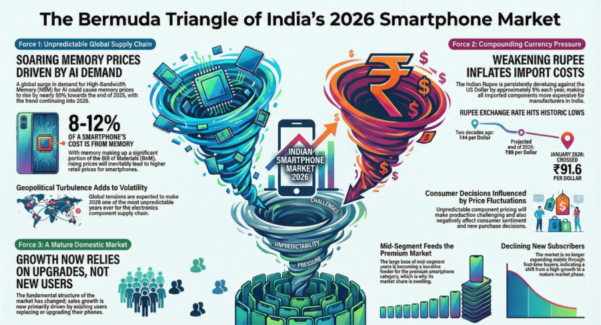

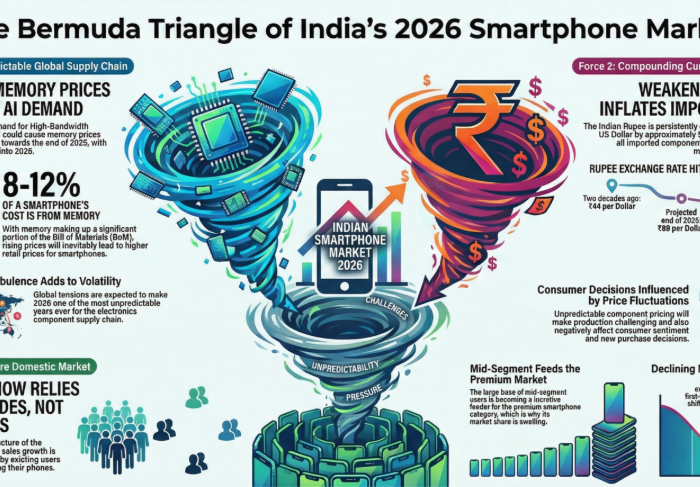

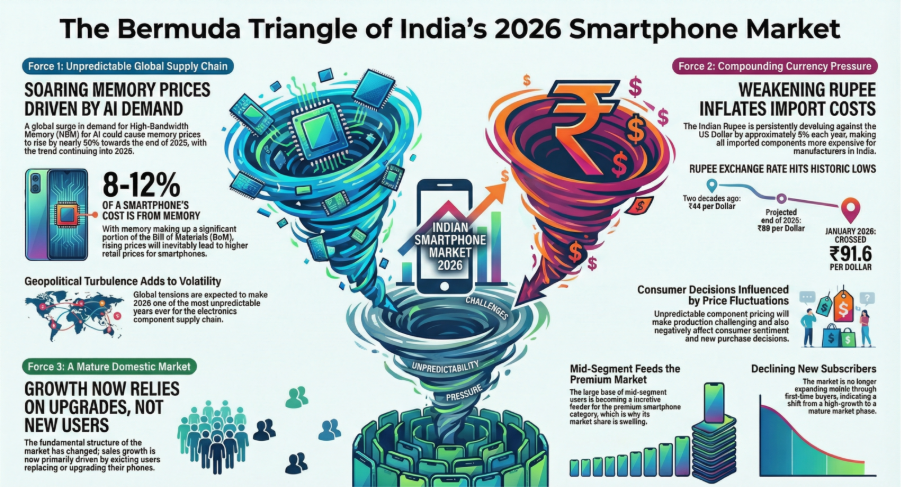

2026 does not appear to be just another year for smartphones in India. There is a ‘Bermuda triangle’ situation expected to disturb the market momentum in 2026 in India. These triangular forces are resulting in challenges on both the demand and supply sides of the market.

