Motorola and Samsung retain their ‘Best 5G Smartphone Brand’ rankings for 2024. 3rd rank is taken over by Realme displacing Oppo comparing 2023 rankings.

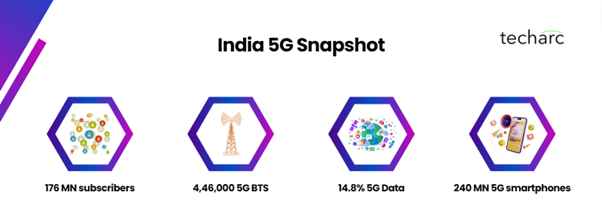

Gurugram – According to the 2nd edition of Techarc’s ‘India Best 5G Smartphone Brand’ report released today, 89% of the total 5G smartphone sales for the calendar year 2024, will lie in the price range of ₹10,000 – 40,000. Out of the remaining 11%, 5G smartphones priced above ₹40,000 are expected to contribute 6% of the sales while the sub ₹10,000 sales of 5G is expected to fetch 5% of the total 5G smartphone sales pie for the year. Overall, the report estimates 123 5G smartphones to be sold during the calendar year amounting to 77% of the overall smartphones expected to sell in 2024.

Quoting key takeaways of the edition, Faisal Kawoosa, Chief Analyst, Techarc said, “This year we see a paradigm shift in the consumer asks when it comes to 5G smartphones. In 2023, consumers were wanting access to 5G giving preference to brands that offered seamless connectivity and coverage. This year consumers are looking beyond these hygiene factors and prefer brands offering superior experiences and wider choice to consumers looking to buy 5G smartphones.”

“Smartphone makers will have to carefully design their 5G smartphones using superlative specifications across key features defining the experience along with having a pampering palette to offer a wide array of choice,” explained Faisal while decoding the consumer preferences regarding 5G smartphones.

Report Key Takeaways

- While smartphone market is defined as entry, basic, mid, premium and luxe (ultra-premium) as a generic segmentation, in 5G consumers are showing three distinct sets of behaviours as defined by price segments – up to ₹10,000, ₹10,000 – 40,000 and above 40,000. The smartphone OEMs will have to align their 5G portfolio as per these segments while designing products to cater to these distinct cohorts of potential buyers.

- In sub ₹10,000 the primary ask is still about 5G connectivity along with a good battery backup. The consumers do understand that while they would want to consume a lot of multi-media content for which display and audio experiences are important, they may not get equivalent of what consumers are getting in higher segments.

- The consumers buying 5G smartphone for more than ₹40,000 have entirely different expectations. Their expectations aren’t exactly defining because of 5G. They want their smartphones to offer secure and safe environments, leverage the brand equity defining their socio-economic profiling, and have the best of the ingredients coming from world’s best component ecosystem. Rather than the 5G capabilities of the smartphone, they are more interested in understanding the invaluable use cases of 5G where they expect AI to play a role especially after GenAI and AI on-device.

- The very demanding and diverse consumer preferences are among consumers buying 5G smartphone in the range of ₹10,000-40,000. However, broadly, these can be summarised as enhanced performance and experience as defined by the specifications of key attributes of a smartphone critical from 5G viewpoint and a wide range of choice to select from. The specifications that they are concerned with regards to 5G experience include display, battery, processor, memory and storage. These are the top 5 specifications that the consumers evaluate while selecting their 5G smartphone in that order ranked by 78% of the respondents surveyed for this study. The non-5G specifications include camera, audio and durability. For the choice the consumers look for range of the models offered by a brand, then the variants defined by the configuration (RAM/ROM) and finally by the colours. The CMF is increasingly becoming an important factor for consumers evaluating 5G smartphones in this range. Though CMF does not have a direct bearing on the 5G experiences, it defines choice for consumers who are also stepping up to next segments while purchasing a 5G smartphone. 68% of the respondents also considered CMF (which defines choice for them) while evaluating their 5G smartphone.

- Overall due to lack of convincing 5G use cases across consumer segments, the evaluation is done on capabilities defined by the specifications followed by the options defined by models, variants and colours.

