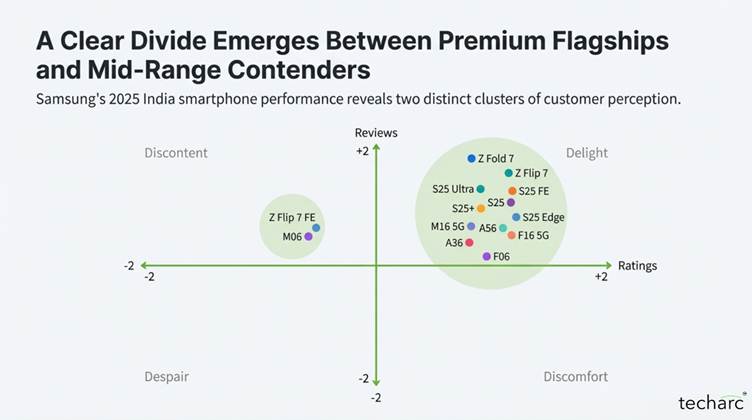

Gurugram / Srinagar: A new proprietary analysis (RaRe Quadrant Analysis Report) by Techarc regarding Samsung’s 2025 smartphone lineup in India highlights a distinct polarisation in consumer sentiment. The report reveals that while Samsung’s premium flagships have secured a “fortress” of user satisfaction, specific value-focused models face a significant disconnect between features and price.

Key Takeaways:

- Premium Dominance in the ‘Champions’ Circle’ Samsung’s high-end strategy has resonated decisively with Indian consumers. The entire flagship S-series (S25 Ultra, S25+, S25) and the Z-series (Z Fold 7, Z Flip 7) fall firmly into the “Delight” quadrant, characterized by high ratings and positive sentiment. Users have validated the premium pricing through superior experiences, with the S25 Ultra and Z Fold 7 leading in performance scores. This success is attributed to a strong focus on “Galaxy AI,” top-tier camera systems, and the maturation of the foldable form factor, which has now overcome early adopter concerns.

- The ‘Fan Edition’ Paradox and Value Disconnect Conversely, the report identifies a “Value Disconnect” for specific models intended to offer budget-friendly entry points. Both the Z Flip 7 FE and the entry-level M06 reside in the “Discontent” quadrant. While qualitative reviews show positive buzz regarding their features—such as the foldable concept on the FE model—quantitative ratings remain low. This signals a mismatch where consumers appreciate the features but feel the compromises made to reach the ‘FE’ price point are too significant, resulting in a poor perceived price-to-performance ratio.

- The Crowded Middle: Solid but Precarious The backbone of Samsung’s volume sales—comprising the A-series, F-series, and select M-series models like the A56 and F16 5G—successfully meets user expectations, landing in the lower half of the “Delight” quadrant. However, Techarc notes this position is precarious; these devices sit close to quadrant boundaries, meaning minor shifts in competitor pricing or features could easily push them into “Discomfort” or “Discontent”.

- Strategic Imperatives: No Room for Despair A critical strength identified is the complete absence of Samsung devices in the “Despair” quadrant (low ratings and negative reviews), indicating a high baseline of R&D quality across the portfolio. To maintain market leadership, the report advises Samsung to:

- Protect the Premium Citadel: Double down on the seamless ecosystem and AI narratives.

- Recalibrate the Value Equation: Urgently re-evaluate the “Discontent” models (FE and M-series) to justify pricing or enhance features.

- Fortify the Profitable Centre: Identify and replicate the specific features driving satisfaction in the A-series to move them higher into the “Delight” zone.

About the Methodology The Techarc RaRe Quadrant plots devices based on two axes: average quantitative ratings (satisfaction) and net sentiment from qualitative reviews (positive vs. negative commentary). In this report, all the key 2025 smartphone launches of Samsung were reviewed and plotted on the RaRe quadrant to analyse and generate insights.