Your cart is currently empty!

5G to pace up revenues for the telecom sector in India with it reaching the landmark revenues of ₹10 Lakh crores by 2023

Posted by

–

- The telecom industry is expected to add ₹1 Lakh crore in every 3 years compared to previous trend of adding the same in 4 years period.

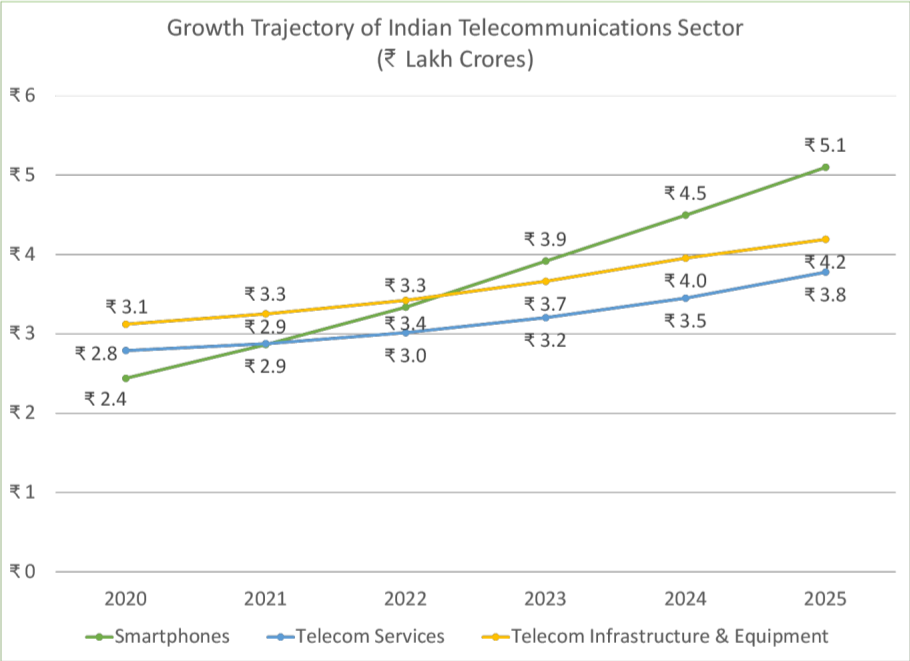

- The telecom sector is expected to grow at a CAGR of 9.4% between 2020-2025, while smartphones industry will lead the growth at a CAGR of 15.9% during the period.

- ₹2 out of every ₹3 earned by the sector are directly paid by the consumers with the remaining coming from telecom operators and enterprises.

- Smartphone growth will continue to be backed by upgrade and replacement trends with estimated 85% of the sales during the period of 2023-25 occurring due to it.

- In 2024, the 5G smartphone sales will exceed that of 4G smartphone sales with the contribution of 5G smartphone sales touching 54.5%. 4G smartphones to however, continue being in demand till a little over 2030.

Gurgaon – Commemorating its 4th anniversary, Techarc today announced a special edition report, “India Smartphone – Big Picture 2025.” The report outlines the outlook, key trends and challenges that are expected to be faced by the smartphone industry in India. The report is based on the analyses done by Techarc along with interactions done with the ecosystem leadership representing the smartphone OEMs, channel partners, component suppliers and other key enablers of the smartphone industry in India.

Sharing the key findings of the report, Faisal Kawoosa, Chief Analyst Techarc said, “Smartphones will continue to be the jewel of the telecom industry in India even as 5G goes commercially live in India anytime now. While 5G is poised to improve the overall health of the telecommunications sector, the significance of the smartphones industry is only going to embolden in the 5G era.”

Key findings of the report:

- The Telecom sector in India is set to grow at a CAGR of 9.4% between 2020-2025. Smartphone industry will grow fastest among the three main segments at a CAGR of 15.9% during the period. With the introduction of 5G, there is a positive impact on the revenues of the industry with CAGR between 2023-2025 expected to be 10.1% against 8.2% for the telecom industry between 2020-2022. The increase in CAGR by 1.9 percent points due to 5G is likely to give accelerated relief to the telecom sector in the country, after a decade of turbulence which saw consolidation and winding up of several telecom operators from the map.

- There is a need to create a trinity between the Indian technology companies of whatever scale and skill, existing R&D centres in public sector and the premier technology institutions like IITs with the sole agenda of India becoming a technology provider globally in her techade.

- With the 5G services expected to go live by the end of 2022 and scaling to several cities and towns of the country in 2023 and beyond, the telecom industry is set to cross the Rs 10 lakh crores landmark in 2023. By 2025, the Indian telecom industry is expected to cross ₹13 lakh crores.

- After 5G rollout, it is expected that the telecom industry will add ₹1 Lakh crore to the revenues in every 3 years starting 2023, which otherwise would take 4 years.

- Smartphones have changed the complete dynamics of revenues for the telecom industry. With its addition to the market pie, today consumers directly contribute for ₹2 out of every ₹3 earned by the telecom industry in India. The remaining ₹1 is through B2B revenues in terms of equipment and infrastructure purchase by the enterprises and the telecom operators.

- The smartphone market will continue to be primarily driven by the replacement / upgrade opportunities. It is estimated that over 85% of the sales for the period 2023-2025,

- Techarc estimates that in 2024, the new smartphone sales will cross 200 million milestone for annual sales. This means it will double in around 8 years. India started selling more than 100 million smartphones annually in early 2016. It took a little over 11 years to reach the landmark of selling 100 million smartphones annually in India.

- With a shift towards premium (₹25,001-50,000) and luxe (₹50,001 and above) segment buying, although the unit sales of smartphones will witness 8-11% growth annually, the revenue sales will grow in the range of 13-18% during the period. By 2025, Techarc estimates that the smartphone sales will exceed ₹5 Lakh crores.

- The true 5G years are yet to come in India that will be marked with the introduction of mass volumes in ₹10,000-20,000. Though, its important that for extremely price conscious segments, there are options in 5G available in sub ₹10,000 also, but looking at the previous trends and consumer behaviour, the mass opportunity is likely to fall in ₹10,000-20,000 range.

- Techarc pegs 2024 to be the year of flip for 5G when the sales contribution of 5G smartphones will exceed half (54.5%) of the total smartphones sold. This does not mean extinction of 4G smartphones anytime soon. While in 2025, Techarc estimates sales of 77 million (36%) of 4G smartphones, demand for 4G smartphones should continue even beyond 2030. Going by the trends, Techarc predicts 20-25 million 4G smartphones being in demand in 2030.

- Techarc estimates the foldable smartphone sales to touch 1 million by 2025 with at least 5 brands making them available for commercial sales. However, Samsung is expected to maintain the lead in this niche smartphone segment.

- The total expected smartphone sales generated through offline channels in 2022 stand at ₹133,449 crores as against ₹91,875 crores of revenue contributed by offline channels in 2014. This is 45% more than what the offline channel was generating in 2014. The dooms day of offline channel does not seem to have arrived and it continues its growing contribution.

To read complete report and insights, please click below

For any queries regarding the report please contact

Media – Media@techarc.net

Industry – Research@techarc.net