AI, CMF (Colour-Material-Finish) to be the key drivers of differentiation, 5G in the lower tier segments. No big shift expected in market leadership positions; however, challenger brands to see further fragmentation. Online likely to contribute more than 55% of the total sales.

Gurugram – In its mid-year review released today for the India smartphone market, Techarc today said it estimates the 2H (Jul-Dec) 2024 sales of smartphones are likely to cross 100 million units. This will take the total annual sales of smartphones for the entire year to settle at 155-158 mn. That would be a 7-9% increase in volume sales over previous year. The factors leading to the growth include harmonisation of sales potential across all segments after focus of the ecosystem at the lower-tier segments, routine replacement and upgrade cycle sales, and innovations led by AI, form-factors & CMF enticing a niche segment of early adopters even if the visibility about tangible use cases and applications remains vague. The likely politico-economic stability expected after the conclusion of general elections in May is also seen as a factor in bringing the market back in action.

Commenting on the mid-term review, Faisal Kawoosa, Chief Analyst and Founder, Techarc said, “The big shift in the strategy of smartphone OEMs after the covid era will start showing its impact in the second half of 2024 and define the market dynamics for next couple of years for the smartphone industry in India.”

“After covid-19 due to various reasons including aligning with the supply chain, smartphone OEMs had started giving preference to premium tiers of the market driving value growth and making the volume growth stagnant to negative. Now, the OEMs are leveraging the technology waterfall and diversifying their portfolio across the customer segments they want to focus. This is a big shift and will drive a balanced growth in value-volume measures of the market,” Faisal explained.

Mid-year review highlights and outlook

- 5G is no longer a differentiator. It has become the default cellular technology being expected by consumers irrespective of the price segment they are looking for smartphones within. Even customers who don’t plan to or cannot use 5G services, are expected to give preference to a 5G smartphone over 4G if available in their target price range. As a result, the gap between 5G live smartphones and 5G subscribers will continue to remain with 70-75% of 5G smartphone users actually using a 5G service. Similarly, users in areas like semi-urban and rural territories where BSNL 4G services are expected to see gaining most, the subscribers are expected to buy a 5G smartphone over 4G smartphone opening up opportunity for ₹8,000-12,000 (Basic segment) of 5G smartphones. The positioning of BSNL 4G sims as ‘5G ready’ is influencing consumers to future proof their smartphone investment. With this potential of 5G driven by consumer preferences and the smartphone ecosystem recalibration, 80% of the smartphones expected to sell in 2H (Jul-Dec ’24) will be 5G smartphones.

- The innovation in the smartphone industry still remains among one of the biggest challenges. AI and CMF innovations are emerging to be the two key differentiators for the smartphone offerings during the period. However, these will not help the OEMs to increase their revenues. Rather these differentiators will help them to retain the revenue levels in the absence of strong and convincing use cases brought to the ecosystem by these ‘innovations’. These innovations are also likely to further widen the replacement cycles as AI will lead to continuous improvement at the software (application) level bringing new features and use-cases for the consumers without any hardware replacement need. Innovations at the CMF level is adding to the durability of smartphones increasing their expected life, hence the replacement. As an example, introduction of metal body instead of plastic / polycarbonate materials significantly adds to the durability of a smartphone. These differentiators are expected to increase the life of smartphones by at least 50%.

- Among the form-factors, ‘fold and flip’ gains the confidence of consumers and moves from an ‘intriguing’ form-factor to an ‘interesting’ form-factor. The upcoming festive season is likely to be one of the best festive periods for the foldable smartphones. Our estimates suggest the sales push during the festive period should help cross 1 mn foldable smartphone sales for the year 2024. There are 6 smartphone OEMs offering foldable smartphones to consumers. We expect 2-3 more OEMs foraying in this form-factor in India before the end of 2024. While foldable smartphones will continue to remain a niche cohort of the market, the OEMs need to package it as a solution rather than attempting to leverage only on the form-factor. For instance, they need to bring in paid content offers for the owners of foldable smartphones who could enjoy reading their newspapers, magazines and other captivating content aligning with the tastes and preferences of the buyer segment. AI can also be uniquely leveraged here that could transform the content in fold friend format delighting users. The smartphone OEMs could also unfold beyond the smartphone and bring in value through associations and alliances beyond devices that could include exclusive club memberships, etc., complementing the lifestyle of primary target segment of foldable smartphone users.

- Smartphone has an economic value for its users. In a study done for Vivo in 2023, the overall economic value was estimated to be 6 times of the ownership cost of a smartphone. Smartphone OEMs having large user bases can further increase this economic value by collaborating with the ecosystem outside their world to bring exclusive deals and appreciate the economic value of the consumers using their brand. Large smartphone active users’ base brands like Samsung, Xiaomi, Vivo, and others can forge exclusive deals for their customers who can get directly benefited by using a smartphone of their brand. For example, quick commerce and online food ordering is increasingly becoming popular among youth. A brand can collaborate with these platforms offering exclusive additional discount defined by the number of orders or for a specific period, increasing the economic value of a smartphone for the users and appreciating the value of brand loyalty. The usual brand loyalty programmes offering greater exchange value, special exchange/upgrade bonus, or discounts on purchasing accessories restricts the scope of enhancing the value. Similarly, the brands targeting premium users can collaborate with the services relevant for premium users giving them exclusive benefits in reward of brand loyalty. This is very important for smartphone brands to pivot from their conventional thinking and bring sustainable differentiators for their smartphone users.

