The smartphone industry continues to be dynamic in many ways, including constantly improving customer centricity and elevating customer delight through premium and rich experiences.

While there is a visible dip in the pace of innovations, the novelty additions continue to keep the space excited. At the same time, the focus on proactively reducing the gaps to mirror customer expectations persistently continues.

In this InsightsPro, we identify the priority areas of improvement for the smartphone industry, which, if addressed, will further elevate the customer delight. The analysis leverages negative comments of more than 9000 buyers of smartphones who shared their pain points concerning various issues and challenges that have retarded their experience levels from this omni-gadget.

Key Insights

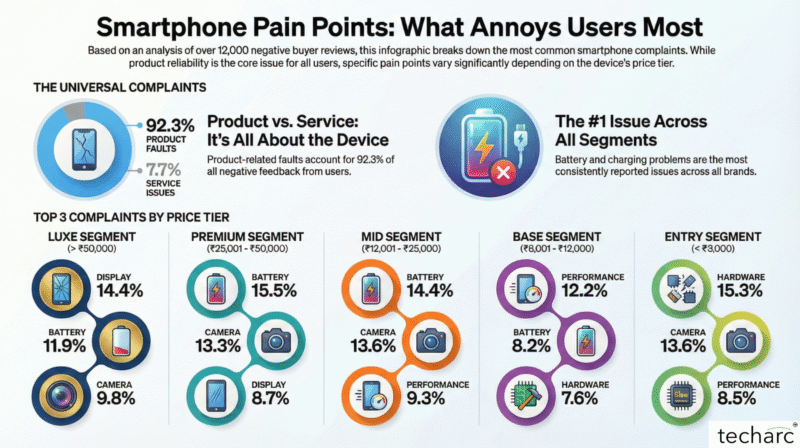

- Product Reliability Is the Core Concern: Across all price segments, product-related issues (e.g., battery, performance, camera, display) persist as the overwhelming source of complaints, over 90% of all feedback, while service concerns remain secondary.

- Most Repeated Issue Across Brands: Battery/charging problems are the most repeated and consistent issue cutting across all brands, segments, and price tiers, often ranking as the top source of dissatisfaction in users.

- Segment-Specific Pain Points: Luxe and premium buyers focus most on display, camera, and battery issues; mid and base segment users are more concentrated on performance, battery, and basic reliability. Entry users emphasize hardware problems, camera, and device malfunctions as their biggest dissatisfiers.

- Service and Support Still Matter: While product faults lead, the frequency of complaints about delivery, service, and replacement highlights the importance of after-sales support, particularly in luxe and base segments, often being the #2 or #3 issue for certain brands and segments.

1.0 Universal Consumer Pain Points

Across major smartphone brands, our analysis shows that product-related issues account for the vast majority of consumer complaints, representing 92.3% of the total. In comparison, service-related complaints comprise 7.7% of overall feedback. The top three product concerns are battery-related issues (12.9%), camera problems (11.5%), and performance-related deficiencies (9.3%). These findings indicate that, despite advances in hardware and design, manufacturers should continue to focus on improving battery efficiency, optimizing camera performance, and enhancing overall system reliability as key priorities for 2025.

