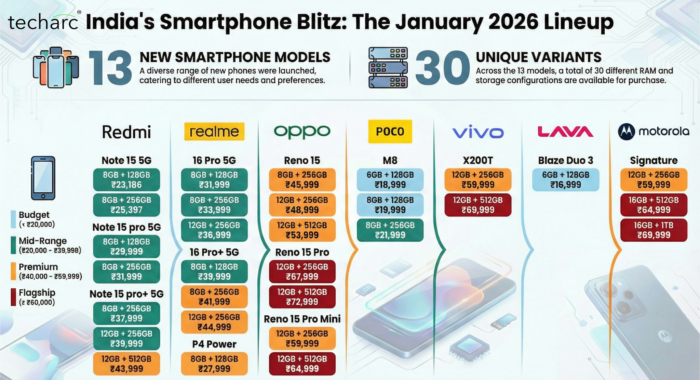

January 2026 saw a slow start to the Indian smartphone market, with only 13 models and 30 variants launched across seven brands, Oppo, Realme, Poco, Motorola, Vivo, Redmi, and Lava, marking a steep decline from the 19 launches each in January 2024 and 2025, and the robust 177 total releases throughout 2025 as outlined in Techarc’s detailed annual report. This slowdown isn’t a mere coincidence; it’s a calculated shift where major brands have sidelined the volume-driving sub-₹15,000 base segment, pushing the cheapest new entrant, Lava’s Blaze Duo 3, to ₹16,999. Rising component costs for 5G chipsets, premium displays, and memory modules, combined with aggressive ‘premiumisation’ strategies, have redefined market dynamics, forcing consumers toward higher price points or financing options. As India’s smartphone penetration nears saturation in urban areas, manufacturers prioritise margins over mass volume, betting on aspirational upgrades and feature-packed mid-rangers to sustain growth amid economic pressures.

Key Takeaways

- Budget Neglect Confirmed: Zero sub-₹15k launches signal the end of affordable new 5G entry points, reshaping volume dynamics.

- Premiumisation Accelerates: Pro variants and flagship specs in mid-range drive margins, with financing as the great equalizer.

- January Dip Foreshadows Caution: 31.6% fewer launches hint at a measured 2026, prioritising profitability over floodgates.

1.0 Launch Overview: A Sparse Yet Premium-Heavy Lineup

1.1 Redmi Stole the show with its Note 15 Series

Redmi’s January 2026 India portfolio is a tight, line-extension-heavy play. Launched Redmi Note15 series, Note 15 5G, Note 15 Pro 5G, and Pro+5G with 7 variants. The brand pushes the Note 15 series across ₹26,999–₹43,999, clearly laddering prices via RAM/ROM upgrades rather than new models. Strategic focus stays on mid-premium monetisation, not volume disruption. Clean execution, but zero entry-level aggression.

1.2 OPPO equally follows with its Reno 15 series

Rolling out three models, including the base Reno 15 at ₹45,999, Reno 15 Pro at ₹54,999, and Reno 15 Pro Mini, spanning seven variants with options from 8GB/128GB to 16GB/512GB configurations. These devices boast aluminum alloy builds, massive 200 MP and 50MP Sony IMX sensors with optical image stabilization, and MediaTek Dimensity 8450 processors, cementing Oppo’s play in the premium mid-range arena where sleek design meets capable performance for photography enthusiasts and social media influencers.

1.3 Realme countered with three strong entries in the 16 series

The 16 Pro, 16 Pro+ 5G at ₹48,999, and a Power variant starting at ₹27,999, offering six variants in total. Equipped with Snapdragon 7s Gen 4 chipsets, 6.78-inch LTPO AMOLED panels refreshing at 120Hz, 200 MP cameras, and 80W fast charging, and the P4 power boasts a massive 10,001mAh Battery. Realme’s portfolio transforms what was once flagship-killer territory into the new everyday mid-range standard, appealing to gamers and content creators seeking value without compromise.

1.4 The remaining brands opted for single mid-flagship bets

Vivo’s X200T launched at ₹59,999, scaling to ₹87,999 for top specs, powered by the MediaTek Dimensity 9400+ and featuring a Zeiss-co-engineered 50MP triple camera system alongside IP68/IP69 dust-water resistance for a true luxury contender. Motorola’s Signature, priced between ₹74,999 and ₹84,999 across three variants, ditches affordability with Snapdragon 8 Gen 5, wireless charging, and an eco-friendly wood-fiber back, targeting eco-conscious premium buyers. Poco’s M8 enters at ₹21,999 with IP66 protection and a 50MP primary sensor, while Lava’s Blaze Duo 3 at ₹16,999 introduces innovative dual displays and stock Android 15, carving a niche for rural and first-time 5G users.