1.1 Unpredictable Supply Chain

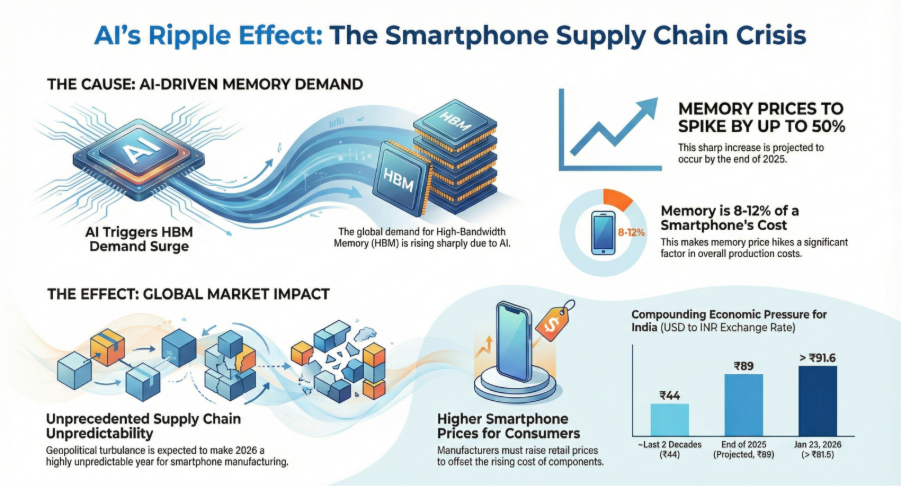

Globally, memory prices have shown a sharp rise as the demand for HBM (High-Bandwidth Memory) surges due to AI. Towards the end of 2025, the increase in prices could be seen as close to 50%, and this trend does not appear to die down at least in the next 2-3 quarters through the year 2026. This unprecedented equilibrium disruption between demand and supply of memories, which contribute 8-12% of the BoM (Bill of Materials) of present-day smartphones, is leaving no option but to go for waves of increase in retail or operating price.

The commotion in the supply chain of smartphones and other electronics components is a global phenomenon, and along with the ‘turbulent’ geopolitical posturing, 2026 is expected to be one of the unprecedented years as regards the predictability of the smartphone supply chain.

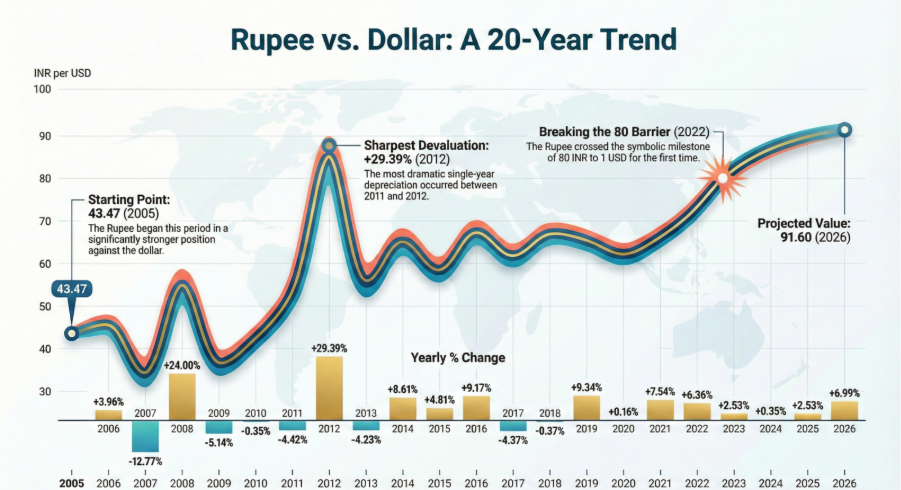

For India, the situation only compounds further as the rupee versus dollar exchange rate equation is not stabilising. In recent years, the rupee is persistently devaluing against the US dollar by around 5% each year. In the last 2 decades, as against ₹44 for a dollar, by the end of 2025, the US$1 would cost ₹89. As on January 23, 2026, the US$1 buy rate has crossed ₹91.6.

This unpredictability in the supply chain of smartphones will result in fluctuating pricing of components which will not only make the production challenging but also influence consumer sentiments affecting new purchase decisions.

1.2 Declining New Subscribers

For many years now, the fundamental structure of the smartphone market in India has remained the same. For instance, there has been one customer segment or cohort driving the growth. In the earlier years, it was the base and mid segments; now, it’s mid and premium segments. The huge installed base of smartphone users in the mid segment is emerging as a lucrative feeder segment to the premium smartphones, which is why we have seen the contribution of premium smartphones swelling in the overall smartphone sales.

