarking operating systems, work on specific areas to enhance the Performance, Experience, and Personalisation score of the software, improving the overall user satisfaction. The operating systems announced by all major OEMs have already created a layer of differentiation. Now, the endeavour should be on building delightful experiences.

3.2 Replicate or Communicate the Delight

Deep dive into the delight factors through RaRe Quadrant and CAST analyses frameworks to identify the reasons that have already delighted a wide base of smartphone users. Replicate these strategies by delivering similar experiences to these customers. If the experiences are already mapped, then identify the communication gaps and create cohort-level messaging, adding to the customer awareness so that they can make the best of their smartphones.

3.3 Leverage AI to personalise improvements

With the help of AI, understand the top use cases and priorities of individual users or user cohorts representing the neutral sentiment. Create a personalised improvement programme aligning with their priorities and elevate their sentiments. This can also be explored as a monetisation stream for some identified cohorts. For instance, if the programme suggests camera improvements for content creators, it could be offered to them as a premium add-on.

4.0 Conclusion: Maximise the Delight Cohort

New customer acquisition is always a challenge. In 2026, acquiring new customers is going to be even more challenging for smartphone OEMs for the reasons outlined in this InsightsPro. In a year, when cost optimisation will be a key focus to absorb the fluctuating situation in the supply chain of key components like storage, memory, and chipsets, arresting inter-switch of users will be paramount. This can only be achieved by achieving an ideal state where every customer is delighted. In a realistic market condition, this is impossible. However, addressing the gaps of the on-the-edge cohort, smartphone OEMs can widen the base of delighted users and achieve business as well as financial goals in conditions that are likely to prevail in 2026 and remain so for a couple more years.

RaRe Quadrant Reports 2025

The Cautioned Outlook for 2026 – ‘Bermuda Triangle’ Situation – Techarc

January 23, 2026[…] […]