This modest tally, down by over 31% from prior years’ January bursts, reflects cautious post-festive inventory strategies, with brands holding back volume launches.

2.0 Segment Breakdown: The Great Price Escalation

2.1 In the luxe tier above ₹50,000, Vivo X200T’s two variants, Oppo Reno 15 Pro’s duo, and Motorola Signature’s three configurations dominate with starting prices from ₹54,999 to ₹87,999. These pack cutting-edge silicon like Dimensity 9400+ and Snapdragon 8 Gen 5, 200 MP periscope cameras, 90W+ charging, and IP68+ ratings, capturing about 25% of launches.

2.2 The Premium segment from ₹25,000–₹50,000 sees Realme 16 Pro+’s three variants, Redmi’s Note 15 Pro 5G & Pro+5G, Oppo Reno 15’s two, and Realme Power, priced ₹27,999–₹48,999, loaded with LTPO AMOLED 120Hz screens, standard 12GB RAM, and AI-boosted imaging, now the baseline for value flagships that absorb former premium aspirations.

2.3 Lower mid-range ₹15,000–₹30,000 holds Redmi Note 15 5G and Poco M8 at ₹18,999–₹22,999 with Snapdragon 6 Gen 3, 5,000mAh+ batteries, and solid daily drivers, while Lava Blaze Duo 3 at ₹16,999 adds unique dual-screen flair—yet no sub-₹15,000 savior appears, leaving the budget void glaring.

3.0 Drivers of the Shift: Costs, Strategy, and Consumer Forces

3.1 Component inflation lies at the heart

5G modems have jumped 20-30% in cost, OLED panels demand premium pricing for 120Hz viability, and LPDDR5X RAM/storage combos render sub-₹15k builds unprofitable without spec compromises like 60Hz LCDs or 4G-only chips. Brands like Oppo and Vivo orchestrate premiumization by flooding lineups with Pro/Plus SKUs, Realme alone triples down here, forcing wallet stretches to ₹20k–₹25k or EMI schemes that mask true affordability.

3.2 Strategic repositioning amplifies this

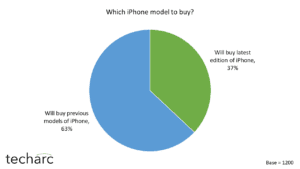

Motorola evolves beyond budget Moto G roots into Signature luxury, Vivo eyes Apple/Samsung turf, and even volume players like Poco exit true entry-level. Consumer trends aid the pivot, rising rural 5G adoption and urban feature hunger demand more than basic 48MP sensors or 5000mAh packs, with mid-rangers now mirroring 2024 flagships in IP ratings and charging speeds.

4.0 2026 Market Forecast: Financing, Features, and Fragmentation

4.1 The budget segment’s demise looms large

Sub-₹12,000 new launches may vanish entirely, ceding ground to refurbished 2024 models, feature phones, or imports, while volumes pivot to ₹20k+ via no-cost EMI surges, projected to underpin 60%+ of mid-range sales. Mid-rangers at near-₹50k must dazzle with flagship perks like periscope zooms, 7-year software pledges, and AI gimmicks to fend off discounted 2025 elites.

4.2 Shipments could grow 5-8% YoY on 5G tailwinds, but premium (>₹25k) slices balloon to 45% share, per Techarc projections, as trade-ins and exchange offers lure fence-sitters. Rural markets face squeezes unless Lava/Redmi doubles down on tailored value.

5.0 Conclusion

January 2026’s smartphone portfolio underscores a maturing Indian market where premium drifts eclipse budget volumes, challenging brands to balance aspiration with accessibility. As we at Techarc forecast, this Bermuda Triangle of forgotten low-end, saturated mid, and crowded high-end demands vigilant tracking of EMI adoption and spec inflation. This will push consumers towards refurbished hunts, while manufacturers risk alienating the masses unless value reemerges. As Q1 unfolds, expect bolder waves, but the budget era feels irreversibly faded.

Why smartphone prices are rising in 2026, and what it means for the buyers | 91mobiles.com

February 5, 2026[…] manufacturers are reportedly cutting low-margin budget models and focusing on “Pro” variants, where they have […]