With a strong player in the space it forayed, how did Realme manage to garner its market share and be among top 5 Smartphone sellers by the end of 2018.

Gurugram – March 4, Monday 2019: Indian consumers are ruthless and show loyalty to none. This looks like a strong statement but is a reality check for brands who take the markets casually after what could be referred to ‘Brand Arrogance’ sets in.

One of the star entrants of 2018, Realme surprised everyone by the growth trajectory they were on and in a very short span of time they become not only a significant brand to catch attention of everyone, but also by the year end, they were among top 5 selling Smartphone brands in India.

How did the brand manage so with nothing unique to offer? The business model and channel were very much tried out by its predecessors and amidst all the confusion about whether it’s a sub brand of Oppo or a standalone brand, it managed to become a star performer.

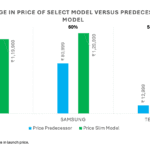

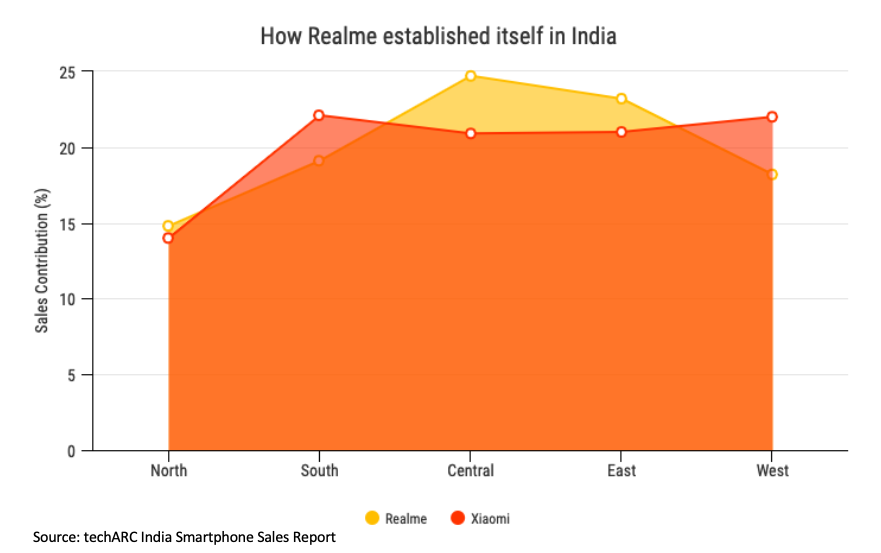

As per techARC’s Smartphone sales analysis, Realme took a different path to establish itself than the competition around. Its main competitor Xiaomi had by that time established evenly across the regions of the country, however, it was still skewed towards South and West. This is not the case of Xiaomi only, but all major online heavy brands including OnePlus and Honor, South is the main contributor of sales followed by West. Realme sailed across the winds and established itself in Central and Eastern regions gaining the maximum of its sales from these two under-served regions.

This is from where Realme got the kick which pushed it to the top 5 Smartphone brands by the end of the year by sales. Central and Eastern regions of the country mainly comprise of Cat B and C telecom circles. These circles had a substantial base of Smartphone users who wanted to either buy their first 4G Smartphone or upgrade to a Basic level Smartphone from their existing Entry Smartphone. This is what Realme capitalised and made sales of over 3 million just in the last quarter of 2018. Against this Xiaomi, which enjoyed the leadership in this segment, wanted to focus more on Mid segment of Smartphones Rs 10,000 – 25,000 and had all its messaging and push for this category followed by a build-up of products.

On this, Faisal Kawoosa, Founder & Chief Analyst, techARC said, “Central and East regions continue to be under-served by online heavy brands. Despite, both Flipkart and Amazon addressing their initial limited reach in these regions, none of the major online players has been able to establish in these regions other than Realme.”

“There is perhaps need for targeted digital marketing specifically for these regions by the Smartphone brands so that they can influence the buying behaviour which appears to be in the favour of offline channels,” added Faisal.

Northern India is another region where online sales contribution is lesser than the other regions for all the brands. But this is also due to the region that the Cat B and C circles falling in this region are among the lowest subscriber base regions, hence the lesser potential to sell. But, Realme has done better in this region as well compared to Xiaomi which is not just a direct competitor but the leader in overall sales as well as the online channel.

The important takeaway for the brands here is that each one has to carve a niche engulfing product, price, promotion and the place (distribution) to make an effective entry in the market and take it from there. Realme has so far been able to successfully register its first cycle of growth. Now will it be able to keep the momentum on, depends on how thoroughly it devises the strategy for its next cycle. It has to know precisely wherefrom it could come like it did in its first phase.