- Among brands while Motorola and Samsung continue to remain preferred 5G smartphone brands in the range, Realme has taken over Oppo followed by Redmi in terms of meeting the consumer expectations basis the 4C framework used in this research. 4C framework factors connectivity, coverage, capability and choice as the four pillars defining brand preferences with regards to 5G smartphones. Among other brands, Vivo and CMF/Nothing are emerging to be two more brands that consumers consider are offering wider and refreshed 5G portfolio to choose from.

Best 5G Smartphone Brands

Owing to their scoring higher with regards to uncompromising capabilities and offering a wide range of choice of 5G smartphones to consumers to buy from, Motorola and Samsung have been able to retain their spots in 2024 in the list of ‘Best 5G Smartphone Brands’ in ₹10,000 to 40,000 price range, which is expected to contribute 89% of the sales for the year. After a dwindling year, Realme has made a comeback ranking 3rd, in terms of aligning its portfolio with the expectations of the consumers buying 5G smartphones.

The rankings are derived using 4C framework with Connectivity, Coverage, Capability and Choice as the four pillars defining preferences of consumers buying 5G smartphones. Compared to 2023, Choice has emerged as the fourth pillar in the framework as an important deciding factor for consumers in the absence of convincing 5G use cases. As consumers are buying 5G smartphones in their natural process of upgrade and replacement, they evaluate brands basis the choice offered. Choice is defined by the number of models being offered, variants in terms of RAM/ROM configurations and the colours within these models and variants.

In the analysis of 5G smartphone models in currency (available for retail in online and/or offline channels), Motorola had 14 models to offer giving a choice of 68 options to consumers to choose from. Realme had 12 models expanding into 59 choices followed by Samsung with 11 models and 73 choices.

The other brands making it to the top 10 ‘Best 5G smartphone brands’ included Redmi, Vivo, Poco, Oppo, iQoo, OnePlus and Nothing / CMF in that order.