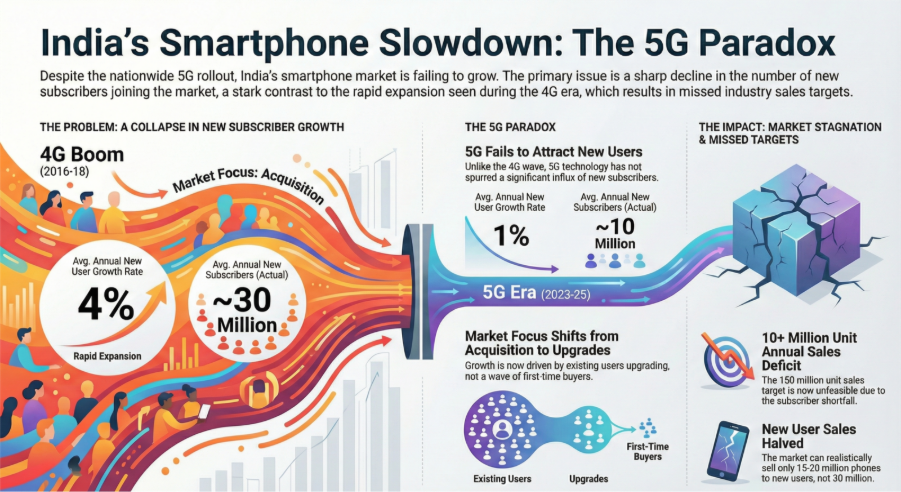

Similarly, the sales contribution is primarily driven by upgrade and replacement. At the same time, new subscribers also contribute to around 20% of new smartphone sales annually. The smartphone industry has been aiming at selling 150 million units a year for the past few years now. By that estimate, around 30 million units should be sold to new subscribers.

Looking at the TRAI data of net subscriber additions for cellular services, only for smartphones, 5G has not been able to attract enough new subscribers to India’s digital bandwagon. In comparison to the 4G wave between 2016-2018, India was able to add an average of 4% new subscribers to the smartphone base annually, while since 2023-2025, there has been an annual addition of just 1% to the smartphone user base, which also includes 4G smartphone subscribers. While in 2025, around a little over 23 million new subscribers were added up to Nov 2025 end, the preceding 2024 saw a decline of 7.8 million subscribers. This reduces the annual average to around 10 million subscribers since 5G has picked up in India from 2023.

The net new subscriber trend clearly shows that there is no appetite in the market to consume ~30 million smartphones annually among new subscribers. In a realistic situation, the market can at best consume around 15-20 million, depending on how many opt for the secondary market or used smartphone market. The mass purchase of 5G smartphones kicked off in India from 2023, and in 2026, we would have a good number of second-hand/used 5G smartphones available for sale after the first users using them for 3-4 years and due for upgrade or replacement.

Factoring this scenario, the sales potential of new smartphones to new users reduces to 15-20 million instead of 30 million units. This means aspiring for 150 million units is not feasible by at least 10 million units because of the declining new subscriber addition.

1.1 Decelerating Innovation

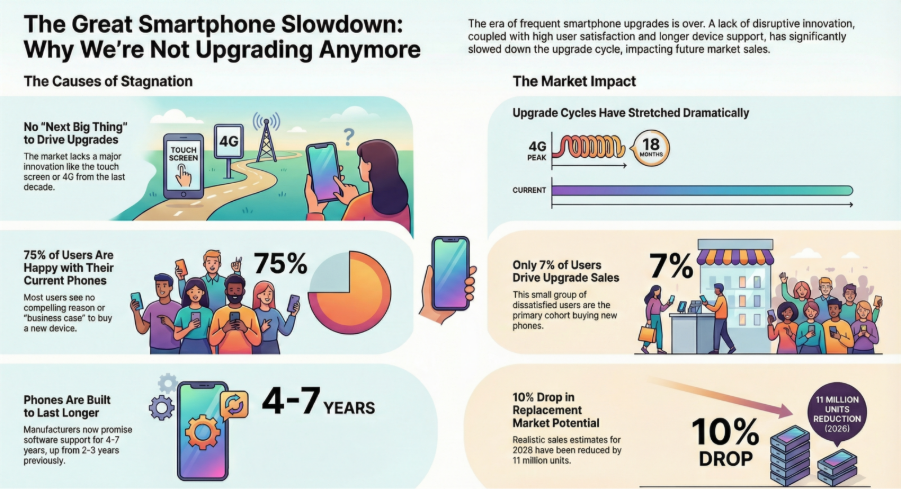

One of the most difficult things to identify in the smartphone industry is something innovative that has the potential to disrupt the market. This does not mean that the industry has not worked towards improving the experience as well as adding new functions. But these are not disruptive enough to trigger a mass replacement or upgrade. Something like the touch screen revolution! After the touch screen, 4G was another disruption as that exponentially increased the potential value of a smartphone and consumers defied the existing patterns to own a 4G smartphone. For instance, during the peak of 4G smartphone sales, the average life cycle of a smartphone had shrunk to as low as 18 months! Consumers were finding a strong value proposition in a 4G-powered smartphone resulting in the digital way of living.

For the past 10 years, there has not been a very strong innovation in smartphones which could trigger a mass replacement or upgrade. Or entice the existing feature phone users to switch to smartphones.

