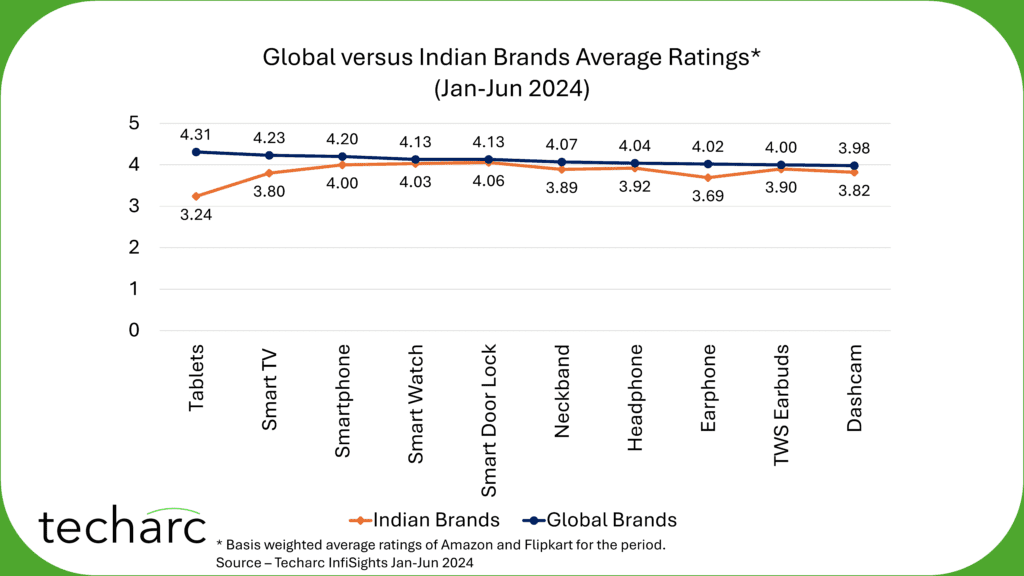

The 1H (Jan-Jun 2024) ratings analysis of more than 150 brands selling various smart devices shows global brands are leading across product categories in average consumer rating for the period comparing their Indian counterparts.

Gurugram – As ‘Make in India’ initiative continues to attract all major global brands across various product categories and successfully establish their manufacturing not only for India but for global markets, the Indian counterparts are still not able to match their quality and experience. This can be concluded by the analysis of average ratings of the products of these brands sold on popular marketplaces of Amazon and Flipkart. While online marketplaces do not represent the entire sentiments as there are customers buying these devices offline also; online marketplaces contributing 30-95% of the total sales of these devices is a significant representation of the overall sentiment regarding customer satisfaction that they express in the form of ratings and reviews.

Overall Ratings

It’s a dichotomy that while Global brands like Apple, OnePlus and Xiaomi have resulted in an average weighted rating of 4.31 in Tablets, the Indian brands like Lava, iBall and IKALL haven’t been able to exhibit similar experiencing resulting in the lowest average rating for Indian brands in this category. For the period, Jan-Jun 2024, Indian brands’ average weighted rating for Tablets stood at 3.24. Indian brands averaged highest 4.03 in Smart Watch across different product categories, where brands like Cultsport, Amazefit, Boult among others have been able to deliver a reasonable product satisfaction to the Indian customers.