- No channel or medium is expected to have an edge over the other. With regulatory interventions and rekindling of channel strategy by OEMs it is unlikely to expect any specific medium – online or offline gaining an edge in sales contribution. Starting 2H 2024, we expect the channel to level achieve an equilibrium state with both almost contributing equally to the smartphone sales. However, online will continue to have edge during festive seasons by 3-5% points due to offers and deals along with convenience factor that is difficult to replicate in the offline medium. However, the good news is that online marketplaces have established their relevance in smartphones and offline channels have reiterated their significance in achieving the business objectives of smartphone OEMs. Going forward, it’s highly unlikely to expect any OEM preferring one at the cost of another, except in cases where the brand wants to play predominantly online or offline, again defined by the business objectives at the brand or conglomerate level.

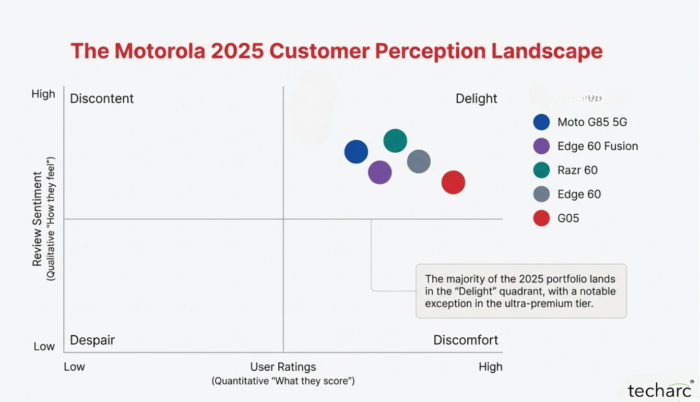

- We expect no big shifts in the market standings of the smartphone OEMs. However, with the growth levels of some of the brands not in the top 5, the number of emerging and challenger brands is likely to increase starting 2H (Jul-Dec ’24). The market contribution of Significant 7 (5+2) brands, which includes Samsung, Redmi, Realme, Vivo (excluding iQOO), OPPO (5) and, Apple and OnePlus (2) is going to contract at an aggregate level. Currently these brands’ cumulative market share by volume ranges 68-73% in a quarter. This is likely to go down to 63-67% in 2H 2024. The brands benefitting out of this transition include Motorola, Poco, iQOO, Nothing, CMF, Honor and Lava (listed randomly). After Significant 7, we are expecting to have Emerging 7 brands also becoming important stakeholders in the India smartphone market. Consequently, we are heading back to the era where top 20 brands would matter after a gap of 7 years since which only top 10 were important for market watchers to take note of. In this market structure, it will be very important for brands to identify their cohorts and strategise for the cohort instead of segments, where they will unnecessarily attract intense competition affecting their business prospects and profitability.

Prescription for the industry

The 2H (Jul-Dec ’24) is expected to act as a ‘mini-playground’ for the India smartphone industry that will define the future game for next 2-3 years. The OEMs need to take this period extremely seriously to be able to align early on with the changing market structure and dynamics defining the next couple of years. We enumerate some of the priorities that the OEMs need to focus on during this period to lay a strong foundation for the opportunity ahead.

- Do not over-hype ‘innovations’. Be modest with the incremental differentiators and avoid tagging them as game-changers and pathbreaking innovations. This will set the right expectations in the minds of consumers who will not quickly discount the value / gain out of the deal. Make customers aware that in every industry there is a period when innovation stalls and they can only expect incremental differentiators to excite their valid need for upgrades and replacements.

- Do not look at 5G, AI or any other technology around as means to super-profit or monetisation. Without very convincing use cases OEMs cannot force consumers to pay a premium to own these technologies. For now, treat them as revenue retention mediums helping the OEMs to maintain revenue levels and arrest the price waterfall that will eventually affect the ASPs.

- The larger live base smartphone brands as well as premium segment OEMs need to see beyond smartphone ecosystem to increase the economic value of a smartphone for their loyal customers. The present playbook of additional offers, exchange bonuses and extra discounts on accessories are seen ‘ploys’ to extract more from loyal customers. Give customers the real rewards adding to their lifestyle and living.

- Enough of idolising camera! With 5G data speeds OEMs need to understand that content consumption of resource guzzling applications is increasing. In premium segment more than 80% of the content consumed is in the form of videos and games. So, start gradual shifts in your KSPs and highlight the innovations in the areas of display, battery (other than fast charging), OS optimisation, performance improvements, etc. Let consumers be educated what is important for making the best of 5G data speeds till real use cases are figured out.

- There cannot be same playbook across user segments being targeted. In premium segments privacy and security is a big concern as against design and aesthetics in mid ranges. In lower tier its still about enablement of key features and functions. Align your content and outreach according to your target base addressing their key concerns in respective segments.

- Avoid talking ‘premiumisation’. It translates into consumer understanding paying more than the intrinsic value of the smartphones. The predominant proportion of consumers in India is very value conscious and if they feel they are paying more than what they are getting, they will restrict the purchase. Tell consumers why they still need to ‘step-up’ to next segments exposing them to superior quality, use of better components, longevity of the product, improvement in performance, security and overall experience.

About the mid-year update

The mid-year review is basis our interaction with the ecosystem including smartphone OEMs, component suppliers, channel partners and sentiments of 10,000 consumers captured through online and offline mediums through analytics and survey methods.

Techarc publishes mid-year review reports to release guidance about the remaining period of the calendar year helping the ecosystem to leverage the insights and make alignments in strategy, product, channel, marketing and other functions to maximise the opportunity basis the consumer sentiments and insights.

To engage for a deeper understanding of the market outlook, please connect.