In many of my earlier notes and media interactions, I have explained how the several shifts and transformations within Xiaomi are resulting in it momentarily losing grip on the market in terms of sale figures. This phenomenon is not new and unique to Xiaomi. In the past we have seen similar trends with many brands which saw a momentary dip due to so many things happening altogether in an attempt by the brand to realign with new market realities.

There are two types of changes that keep the market a dynamic place. There are short term fads and waves to which brands tactically respond. The brands may not be identifying themselves with these changes or may not be convinced about them at all. But to keep with the trend or for FOMO, they adopt these changes too. However, these changes are quick to absorb and do not necessarily impact the growth trajectory of a brand. It doesn’t result in dip in any momentum. Examples could be launching similar offers, campaigns, etc.

But on the more strategic changes, there is a new course defined, and it takes time to align on that path. Yet, some brands do not maneuver this transition well and lose the market grip permanently. Nokia in smartphone is a classic example. On the successful transition side, Samsung’s catching up with online sales is a good example to talk about. Samsung launched M series and tried to bring similar portfolio to Redmi and Realme of 2018-19, which were ruling online sales back then. Obviously, this took time for Samsung, but a brand which was completely offline, started seeing sales from online marketplaces too. Subsequently, it added more models for online sales channel.

Coming to Xiaomi’s recent dip, it’s because of three main factors. One is of course its transition from a value for money brand to going into premium lane. That journey will take time. As recently highlighted, I think Xiaomi 15 launch has established it in the right orbit, now it needs the right velocity to gain share in premium tier.

The second factor, of course was its people movement and accounts being frozen for them. That too does impact the operations. This too made them to implement contingency plans, and we are now seeing things settling down here too.

The third and important factor is the changing buying behaviour. One of the key success factors for Xiaomi, especially Redmi has been a strong community push. Prior to Xiaomi only LeEco had attempted a community push but then it had to wind up for an unviable business model. By the way, LeEco smartphones weren’t bad!

One might argue, how does this prove that the community led smartphone brands are losing the market grip and this is not specific to Xiaomi alone. Well, if we closely observe the brands that have been witnessing a consistent dip in the market in recent quarters against the brands that are growing, the difference is only about being community driven or otherwise. Redmi, Poco, OnePlus are a few examples of smartphone brands which have been consistently witnessing a dip in the market sales. Realme and iQoo too are community driven, but then Realme was smart enough to develop very good rapport with the offline retailers in past few years, and we saw channel associations even ‘endorsing’ them in public forums. iQOO is a purpose driven community which has gamers, so makes sense. The recent addition is of Nothing community, which is anyways registering growth owing to its early journey. It too might have to pivot quickly from this community obsession.

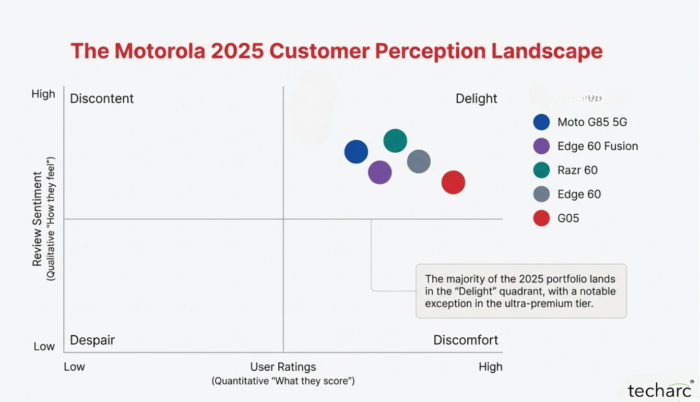

Now, let’s look at the brands registering growth. These include Vivo and Motorola. Both don’t have any kind of organised community. Yet they are not only maintaining sales momentum but also registering growth at the same time.

Other brands like Samsung and Tecno, also had been pushing around content creators, etc., in recent times. I have seen their launches flooded with content creators. We are noticing that’s not paying off well too.

Well, I am not suggesting that this is the only reason for all the brands that are showing southward trends in sales and market shares. But, yes, there appears to be a strong inverse correlation between sales and community driven brands in recent quarters. Other than that, there are very brand specific reasons as well that affect their performance.

Another interesting trend that corroborates is the rise of offline. Usually, community driven things worked best for online and social selling. The fact that offline has grown over past few years, reaching to mid-point from 40-42% average, shows that users are wanting to purchase directly and not go through the community gatekeepers.

Xiaomi as well as other brands, which still rely heavily on community, especially a community which doesn’t have a common purpose like gaming, etc., have to rethink their go-to-market and align with the changing buying behaviour. This is the thing to look into.

Ranjeet Singh

May 21, 2025Sales dip can be cyclical, change in portfolio as you have correctly highlighted – value for money to premium lane..

The start of community starts with purpose, as long as brands remain true to the purpose, community would stay. The dismantling of community happens when the “Why” of the purpose is diluted.

Kailash Lakhyani, Founder Chairman AIMRA

May 21, 2025You’re right, Mr. Kawoosa. Consumers still trust traditional mainline stores, especially for mobile phones and other electronics, not for items like doormats or tea leaves.

The mobile phone is always a buyer’s experience product. Brand CEOs misused modernization and digitization to create a monopoly when they supplied stock to e-commerce for various and vested interests. That’s why they committed fraud with the system, aiming to portray themselves as the “Amitabh Bachchan” of the industry. However, they were involved in unlawful and anti-competitive businesses with e-commerce, as revealed in the recent CCI report.

Numbers in the mobile industry are manipulated for valuation, to safeguard jobs, and for white-collar fraud. Even today, numbers are fake because most e-commerce stock ends up in the grey market, and a lot of it is exported, which is an open secret in the smartphone industry.

Sales shown on e-commerce are diverted to the grey market and then to small retailers. The actual end customers are buying from these small retailers, who, like others, disregard the law of the land for their survival or for earning money by hook or by crook. Anyway, the numbers show e-commerce sales, but the fact is that 80% of these sales end up in the grey market and for export.

E-commerce stock routed for export again shows up as e-commerce sales, but the end customers are in foreign countries. “Pre-activated” or “air-activated” means the figures show Indian business, but the customers are in other countries, while the brand gets a share in the Indian market based on activation.

When these grey market and export activities are stopped, the India business of these notorious and fraudulent business practices will show a nosedive. Then, whatever Guinness records, No. 1 tags, and “best CEO in the country/world” accolades will fade out, and they will be out of the industry.

Anyway, the reality is that customers are not permanent for any brand or store. Customers want new things, the best quality products, good prices, and respect; they always seek uniqueness. Everyone should be humble and must constantly chase consumers and the needs of the hour.

In our country, there are loopholes and greed, so you never know who the actual leader in Android smartphones is, because whatever numbers are shown by agencies are based on shipments, so there’s a year-on-year change in leadership.

Customers are buying good products, value for money, and the trust of the brand.