2.0 Segment-Specific Reliability Benchmarks

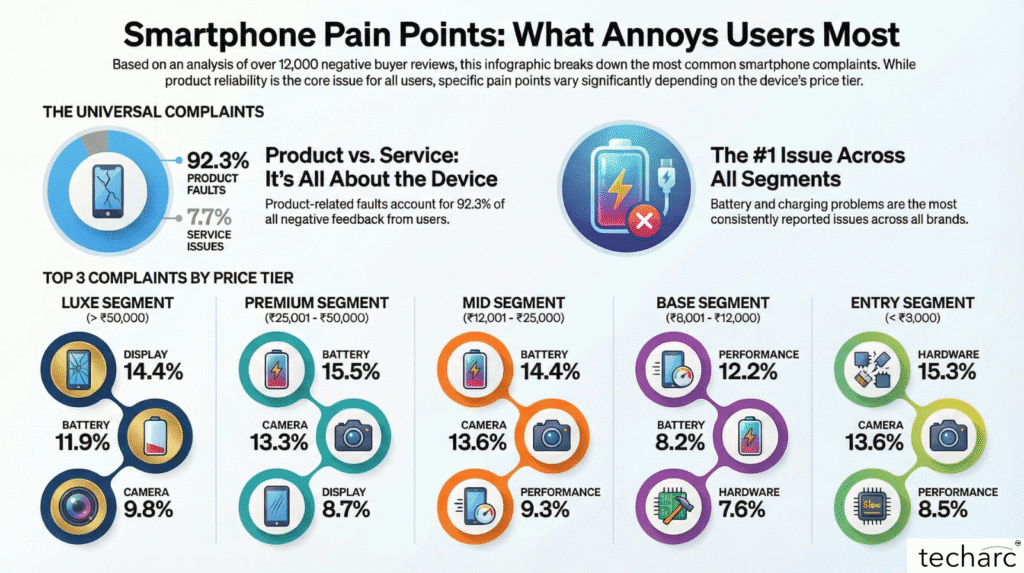

Consumer expectations and the nature of their reported issues vary significantly by market price tier. The following breakdown provides a benchmark of the top reliability concerns within each of the five key market segments

2.1 Luxe Segment (More than ₹50,000)

In the luxe smartphone segment, approximately 89 percent of reported issues are product-related, while service and replacement concerns account for over 11 percent of complaints.

The top three product issues identified within this premium category are:

- Display: 14.4%

- Battery: 11.9%.

- Camera: 9.8%.

These insights underscore the need for ongoing enhancements in display technology, battery performance, and camera quality among luxury smartphone brands.

2.2 Premium Segment (₹25,001-50,000)

Product-related complaints dominate the premium smartphone segment, accounting for approximately 93 percent of all reported issues, while service-related complaints constitute only 7 percent. This suggests that consumers place considerable emphasis on device functionality and reliability over service experiences in the premium category.

- Battery: (15.5%): Persistent problems with battery life and charging indicate continuing consumer expectations for longer-lasting, quicker-charging devices.

- Camera: (13.3%): Complaints about camera performance highlight users’ growing demand for better photo and video quality, even in high-end models.

- Display: (8.7%): Problems with screen quality or touch responsiveness remain a notable pain point, pointing to the importance of user interface experience.

2.3 Mid Segment (₹12,001-25,000)

Product-related complaints are by far the most prevalent in the mid-range segment, accounting for around 93 percent of issues, similar to premium devices. And 7% complaints about the service and replacement.

The top three issues or concerns in the mid segment are as:

- Battery: 14.4%

- Camera: 13.6%

- Performance: 9.3%

These categories represent the most significant sources of user dissatisfaction for mid-range devices, highlighting the need for manufacturers to address general device reliability, battery performance, camera quality, and system speed.

2.4 Base Segment (₹6,001-12,000)

In the basic smartphone segment, product-related complaints make up the vast majority, accounting for approximately 93.8 percent of total issues. These product complaints include device performance, battery/charging, defective/not working, connectivity, display, camera, audio, software, heating, accessories, and build quality.

Service-related complaints, which focus on delivery, service, or replacement experiences, represent about 6.2% of total reported issues.

- Performance: (12.2%)

- Battery: (8.2%)

- Hardware: (7.6%)

These results indicate that users of basic smartphones are particularly dissatisfied with device speed and responsiveness, battery reliability, and hardware faults. Addressing these areas should be a strategic priority for manufacturers aiming to improve user experience in base level devices.

2.5 Entry Segment (Up to ₹6,000)

In the entry segment almost all the concerns are related to the product and the top three issues are with:

- Hardware: 15.3%

- Camera: 13.6%

- Performance: 8.5%

Product reliability problems, such as defective units and camera performance, are the leading sources of dissatisfaction for entry-level smartphone users. Performance lags and hardware-related concerns follow closely behind. No significant service-related issues are represented in this segment, showing that basic device functionality is the primary focus for buyers at this tier.

About the Analysis

This analysis is based on user comments and reviews with 1- and 2-star ratings from all the leading e-commerce platforms. In this particular analysis, 9053 such reviews pertaining to 2025 were analysed using Techarc’s proprietary AI-ML algorithms to theme out the concern areas. Techarc themes reviews in more than 12 areas, which include product – camera, battery, display, OS, design, etc., price – discounts, offers, net effective price, etc., service – after sale, spare parts, etc., and market – delivery, packaging, etc.