This, along with the smartphone ASPs going up, has resulted in a slowdown of upgrade and replacement cycles. The OEMs have also aligned themselves with it by promising software upgrade support for anywhere between four and seven years. Earlier, it used to be two years and, in some cases, three years.

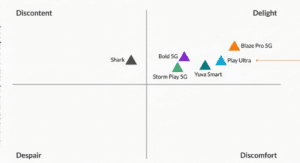

In a recent Techarc report assessing the customer sentiment across smartphone brands, 75% of these users reflect a positive sentiment about the experience they derive from their existing smartphones. They don’t have a ‘business case’ to upgrade or replace, other than the device conking off! From the remaining users, only 7% are dissatisfied, meaning they could be the primary cohort of users triggering replacement and upgrade sales in the absence of any compelling or strong innovation motivating existing users to fast-track their decision to buy a new smartphone.

In our assessment, from the 120 million (150 less 30) smartphone units that the smartphone OEMs have been anticipating that the existing users will buy for replacement and upgrade reasons, the above reasons further reduce the potential by around 10%, realistically estimating this number at around 109 million units in 2026.

1.4 Sales Outlook for 2026

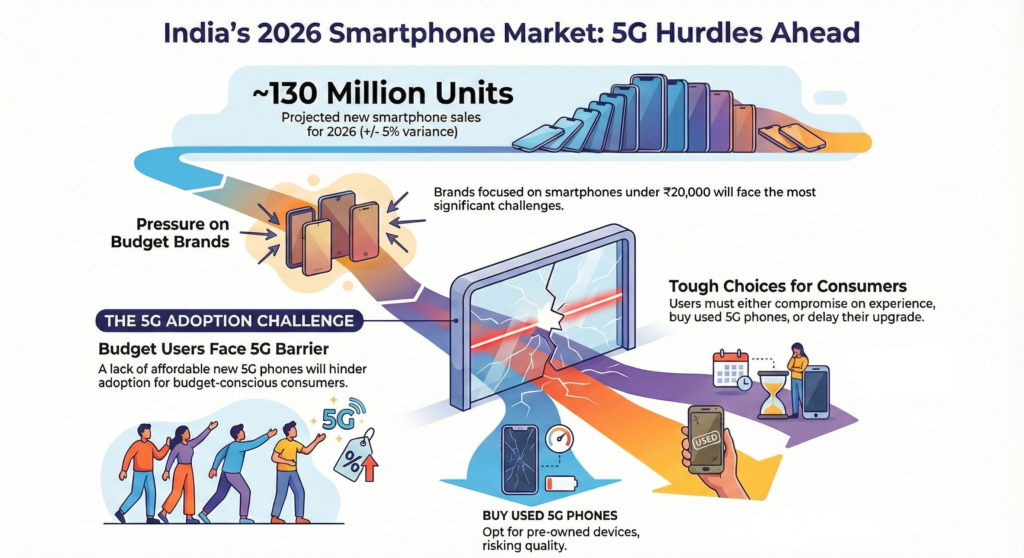

For the supply unpredictability and demand tightening, Techarc does not expect the new smartphone sales in India to cross 130 million units (129.9). This could finally settle +/-5% depending on several factors – global as well as domestic that could affect the assumptions factored while modelling the present estimates.

While the upper layers or segments of the smartphone market, defined by price segments, will still be able to absorb the anticipated market changes, the brands which are heavily focused on sub ₹20,000 could face the pressures of the dynamics arising out of 2026 situations. This is also not a good sign for India’s digital journey as the lower segment users would now be due for adopting 5G, and if they do not get smartphones to buy within their permissible budget limits, they will have to either compromise with the experience, or buy used 5G smartphones which will deprive them of the latest technologies and improvements in other features and functions, or they will be simply pushed to defer their decision of joining 5G.

2.0: Smartphone analysis of 2025 launches in India

A total of 177 smartphones were launched in 2025 across 23 brands in India. Realme led the market with the highest number of launches (24 smartphones) during the year.

July (Q3) emerged as the peak launch month in 2025. Foldable smartphones saw renewed momentum, driven by the launch of high-performing models during the year.

In 2026, we estimate even a leaner portfolio with brands limiting their launches to high sales contributor models only to define an equilibrium between demand and supply. Also, the depth of model options (variants) might see a squeeze aligning with the expected shortage of RAM, meaning brands might discontinue the practice of launching multiple RAM-ROM configuration variants of the same model.