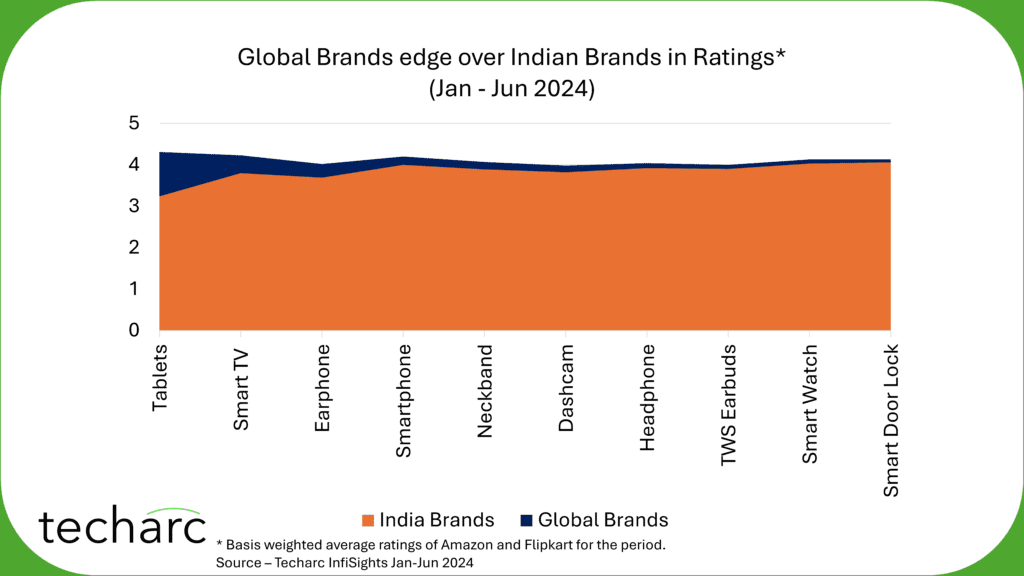

The gap between satisfaction measured by consumer ratings is widest in Tablets, followed by Smart TVs and Earphones in that order. Indian brands need to catch up fast in these segments to narrow the gap and deliver equitable experiences to consumers as is delivered by the global brands. The good news is that in products like Smart door locks, Smart Watch and TWS Earbuds, the gap is not very significant. In Smartphones, which is the major contributor of sales by volume and value across these categories, the global brands still have an edge, but the gap is not too wide. For the period (1H 2024) the gap between global and Indian smartphone brands in average weighted ratings was just 0.20 in absolute terms.

Key Takeaways

The report reflects that the Indian consumers are increasingly becoming quality conscious across different price segments and their preference for brands offering better quality and value for money get a higher rating irrespective of their country of origin. The key takeaways of the analysis can be summarised as: –

- ‘Make in India’ has offered best in class infrastructure to the brands as global brands like Apple, Xiaomi, OnePlus, Sony, etc. which are manufacturing their products in India are able to earn high customer ratings in their respective product categories. The Indian brands need to focus more on R&D, product IP and align their sourcing at par with the global brands to be able to offer equitable satisfaction and value for money.

- The ‘sentiment sales’ do not suffice in the market. While consumers would love to use Indian brands, they also need to scale up their quality, performance and experience for users to be able to use them reliably. As we see a shift in consumer preferences in favour of brands like Apple known for quality and performance, the Indian brands need to understand that consumers are looking for reliable quality and performance which can only be offered by having a deeper integration with the value chain and stronger focus on product design and development.

- India badly needs more brands in products like Smartphone. There is effectively only one brand Lava, though Micromax is also sold through online platforms. By promoting newer brands in smartphones, either by supporting promising startups or encouraging large Indian business conglomerates to foray in this product category, we could create a competitive environment forcing Indian brands to level up the quality, hence satisfaction and sales.

- The gap in Tablet ratings between global and Indian brands is significant. The existing Indian brands need to have a dedicated focus on improving products in this category and explore markets beyond those enabled through government procurement through tendering, etc. Indian brands in Tablet need to make them for consumers and not for qualifying in eligibility criteria of various government tenders. Even by doing so, they are not able to make big sales as the government evaluation process also favours quality and best value for money.

- Fortunately, in the wearables category we have some promising Indian brands like Boat that has been able to get higher ratings in categories it operates. However, the primary reason for driving this sentiment has been value for money positioning. Boat now needs to intensify its R&D and product IP initiatives to be able to offer experiences comparable to global players in these product categories.

