Remember the moment everyone started talking about ChatGPT? That spark — the popularization of generative AI — did something remarkable: it suddenly made a very specific piece of hardware feel like the backbone of an entirely new economy. That hardware was made by Nvidia, and the result was a dramatic re-shaping of the company’s fortunes. Fast forward a couple of years, and Nvidia wasn’t just riding a wave — it became the first public company to hit a $4 trillion market cap.

This wasn’t random. It was the result of timing, technology, and a whole lot of companies betting the future of their businesses on the same stack: Nvidia’s chips + software.

The simple story, in one paragraph

AI models got huge and hungry. Training them needed massive parallel compute, memory, and fast networking — problems GPUs solved beautifully. Nvidia had the fastest, most mature stack (chips, interconnects, and software), the hyperscalers needed it, and the orders kept rolling in. Revenues ballooned, investors rewrote valuation math for the AI era, and in July 2025 Nvidia became the first company to cross $4 trillion.

Why the market suddenly cared about GPUs

If you’re not deep into machine learning, think of model training like baking a gigantic cake. The recipe (model) and ingredients (data) matter, but if you don’t have ovens that can handle industrial trays, the cake never happens. GPUs are those industrial ovens for AI: they do huge matrix math fast and efficiently, exactly what LLMs and multimodal models need.

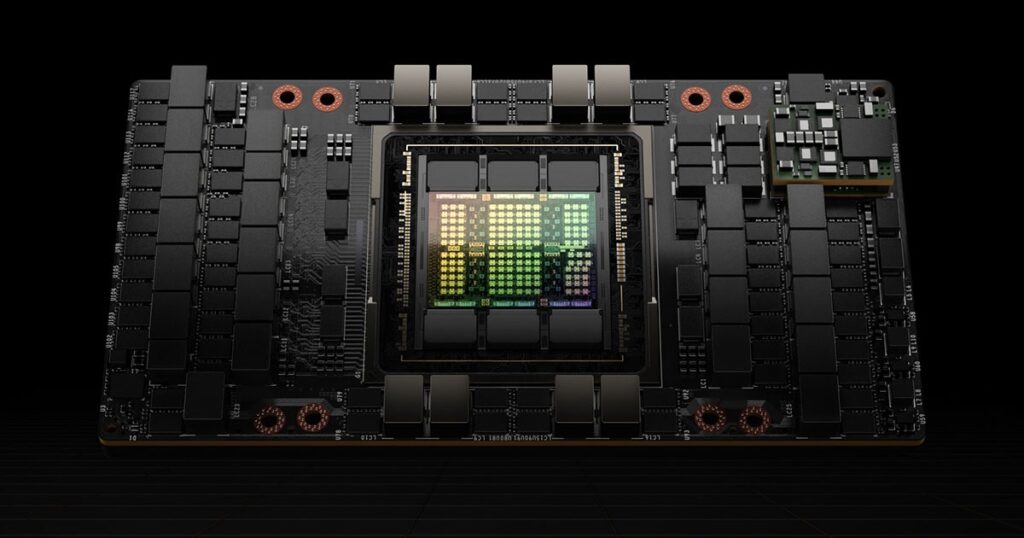

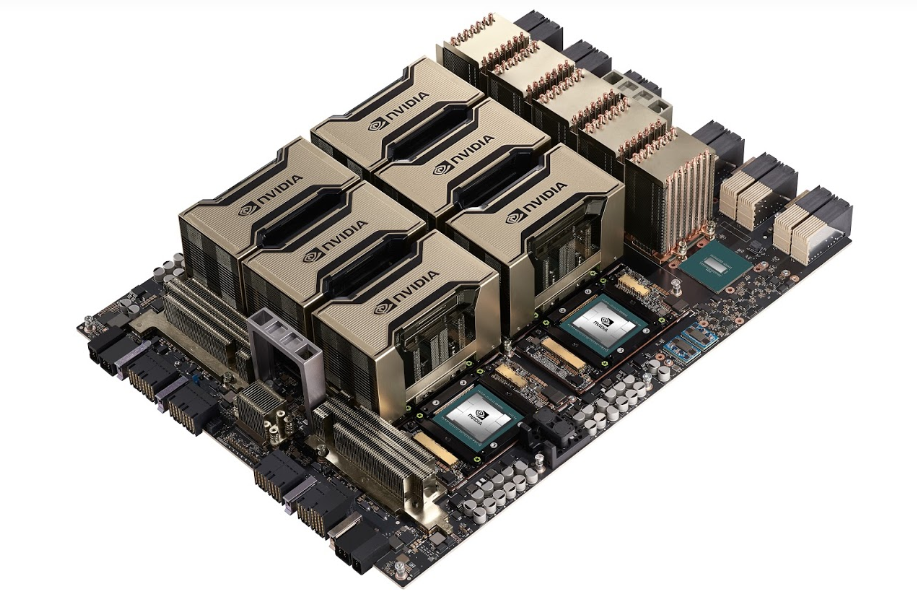

What made Nvidia special wasn’t just one great chip. It was an entire ecosystem:

- GPUs built for AI (A100 → H100 → Blackwell)

- High-speed networking (Mellanox) to stitch many GPUs together

- Software libraries and tools (CUDA, cuDNN, NVIDIA AI Enterprise) so researchers and engineers could scale models without reinventing the wheel

Put those pieces together, and you don’t just sell a chip — you sell a complete platform.