2.1 Brand-Wise Segmentation

In 2025, 23 brands launched smartphones in India. The top three ranks by number of launches were taken by the following brands:

1. Realme 24 models.

2. Samsung & Vivo with 20 models each.

3. Oppo 16 models.

2.2 Price Segmentation

2.2.1 Entry Segment (Up to ₹6,000)

No brand launched a smartphone in the entry segment, highlighting OEMs’ strategic shift towards mid-range buyers while overlooking the critical entry-level segment.

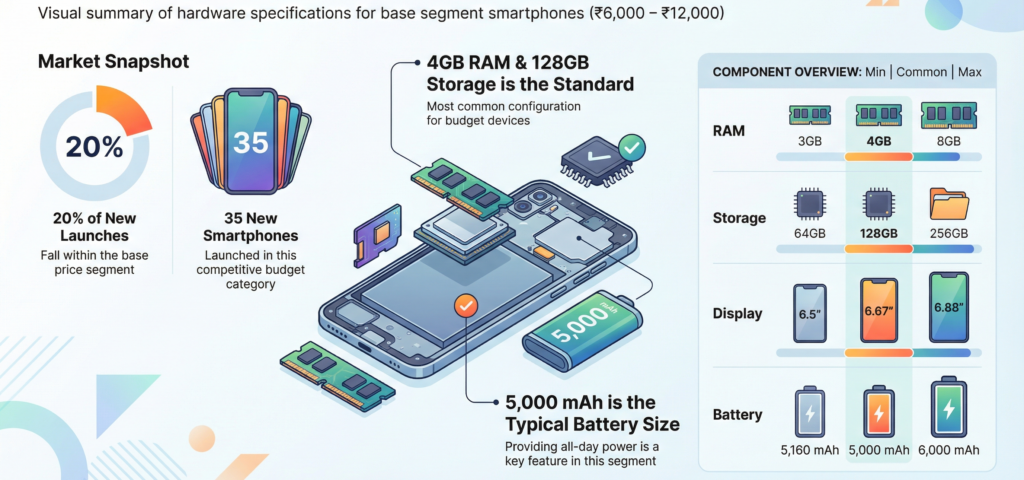

2.2.2 Base Segment (₹6,000 – ₹12,000)

- Base segment represented 20% of the launches.

- 35 smartphones were launched in this segment.

2.2.3 Mid Segment (₹12,000 – ₹25,000)

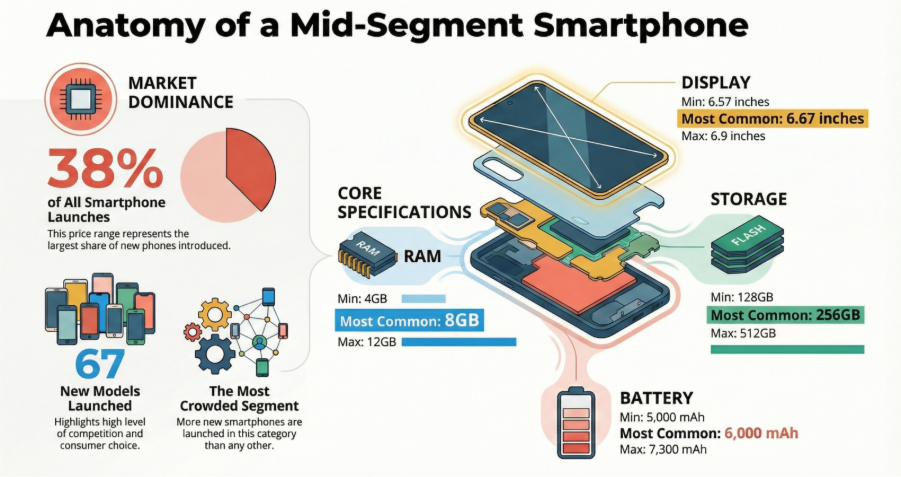

- Mid segment represents 38% of the launches.

- The highest number of launches are concentrated in this segment.

- 67 smartphones were launched in this segment.

