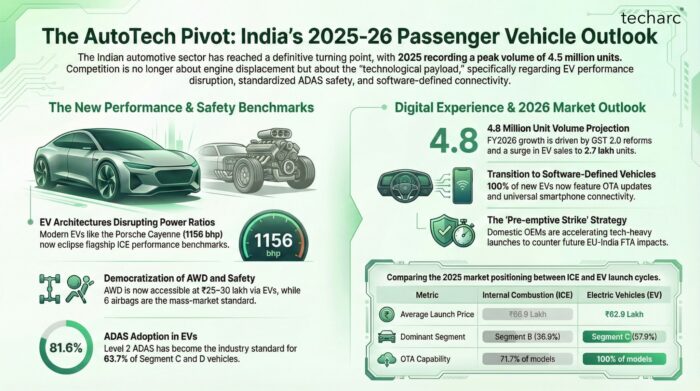

The Indian automotive sector has undergone a definitive strategic pivot. In 2025, technology transitioned from a peripheral luxury to the primary technological payload driving the consumer experience. Modern Original Equipment Manufacturers (OEMs) are increasingly utilizing AutoTech scores, a proprietary metric measuring consumer-facing technologies across performance, safety, and connectivity, to differentiate their offerings in a market undergoing structural recovery.

The 2025 performance data illustrates a resilient industry that achieved a record volume of 4.5 million units. Despite stagnant demand in entry-level mass-market segments for much of the year, the launch calendar remained aggressive, featuring 130 new models. The split between Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs) reveals a strategic land grab in the mid-size categories as EV architectures begin to disrupt traditional price-to-performance ratios.

The following table benchmarks the market positioning and pricing of the 2025 launch cycle:

| Metric | Internal Combustion Engine (ICE) | Electric Vehicles (EV) |

| Total Launches | 92 Models | 38 Models |

| Average Launch Price | ₹66.9 Lakh | ₹62.9 Lakh |

| Dominant Segment | Segment B (36.9% / 34 models) | Segment C (57.9% / 22 models) |

| Entry Price Point | Renault Kwid 1.0 RXE | Vayve Mobility Eva (₹3.3 Lakh) |

| Peak Price Point | Aston Martin Vanquish V12 | Mercedes-Benz G 580 (₹315 Lakh) |

Late-year momentum was significantly bolstered by external catalysts, specifically the GST 2.0 reforms, which rationalized the tax rate to 18%, and positive festive sentiments. These variables have set a high baseline for the coming fiscal year, where competition is shifting from mechanical specs to technical domains.

Power and Performance: The Competitive Divergence of ICE and EV Architectures

Powertrain performance, once a purely mechanical metric of displacement and cylinders, is being redefined by AutoTech integration and torque delivery profiles. We are witnessing a divergence where EV architectures are fundamentally disrupting the traditional price-to-performance ratio, offering levels of output that were previously gated behind elite ICE entry-barriers.

Performance Ceilings and Benchmarks

Modern EVs are establishing new performance ceilings. The Porsche Cayenne electric serves as the 2025 benchmark, delivering a massive 1156 bhp and 1500 Nm of torque. This eclipses the highest-performing ICE launch of the year, the Aston Martin Vanquish, which produces 824 bhp and 1000 Nm from its V12 engine. While ICE models like the Audi RSQ8 Performance maintain a niche for V8 enthusiasts, the absolute power-to-weight potential has shifted toward electric powertrains.

Democratization of All-Wheel Drive (AWD)

A significant strategic trend is the democratization of AWD. In the ICE domain, AWD remains an exclusive feature, typically requiring a capital outlay exceeding ₹65 lakh. Notable exceptions that broke this price barrier in 2025 include the Skoda Kodiaq Lounge and the Toyota Camry Sprint edition. Conversely, EV architectures are making AWD accessible in the ₹25–30 lakh range, allowing mid-tier consumers to access high-performance traction previously reserved for the luxury segment.

EV Range Benchmarks

In the electric segment, the 500+ km range has transitioned from a premium feature to a baseline requirement, with 68.4% of 2025 launches meeting this standard. The Mercedes-Benz EQS 450 leads the market with an 820 km range, followed by the Mahindra BE 6 Pack Three (683 km) and the Tesla Model Y Long Range RWD (661 km).

As these performance metrics become increasingly software-defined, the competitive landscape is moving beyond how a vehicle moves to how it protects its occupants.

The Safety Imperative: Standardizing ADAS and Occupant Protection

A safety-first consumer shift has accelerated the transition of high-end safety technologies into mass-market segments. What were once flagship differentiators have become competitive necessities as OEMs prioritize AutoTech integration to secure market share.

ADAS Adoption and the Shift to Level 2

Advanced Driver Assistance Systems (ADAS) have seen rapid adoption, particularly in EVs, where the adoption rate stands at 81.6% compared to 45.7% in ICE models. We are also seeing the technical obsolescence of Level 1 systems; only 5.5% of equipped models utilize Level 1, as Level 2 becomes the industry standard across 63.7% of Segment C and D vehicles.

