Your cart is currently empty!

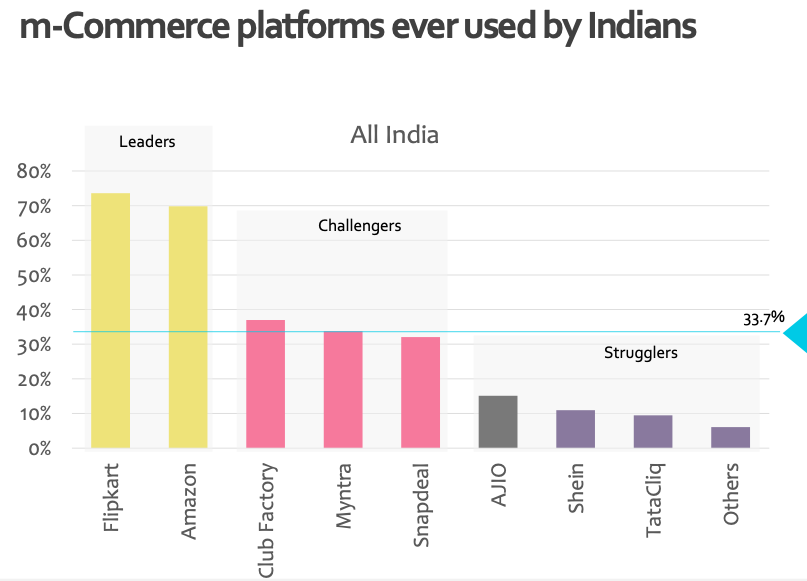

Flipkart and Amazon emerge as leading platforms, Club Factory is growing fast as an alternative among Challengers.

Gurugram: Techarc today released 1st Edition of India m-Commerce Insights report capturing user trends about adoption of m-Commerce in India. With the widespread use of Smartphones along with affordable data services, Smartphones have become the default mediums of interface for users. India, a mobile first economy, is increasingly consuming digital services and applications including e-Commerce over Smartphones.

Releasing the report, Faisal Kawoosa, Founder & Chief Analyst, Techarc said, “The market is getting structured as a ladder between Leaders, Challengers and Strugglers. While Flipkart and Amazon lead as the most engaged platforms, new entrant Club Factory is growing up fast among Challengers. The other platforms are not able to garner much attention, primarily due to their limited offerings which makes them as niche m-Commerce platforms.”

“To grow as a sustainable m-Commerce platform in India, having multiple product categories with wide range of options to choose from is an important prerequisite,” added Faisal.

Some of the key findings of the research are:-

- Urban locations are leading in m-Commerce with 34.8% users having shopped over these platforms, but Rural is also catching up fast. 30.3% of users in the rural areas have purchased a product using m-Commerce.

- The trend of ‘casual’ m-Commerce is not high on mature platforms. Users are repetitively buying from credible m-Commerce platforms. For leaders like Flipkart and Amazon, casual shoppers were just under 15%.

- While Flipkart and Amazon installations are driven by their respective festival offers during the period, Club Factory’s rapid growth among Challengers can be attributed to focusing on affordable range of products as well as charging zero commission from the sellers.

- 89% of the users install the m-Commerce app of their choice through the respective app stores of the Smartphone they use. Only 5% discover a platform pre-installed on their Smartphones.

- The market is almost evenly spread between shoppers buying regularly once in a month, users purchasing on need basis and buyers triggered by offers and promotions. This is a major shift in the motivation for buying online where offers and discounts are not the only triggers.

- With quick replacement / exchange policies and use of advanced technologies to help buyers select the right sizes for apparels, footwear, etc., the Fashion, Apparels and Accessories category is leading m-Commerce in terms of product category. This is followed by Electronics & Home Appliances. Groceries is the least bought category but is growing fast, especially among urban users.

- Convenience is the main factor driving m-Commerce. Users are buying at their time of convenience over these platforms. There is no fixed schedule followed to shop and users place orders as per their leisure time periods.

- The overall trust is increasing on the m-Commerce platforms. Shoppers are mostly finding no major gap between the promise and the delivery of products. This has brought down the replacement / refund instances. Close to 30% of users never sought any replacement / exchange.

- 67% of the users shopped using an app, while remaining accessed the online store through browser using Smartphones. Lack of availability of space of Smartphones, casual buying and poor internet connectivity are some of the factors driving users to access the platform through browsers.

Outlook: m-Commerce is getting mainstream and is no longer driven only by discounts and offers. It is being preferred for other factors like convenience and choice as well. Going forward, platforms which are offering wide range of products and are not confining themselves to a particular or a few product categories have the potential to grow and emerge as a strong competition to the leaders. Leaders like Flipkart and Amazon shall have to reorient and lead the space through new technology interventions and move beyond catalogue selling. They shall have to bring in more immersive experience to the overall shopping process.

About the Report: The report is based on consumer insights captured from 500 m-Commerce users in India. 400 of these respondents were from Urban areas and the remaining 100 were from Rural geographies. The results are at 95% level of confidence with 4.38 margin of error.

Download India m-Commerce Insights report.