- In the IoT / Smart Home category, while the gap between the ratings of global and Indian brands is not too wide, the fragmentation of this category and many ‘no so known’ brands foraying and being able to get top positions by ratings is a matter of concern. There is a scope for the government and market regulators to proactively verify the antecedents of brands in these product categories to allow only genuine brands grow who are making efforts to design and develop India centric products in categories like smart door locks and dash cameras.

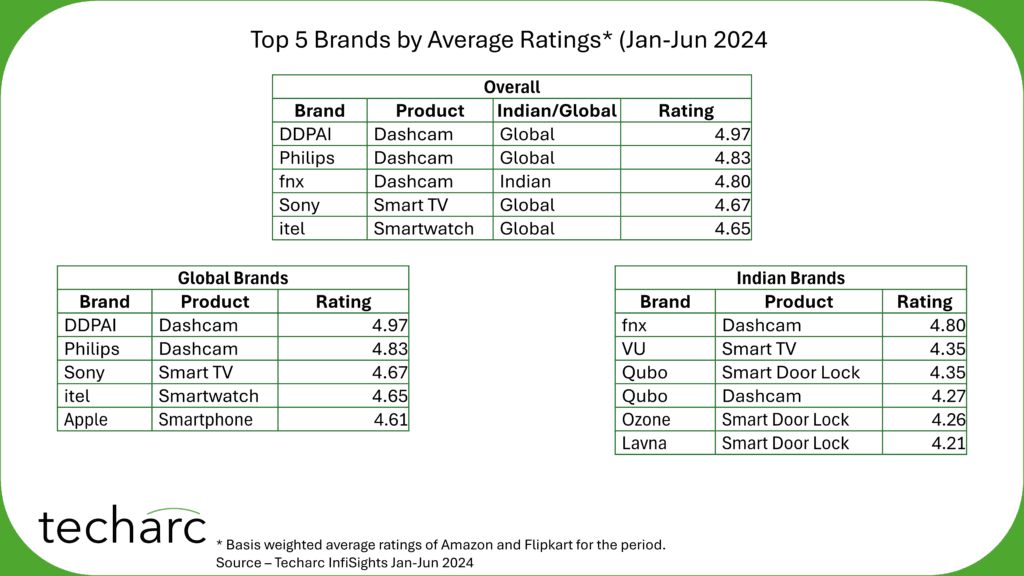

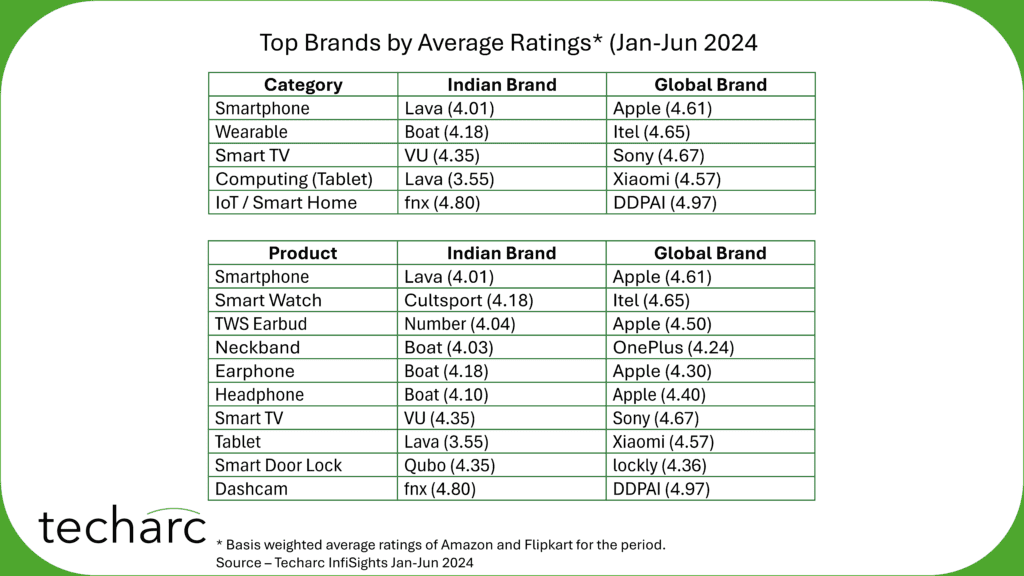

Top Brands

Dash cam brands are top performers in terms of customer ratings. The first 3 positions in the top 5 list across global and Indian brands are of dash cam makers. DDPAI, Philips and fnx which make dash cams had ratings of 4.97, 4.83 and 4.80 respectively for the period. The other two brands that featured in the top 5 are Sony (Smart TV – 4.67) and itel (Smart Watch – 4.65). The noteworthy point here is that only 1 Indian brand – fnx – featured in the top 5 list. It is surprising to note that none of the prominent Indian brands across these device categories has been able to make it to the top 5.

In global brands, DDPAI (Dash cam – 4.97), Philips (Dash cam – 4.83), Sony (Smart TV – 4.67), itel (Smart Watch – 4.65) and Apple (Smartphone 4.61) emerged as the top 5 devices makers with highest ratings.

Among Indian brands, fnx (Dash cam – 4.80), VU (Smart TV – 4.35), Qubo (Smart Door Lock – 4.35), Qubo (Dash cam – 4.27), Ozone (Smart Door Lock – 4.26) and Lavna (Smart Door Lock – 4.21) were the top 5 brands for Jan-Jun 2024 on the basis of average weighted ratings by consumers on leading online marketplaces – Amazon and Flipkart.

In terms of categories, Lava with 4.01 and Apple with 4.61 led the smartphone brands with highest ratings for 1H (Jan-Jun 2024). For the wearable category of products, Boat emerged as the top-rated Indian brand with an average weighted rating of 4.18 for the period. Among global brands, Itel got a rating of 4.65 for the period. For Smart TVs VU led the Indian brands with 4.35 rating while Sony led the global brands with a rating of 4.67. In computing (Tablets) Lava topped among Indian brands with a rating of 3.55 while Xiaomi got a rating of 4.57 during the same period. For IoT/Smart Homes category, fnx with a rating of 4.80 led Indian brands and DDPAI got a rating of 4.97 for their dash cam products.