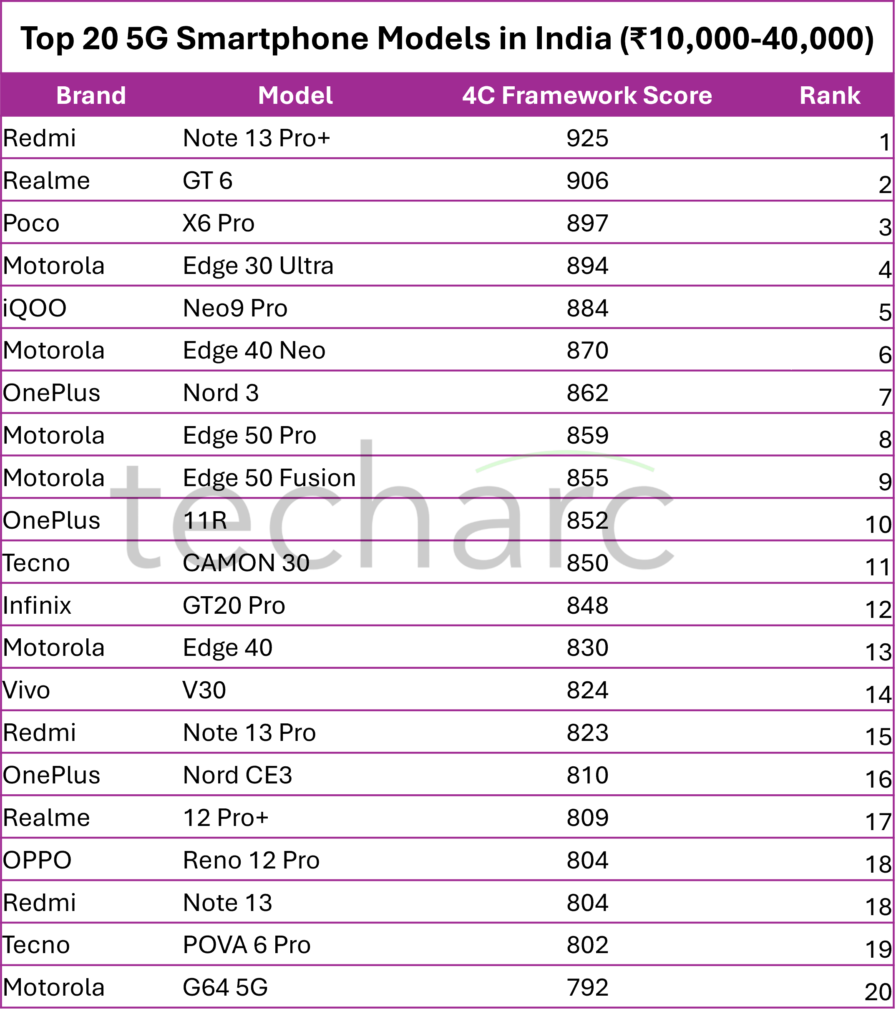

In terms of 5G smartphone models, Redmi’s Note 13 Pro+ scored top rank followed by Realme’s GT 6 and Poco’s X6 Pro at 3rd spot. In top 20 5G smartphone models, 6 models featured from Motorola, while Redmi and OnePlus had 3 each 5G smartphone models. Realme and Tecno had 2 each models in the list. By chipset makers, MediaTek’s Dimensity powered 11 out of top 20 5G smartphone models while Qualcomm Snapdragon chipset powers 10 models. By specific SoC, Qualcomm’s Snapdragon 7s Gen 2 powered 3 out of top 20 5G smartphone models in the range. Qualcomm’s Snapdragon 8+ Gen 1, Snapdragon 7 Gen 3 and MediaTek’s Dimensity 6080 powered 2 each 5G smartphone models of the top 20 in ₹10,000 – 40,000 range. Notably, none of the Samsung 5G smartphones in the range featured in top 20 as per the 4C ranking framework used by Techarc.

Forward Outlook

With 5G yet to find out a convincing use case for consumers, the 5G smartphone sales will be driven by the routine upgrade and replacement needs of consumers. This means from 5G standpoint finding a straight and direct evaluation criterion for consumers to select their preferred 5G smartphone or brand will continue to be challenging. In this scenario, consumers will continue to evaluate 5G smartphones basis the capability as defined by specifications and the choice as determined by CMF.

As a consequence, the smartphone OEMs will result in a ‘specs war’ where the incremental innovation and differentiation is defined by the additional strength of specifications of various features and attributes of a smartphone. However, instead of camera being the key criteria, consumers will now evaluate a bouquet of specifications that includes display, battery, processor, memory and storage. These are essentially the factors that will define the performance of a smartphone while consuming resource guzzling applications like AI, gaming, rich multimedia content, etc.

The other factor will remain choice helping OEMs to package the upgrade experience for consumers. In essence, consumers will perceive best 5G smartphone brands and models basis adjacent factors and features and not the real 5G factors like the gigabit data speeds, zero latency, etc. For now, we don’t have use cases where these would make the real difference in consumer experience besides the network quality.

Notes to Editor

- Publications and editors are at the sole discretion of using excerpts or the entire release for their features and stories.

- The insights and analyses are purely based on the customer opinion. For this survey, we had surveyed 2,000 customers using a 5G smartphone and 1,000 planning to upgrade their existing smartphone.

- The survey was conducted 15 locations representing urban/rural and metro/non-metro universe of smartphone users. The survey was conducted during July 2024.

- A total of 115 smartphone models and variants were covered in the survey. The models were identified being in currency – available online or offline for sale.

- Techarc uses its proprietary 3C framework to score smartphone models and brands for adjudication of Best 5G smartphone brands/models. However, after consumer survey, it was observed that consumer parameters have changed, and ‘choice’ has become another important factor. Accordingly, 3C framework was changed into 4C framework and weights were adjusted as per the consumer preferences.

- No brand or its partner is allowed to represent this research in part or whole, in any format, without the explicit permission from Techarc.

Read the entire report here.

If you have any queries about the report or want to understand deeper about the 5G smartphone landscape in India, please connect.

What Samsung needs is to carve out a constellation for the masses within its galaxy of devices - Techarc

August 27, 2024[…] have seen 2-3 times growth in their market share over past few years. Why have these brands been able to do so? It’s not just about 5G. Offering 5G is now a hygiene. These brands asides […]