The Anatomy of a Comprehensive ADAS Suite

Based on 2025 benchmarks, a robust ADAS suite is categorized by the following essential features:

- Collision Avoidance: Forward Collision Warning (FCW), Automatic Emergency Braking (AEB), and Blind Spot Collision Avoidance Assist.

- Lane Management: Lane Departure Warning, Lane Keep Assist, and Lane Departure Prevention.

- Driver Awareness: Driver Attention Warning, Blind Spot Monitor, and Leading Vehicle Departure Alert.

- Driving Automation: Adaptive Cruise Control, Speed Assist Systems, and Traffic Sign Recognition.

- Exclusive Visibility: Adaptive High Beam Assist, found in elite models like the Mercedes-Benz EQS 680 and Hyundai Creta EV Excellence.

The Shifting Airbag Benchmark

Occupant protection benchmarks have seen a significant upward revision. While budget variants historically relied on two airbags, 6 airbags have become the mass-market standard, present in 53.8% of all 2025 models. In the luxury tier, the competition has moved to an 11-airbag threshold, as demonstrated by the BYD Sealion 7.

This focus on safety is being matched by an evolution in the digital interface, as vehicles transform into connected hubs.

The Digital Experience: Connectivity, Infotainment, and Cabin Ergonomics

In 2025, the vehicle cabin has matured into a living room on wheels, marking the transition from hardware-centric designs to Software-Defined Vehicles (SDV). Connectivity and infotainment now serve as the primary grounds for brand differentiation.

The Screen War and Universal Connectivity

The Screen War has intensified, with primary touchscreens ranging from 7 inches in budget models like the Maruti Suzuki Victoris to 15.6 inches in the MG Windsor EV and BYD Sealion 7. Connectivity via Android Auto and Apple CarPlay is effectively universal in EVs and missing in only 10% of ICE launches.

Sensory Luxury: Premium Audio and Dolby Atmos

Audio quality has emerged as a flagship differentiator. OEMs are increasingly leveraging sensory luxury through brand partnerships:

- Burmester & Bang & Olufsen: Exclusive to Mercedes, Porsche, and Audi.

- Harman Kardon, JBL, & Bose: Integrated into BMW, Mahindra, Tata, and Hyundai.

The widening gap in luxury is best illustrated by the 27-speaker system in the Maybach 600 versus the 4–8 speaker standard in mass-market models.

Elite EVs like the Mercedes EQS 450 and Lotus Emeya GT feature Dolby Atmos via Burmester and KEF systems. High-performance models like the Mercedes-AMG G 63 and CLE 53 also offer this immersive audio. In the more accessible segment, the Maruti Suzuki Victoris and Tata Sierra include Atmos on premium trims, bringing cinematic sound to a wider audience.

Post-Purchase Value: OTA and Remote Vehicle Status

To maintain vehicle value post-purchase, OEMs are prioritizing Over-the-Air (OTA) updates and Remote Vehicle Status checks. OTA capability is present in 100% of EVs and 71.7% of ICE models, ensuring that the AutoTech payload can be enhanced long after the initial sale.

Strategic Outlook for FY2026: Competitive Positioning and Market Growth

The 2026 fiscal year is projected to reach a volume of 4.8 million units, with EV sales climbing to 2.7 lakh units. This growth will be driven by the new 18% GST rate and a strategic rationalization of the product portfolio by leading brands.

The EU-India FTA and the Pre-emptive Strike

The signing of the EU-India Free Trade Agreement presents a critical strategic variable. While its impact on luxury European imports will take time to materialize, domestic and non-European OEMs (such as Tata and Mahindra) are expected to launch a pre-emptive strike. We forecast aggressive discounting and tech-heavy launches during the 2026 festive season to lock in brand loyalty before European models potentially become more price-competitive due to revised tariffs.

Key Selling Propositions (KSPs) for 2026

The industry will focus on significant improvements in two specific AutoTech domains:

- Safety & Security: Deeper penetration of Level 2 ADAS and higher airbag counts in Segments A and B.

- Entertainment & Connectivity: Standardizing Dolby Atmos and immersive multi-screen clusters in mid-range SUVs.

Conclusion: The AutoTech Score as the Market Determinant

As the industry enters the 2026 recovery phase, winners and losers will be dictated by their AutoTech Score. Success depends on an OEM’s ability to seamlessly integrate complex ADAS suites, SDV architectures, and premium digital experiences into a cohesive package. In a market where mechanical parity is common, the “technology payload” is now the ultimate arbiter of market share.

RESEARCH NOTES:

- The market estimation and forecast have been done by analysing various credible data sources, including government data, industry association reports, and insights by leading industry leaders.

- Prices mentioned are ex-showroom.

- Car launches analysed in 2025 reflect more than 95% of the models announced during the year.

- Techarc India PV AutoTech Dashboard includes more than 60 attributes.