2.2.4 Premium Segment (₹25,000 – ₹50,000)

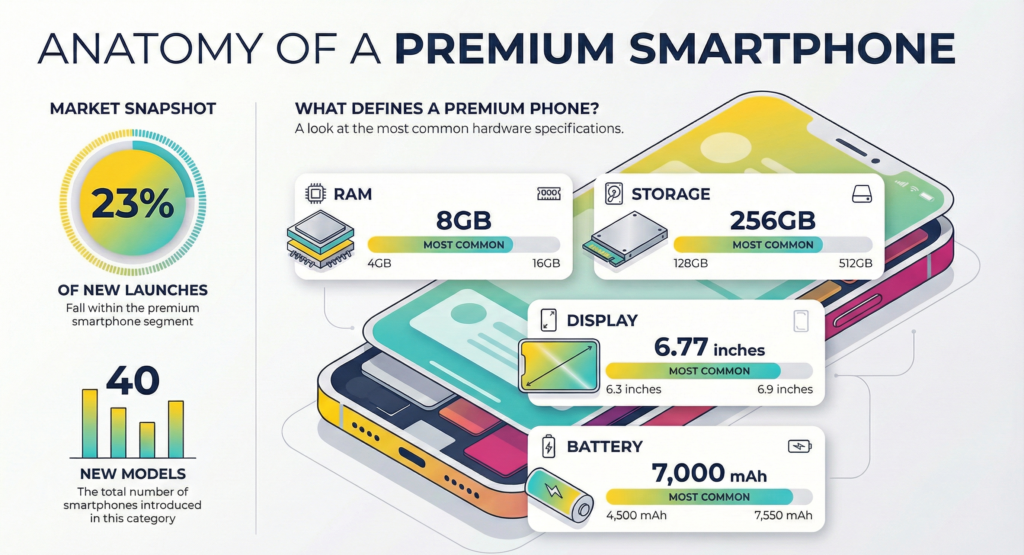

- Premium segment represented 23% of the launches.

- 40 smartphones were launched in this segment.

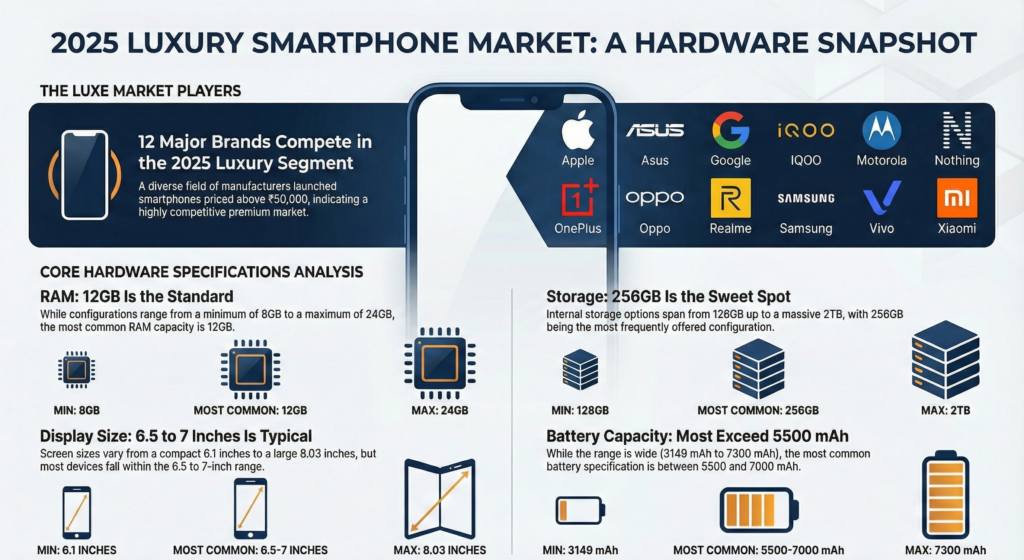

2.2.5 Luxe Segment (Above ₹50,000)

- Luxe segment represented 19% of the launches.

- 34 smartphones were launched in this segment.

- Apple strengthened the segment with its iPhone 17 series.

- Samsung continued to see steady demand for its S and Z series.

In 2026, we anticipate the portfolio spread to mimic the 2025 strategy of key OEMs with launch concentration focusing on key growth segments of mid and premium tiers. While it is essential to be present in entry segments, the supply-chain pressures might force some more brands to exit out of the sub ₹15,000 price band.

2.3 Connectivity Transitions in 2025

Of the 177 smartphones launched in 2025, the market was overwhelmingly 5G-driven, with 5G models accounting for 94% of smartphone launches (166 models), while the remaining 11 models were 4G smartphones.

This will be a tough call for OEMs to decide whether to discontinue the 4G portfolio, especially when the cost of 5G smartphones is increasing and the threshold of owning a new smartphone is going up. To bridge the gap, the brands focusing on this segment of users might continue with a very thin 4G portfolio of smartphones.

