Laptops have lacked the element of personalisation, though being an extension of personal computing devices or PCs. The reason to this has been that the volume of sales is still enterprise led where the emphasis has been more on utility than anything. For the consumer side, the approach of OEMs has been offering general purpose computing devices without any endeavours to personalise them.

In 2026, we anticipate this to change with OEMs fundamentally focusing on delivering personalised experiences through orchestration of meaningful improvements in areas like design, portability as well as the specifications, making the laptops reflect the user’s specific needs. However, it does not mean these laptops won’t be able to perform the expected generic set of tasks, retaining their multi-tasking capabilities.

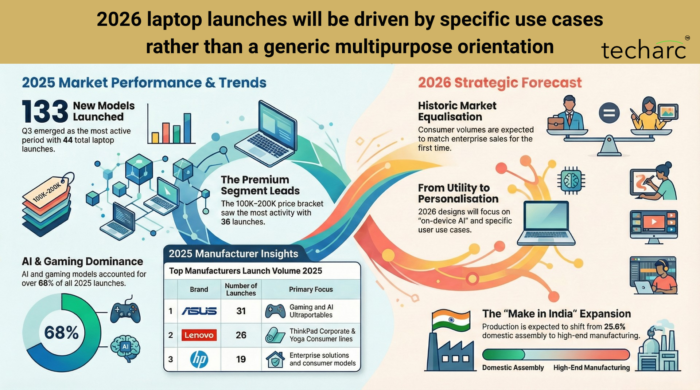

The laptop market continues to hover in the range of 11.5-12 million units a year and in 2026, we expect it to remain at the same level. However, it will still be a marginal growth over the 2025 sales.

While there are alternatives that will continue to cannibalise potential laptop sales, which include tablets as well as smartphones, especially book form foldables, the increasing need for creating pro-grade content with the rising industry benchmarks and audience expectations will be advantageous for the laptop market with more such users preferring it for the convenience and control it offers while creating such ‘studio’ grade content.

Historically, the laptop sales have been propelled by the demand in enterprises with around 55-60% of the sales contribution originating from enterprises, SMBs and the government. Considering many small businesses and solopreneurs use a consumer laptop for their business needs, the actual business purpose driven sales contribute even higher than this. However, with changing market dynamics, some of the hobby led use cases like gaming, content creation, etc., where the user is a hybrid commercial-personal user is expected to add more sales to the consumer laptops. By the end of 2026, the enterprise versus consumer sales by volumes of laptops could equalise, which will be first time in the Indian laptop market.

Overview of 2025

The laptop market in 2025 was quite dynamic and innovation oriented. In this report, as per our market tracking of the launches, a total of 133 laptop models were launched in 2025. The market is increasingly shifting towards AI-capable hardware, OLED displays, and faster connectivity standards. At the same time, the OEMs are also conscious of adding design elements, bringing vibrant colours and enhancing the portability, primarily appealing to GenZ.

This report analyses key trends, market segmentation, brand performance, and technological shifts that have defined the laptop landscape this year. By analysing launch data, hardware specs, and adoption patterns, Techarc reveals how OEMs responded to consumer demands for performance, portability, and futureproofing in India’s competitive PC market.

1. Brand-Wise Performance

1.1 Brand-Wise Segments

ASUS maintained its lead primarily through aggressive product segmentation, targeting both the high margin gaming market and the growing demand for AI, premium, thin and light ultraportable with 31 launches. This strategy allowed ASUS to capture diverse buyer personas, from gamers seeking raw power to professionals prioritizing sleek designs. Lenovo followed closely with 26 launches, leveraging the strength of its established ThinkPad line in the corporate sector while making significant inroads with its versatile Yoga and IdeaPad consumer offerings. HP stood 3rd with the launch of 19 laptops through the year, focusing on reliable enterprise solutions and consumer-friendly models.

1.2 Performance

The competitive landscape showed a clear division: brands like MSI focused intensely on the high performance and gaming niches, while others like HP and Acer pursued a broader, more balanced appeal across different price points. The ‘Others’ category, heavily influenced by Apple’s M-series launches, continued to dominate the ultra-premium and ecosystem driven segments. This bifurcation highlights how niche players thrive in specialized areas like gaming, while mass-market brands emphasize versatility to appeal to a wider audience.

2.0 Launch Patterns

The launch pattern of laptops in 2025 had a definite seasonality. January 2025 saw the greatest number of launches that is 20. This is an indication that the beginning of the year has a lot of momentum in terms of laptop launches. July follows closely with 18 launches, August comes third with 16 launches and if we look at quarterly launches, Q1 has 31, Q2 has 30, Q3 has the highest 44 launches. The Q4 has 28 launches.

These patterns align with global trade shows, fiscal year-ends for brands, and pre-festival shopping peaks in India, driving OEMs to front-load announcements for maximum visibility and early sales momentum.

3. Price Segmentation

The 2025 laptop launches ranged from highly affordable entry-level models to ultra-premium gaming and creator devices, reflecting strong market segmentation. Budget laptops focused on essential performance and accessibility, while the costliest models prioritised advanced hardware, premium materials, and maximum performance. The costliest laptop launched was MSI Titan HX Ai and cheapest was Primebook 2 NEO. The market is properly segmented, but most of the action is in the Mid to Premium segment.

This segmentation caters to India’s diverse economy, from price-sensitive students to high-income creators and gamers.

3.1 Entry Segment (0-50K): The entry segment focused on affordability for students and first-time buyers. The entry segment has 22 launches.