In specific products, among global brands Apple swept the top ratings in Smartphone, TWS Earbuds, Earphones and Headphones products. Across all these products Apple got a rating of 4.30 or more. Among Indian brands, Boat topped in Neckbands, Earphones and Headphones with ratings of 4 or above.

Notes to Editor

- The analysis does not reflect the overall sentiment since the data used for this analysis is basis the ratings and reviews of two major marketplaces Amazon and Flipkart. However, this represents 35-95% of the total sales of the categories / products included in the analysis.

- The analysis ignores the pricing and segment of the products included. This may result in comparison of products targeted for entirely different market segments. For example, Apple and itel in case of Smart Watch category, where Apple is for premium consumers while itel offers in the value for money segment.

- The brands classified as global and Indian brands is on the basis of the country of origin of the brand. It is not on the basis of the country of manufacturing. There are global brands manufacturing in India and vice versa.

- The data pertains to the Jan-Jun 2024 period. However, certain products and brands were included in the analysis between Jan and Jun 2024.

- The ratings analysis presented in this report is different from the individual platform ratings available on Amazon and Flipkart respectively. This analysis is basis average weighted ratings factoring product ratings on both the platforms of Amazon and Flipkart. In case the product is only sold on one of them, the platform rating equals the average weighted rating.

- The purpose of this report is to help consumers make informed decisions basis the acceptance of existing customers as measured by ratings given by them. Ratings is a quick reflection of the acceptance of customers of a product in terms of satisfaction, performance, quality and value for money.

To experience the interactive charts please select the category chart from below.

Have a query about this analysis or want to know more about our flagship analysis InfiSights, please send your query.