2.3.1 Performance Experience in Smartphones – 2025

In 2025, smartphone performance shifted from raw speed to sustained peak performance and on-device AI integration. User experience was defined by:

- Significant increases in battery capacity

- Mainstream adoption of advanced cooling systems

- Evolution in memory standards driven by generative AI workloads

In 2026, performance will remain a core focus of OEMs with the objective of improving the post-purchase experience responsible for user delight. Batteries will lead with significant improvements in both capacity and type, with more OEMs adopting Si/C (Silicon Carbon) Li-ion batteries, allowing them to go for higher capacities while achieving a slimmer form factor and lighter weight, adding to the pocketability (Techarc’s measure of comfort-convenience equilibrium) of smartphones.

3.0 Wax-Wane Analysis

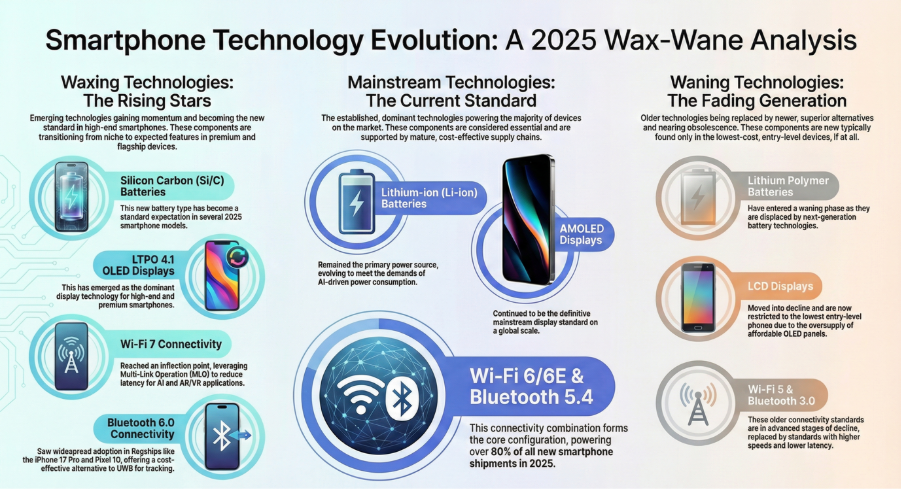

3.1 Waxing Transitions

3.1.1 Battery Type: Silicon Carbon (Si/C) batteries gained momentum and became a standard expectation in several smartphones.

3.1.2 Display Type: LTPO 4.1 OLED emerged as the dominant display technology for high-end devices.

3.1.3 Wi-Fi & Bluetooth: Wi-Fi 7 reached an inflection point, becoming the new standard for premium devices, leveraging Multi-Link Operation (MLO) to reduce latency for AI and AR/VR applications.

3.1.4 Bluetooth 6.0 saw widespread adoption in 2025 flagships such as the iPhone 17 Pro and Pixel 10, offering a cost-effective alternative to UWB for tracking and secure digital keys.

3.2 Waning Transitions

3.2.1 Battery Type: Lithium Polymer batteries entered a waning phase, displaced by superior next-generation alternatives.

3.2.2 Display Type: LCD displays moved into decline, now largely restricted to the lowest entry-level price segments due to oversupply of affordable OLED panels.

3.2.3 Wi-Fi & Bluetooth: Wi-Fi 5 and Bluetooth 3.0 entered advanced stages of decline, replaced by newer standards supporting higher data speeds and lower latency.

3.3 Mainstream Transitions

3.3.1 Battery Type: Lithium-ion (Li-ion) batteries remained the mainstream power source, supported by a mature and cost-efficient supply chain while evolving to meet AI-driven power demands.

3.3.2 Display Type: AMOLED technology continued as the definitive mainstream display standard globally.

3.3.3 Wi-Fi & Bluetooth: Wi-Fi 6/6E and Bluetooth 5.4 formed the core mainstream configuration, powering over 80% of new smartphone shipments in 2025.

Make in India of Smartphones – CBUs dismantled, Components build up

The flagship Make in India launched in 2014 has achieved some important milestones in the past 11 years. An ecosystem has been developed in India for smartphones which is consistently being improved both on quantity (capacity) as well as quality (value addition).