3.2 Base Segment (50K-70K): The Base segment acted as the mainstream value category, offering better performance and reliability. This segment accounts for 27 launches.

3.3 Mid Segment (70K-100K): The most competitive segment with 33 launches, with a focus on 16GB RAM and OLED display enhancements.

3.4 Premium Segment (100K-200K): This segment has the highest number of launches with 36. This is where most of the action for Copilot+ PCs and AI-enabled laptops is taking place.

3.5 Luxe Segment (>200K): The luxe segment shows the least number of launches with just 15, boasting specs such as 2TB+ storage and RTX 50-series graphics cards.

4. Hardware Benchmarks by Segment (Most Common)

| Segment | RAM | Storage | Display | Battery |

| Entry (<50K) | 8GB | 512GB | 15.6 | 41WH |

| Base (50K-70K) | 16GB | 512GB | 14 | 41WH |

| Mid (70K-100K) | 16GB | 512GB | 14 | 60-64WH |

| Premium (100K-200K) | 32GB | 512GB | 14 | 70WH |

| Luxe (>200K) | 32GB | 2048 | 16 | 90WH |

These modal specifications illustrate a clear progression: entry-level models prioritize basics, while higher tiers emphasize multitasking power, endurance, and immersive visuals for demanding workflows.

5. Wax-Wane Analysis

The technology landscape in 2025 shows clear patterns of innovation, obsolescence and standardization across key hardware components.

5.1 Waxing Technologies

- AI-PC architectures with dedicated NPUs gained rapid momentum.

- OLED displays becoming standard.

- Wi-Fi 6E is emerging.

- Bluetooth 5.4 pushing boundaries.

These rising techs signal a push towards intelligent, vibrant, and connected devices suited for AI workloads and hybrid work.

5.2 Mainstream Technologies

- SSD storage became standard across all segments.

- Bluetooth 5.3 remained the dominant connectivity baseline.

- 16GB RAM transitioned from premium to mainstream expectation.

5.3 Waning Technologies

- Low-resolution TN displays became increasingly irrelevant.

- Wi-Fi 5.0 and Bluetooth 5.0 phased out in new launches.

6. Portability & Convenience

Ultra-portable laptops with weights less than 1.2 kg have become more popular for productivity and business use cases, with OEMs such as Lenovo, HP, and Asus dominating this feature. On the opposite end of the spectrum, gaming laptops were again reported to have the highest weight, exceeding 2.5 kg, with dedicated GPU support. The smallest laptops launched were more about smaller screen sizes rather than smaller laptop designs per se. The heaviest laptop launched in 2025 was by dell (Dell Alienware 18 Area 51) and the lightest laptop was from Microsoft (surface Pro-12).

This contrast underscores the trade-offs: lightness for mobility versus heft for thermal headroom in gaming.

7. AI/Gaming Laptops

In 2025 a total of 91 gaming and AI laptops were launched that is approx. 68.4% of the total launches, we saw jump from 67 AI & Gaming laptops in 2024, though AI-branded laptops showed rapid growth. AI laptops primarily appeared in premium productivity segments and are positioned as the next growth wave, but gaming remains a more established and volume-driven category.

8. India Laptop Market Technology Adoption (2024–2025)

In 2025, the Indian laptop industry demonstrated year over year technological advancement over 2024.

8.1 Audio Advancements

The adoption of Dolby Atmos technology escalated substantially, advancing from being featured in approximately 45% of laptop models in 2024 to almost 55% in 2025, signifying a transition from being used only in high-end models to becoming a mainstream standard.

8.2 Processor Kings

2025 was the year when Intel’s reign was seriously threatened in the laptop market. Analysis of processor brand shares indicates that Intel continued to lead the market, contributing to around 65-70% of models in 2024 and then settling down to around 60-65% in 2025, while AMD and ARM-based processors together registered a slight increase, particularly in the realm of performance and AI-centric laptops. Although Intel continued to lead the market in terms of overall volume, Qualcomm (Snapdragon X series) and AMD (Ryzen AI 300 series) managed to make a strong impression in the high-end ultraportable market.

8.3 Make in India Effect on Laptop Market (2025)

In 2025, the Indian laptop industry is still import oriented with just 25.6% of laptop models manufactured in India, with most of the laptops being produced outside the country and then imported to India either as ready for sale Complete Build Units (CBUs) or as partially assembled products. In the analysis we saw China (39.1%) leading the manufacturing, while Taiwan is at 22.6% and is at third number as per manufacturing of laptops due to their well-developed electronics industry, cost-effectiveness, and large-scale production capacity.

In 2026, we expect the high-end premium laptops also shipping out of India as the OEMs and their partners gain trust of the domestic manufacturing along with the positive facilitation through government schemes and initiatives.

9. 2026 Outlook

Despite of macro supply chain issues affecting the entire electronics manufacturing worldwide, we anticipate no significant reduction in the laptop launches in 2026. Our estimates suggest that the industry will hover around the same number of launches during the year as in 2025.

The launches will be driven by factors like increased personalisation along with serving dedicated use cases going beyond gaming, which will continue to be one of the user cohorts being addressed.

From technology point of view, AI naturalisation will continue with OEMs focusing more on on-device AI. Other than this, CMF will be another area influencing the design language of the laptops in 2026 with primary focus on aesthetics and portability of laptops.

We also anticipate India launch of some of the unique form factors showcased in 2025 and early 2026 at global tech shows like CES. Prominent among these could be multi-screen touch laptops, multi-fold hybrid laptops, among others. However, these are expected to remain a niche segment of the total market.