Who bought up all those chips?

The big buyers were familiar names: Microsoft, Amazon, Google, Meta — the cloud and consumerinternet giants. They needed GPU farms to train their models and to offer AI services to customers. When these hyperscalers decided to scale up, they bought tens of thousands of GPUs. That kind of demand has ripple effects: big orders, long-term vendor relationships, and a lot of predictability for Nvidia’s revenue.

Startups, enterprises, carmakers (for in-vehicle AI), and even national AI projects joined in. As more customers built their software atop Nvidia’s tools, it became harder — and more expensive — to switch away. That stickiness is gold for a tech company.

A fast-moving timeline (the short version)

- Late 2022–2023: Generative AI hits the mainstream; GPUs become mission-critical.

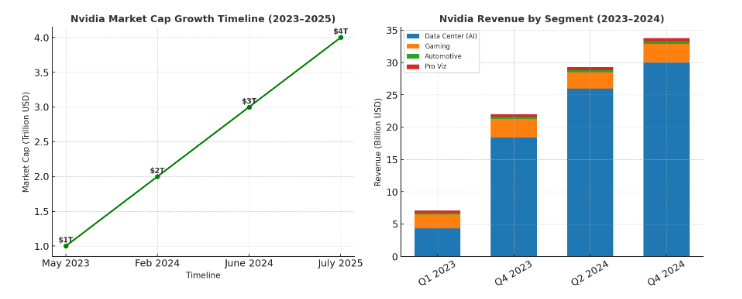

- May 2023: Nvidia hits $1 trillion as investors price future AI demand.

- Feb 2024: $2 trillion after blockbuster earnings and bullish guidance.

- June 2024: $3 trillion as AI rollouts accelerate.

- July 2025: Nvidia becomes the first public company to reach $4 trillion — a valuation driven overwhelmingly by Data Center/AI demand.

Along the way, quarterly revenues moved from the low teens (billions) to the $30–35B range in late 2024 — a scale-up that few companies can match so quickly.

Numbers that explain the frenzy

You don’t need every decimal to see the trend: Data Center revenue — the part of Nvidia’s business tied to AI servers — shot up to be the dominant slice of the company’s sales. In peak quarters, Data Center made up roughly 80–90% of revenue. Gaming and automotive kept growing, but they were never the headline — the AI data centers were.

When a single segment becomes that large and is expected to keep growing, markets re-price the entire company. That’s what happened with Nvidia.

Why competitors didn’t stop Nvidia

A few things gave Nvidia an advantage that wasn’t easy to beat overnight:

- Ecosystem lock-in: CUDA and Nvidia’s tooling are deeply embedded across research labs and production systems. Rewriting years of work for a new chip is expensive.

- Scale and performance: Nvidia’s high-end GPUs led in raw performance for training many types of models.

- Systems and networking: Hyperscalers didn’t just buy chips — they bought ready ways to connect thousands of GPUs. Nvidia could offer that system-level thinking.

Competitors like AMD and Intel made progress, but they faced uphill battles: building matching software ecosystems and convincing big customers to switch.

The business moves that mattered

Nvidia didn’t get lucky — it executed:

- A predictable cadence of product releases that matched what AI developers needed.

- Expansion from chips into full systems (DGX), networking, and enterprise software so customers bought whole solutions.

- Close partnerships with cloud players so those clouds spun up huge GPU instances quickly.

- Smart capital moves (buybacks, stock split) that kept investors’ attention.

Combine all that with a tidal wave of AI projects across industries, and you get the perfect storm for rapid valuation growth.

A quick reality check — risks that could slow things down

No boom lasts forever without reason. The big risks are:

- Hyperscalers build their own chips or diversify suppliers.

- Competition closes the performance or software gap.

- AI spending cools if the tech hits a plateau or economic conditions tighten.

- Geopolitics and export controls change where chips can be sold.

At $4 trillion, expectations are sky-high — and markets will punish any slip-ups harshly.

Why this matters beyond stock prices

This story is important because it proves something: in the AI era, hardware and systems matter as much as models and data. Software advances drove interest in AI, but hardware created the capacity to turn prototypes into real products and services at massive scale. Nvidia became the poster child for that shift — a reminder that tech revolutions often lift unlikely winners.

Final thought

Nvidia didn’t just sell faster chips — it sold the infrastructure of a new kind of computing.

Hyperscalers built AI factories, enterprises re-architected products around AI, and investors bought the narrative. The result was a valuation milestone: one part company execution, one part industry transformation, and a whole lot of momentum