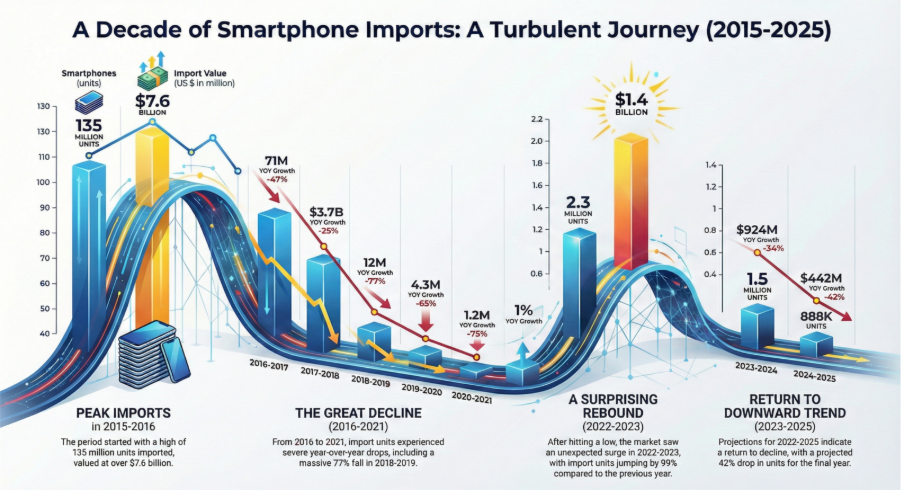

The result of unwavering efforts towards successful outcomes of ‘Make in India’ has resulted in minimal imports of smartphones as a finished product (CBU or Completely Built Unit). As against the peak of 2015-16, when the CBU imports of smartphones exceeded $7.6 billion, in 2023-24, the import bill of CBU smartphones was mere $442 million. Today all the smartphone makers are manufacturing their smartphones directly or through contract manufacturers in India with different grades of manufacturing complexities. The import bill for CBU smartphones may never become ‘zero’ as brands will continue to import some models which are universally launched in very small quantities and shipped across key markets. The good takeaway of ‘Make in India’ efforts has been that the monstrous import mountain has been ‘detonated’.

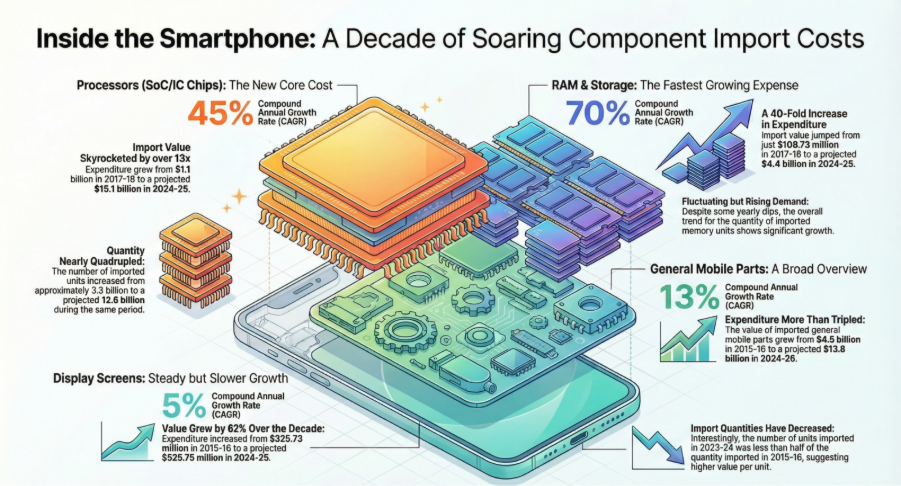

While bringing down CBUs or finished smartphones to their lowest possible is a remarkable achievement, the dependence on global supply chains has exponentially increased our imports of components used for making smartphones. In our analysis, we traced the evolution of three key components – processors, memory, and displays – reflecting a significant increase in imports of these essential building blocks of a smartphone.

The first decade of Make in India was about encouraging and inviting global players to set up their manufacturing facilities within India that would create jobs, bring in technology, and result in the development of micro-ecosystems around key components. The 2nd phase of Make in India has already begun with the government recognising the need for getting deeper into the ecosystem and increasing the domestic value addition. The policy interventions and executive decisions taken to set up components ecosystems, including semiconductors, are aligned to this objective. The next decade from 2025-2034 would all be about increasing the value addition so that we could rationalise our imports of electronic components, which, if not done, will otherwise neutralise the gains achieved out of minimising the smartphone CBU imports.

This would very much align with the Viksit Bharat 2047 roadmap, with the 3rd decade of 2035-2044 investing in developing complex technology solutions fundamentally using India’s own IP that could establish India as a key technology hub in the global value chain and pave the way for India entering the Viksit Bharat era as a core technology country along with the present economies of the US, China, Japan, and a few more countries having a significant role in the present global supply chain of technology.

Report Credits – Techarc Team

Visualisation Credits – Google Gemini