From Innovation to Novelty

Smartphones have over these past 2 decades absorbed so much in them that its challenging for the ecosystem to innovate beyond a point. No doubt it will continue to be the preferred medium of serving consumers the latest in tech, be it 5G as a cellular technology or AI as the interface layer. Bringing a fundamental innovation in smartphones is increasingly becoming challenging which throws another big challenge of keeping consumers excited about every new launch. The expectations from smartphones have been set as such over these years that consumers expect it to add a significant value.

It might take another 5 to 10 years to breakthrough once again in smartphones and take its innovation quotient to the next orbit. Till then the OEMs and the entire ecosystem will have to continue with incremental value addition besides adding the novelty elements to the proposition which keep motivating consumers to upgrade.

The smartphone industry has started adding novelty elements to smartphones and the two tangible ones are – making phones slimmer in thickness and lighter in weights. This instantaneously creates tangible differentiating factors which attract consumer attention. At the same time, the OEMs are putting across these two changes as a premium feature in anticipation of taking ASPs or average selling price to a higher level.

The consumer benefit of slimmer and lighter phones is that it makes them pocketable – an equilibrium between comfort-convenience. OEMs are ensuring they load smartphones with every possible technology to bring all the comfort in their hands, while making them slimmer and lighter to make them comfortable to carry. Simply imagine how comfortable it is to hold a lighter smartphone in hands while scrolling through reels, etc.

Why Brands Are Switching to Slim Smartphones?

- A slim form-factor also elevates the technology prowess of an OEM as there is lot of ‘behind-the-curtain’ innovation in battery, materials, thermals, etc., that makes it possible.

- Brands increasingly promote thin and slim form factors as premium features offering a novelty that resonates with current consumer trends and lifestyles.

- A slim and lightweight smartphone offers enhanced comfort-convenience equilibrium adding tangible value for consumers. Techarc’s Pocketability Index evaluates smartphones on this equilibrium and ranks them on the basis of their convenience to carry.

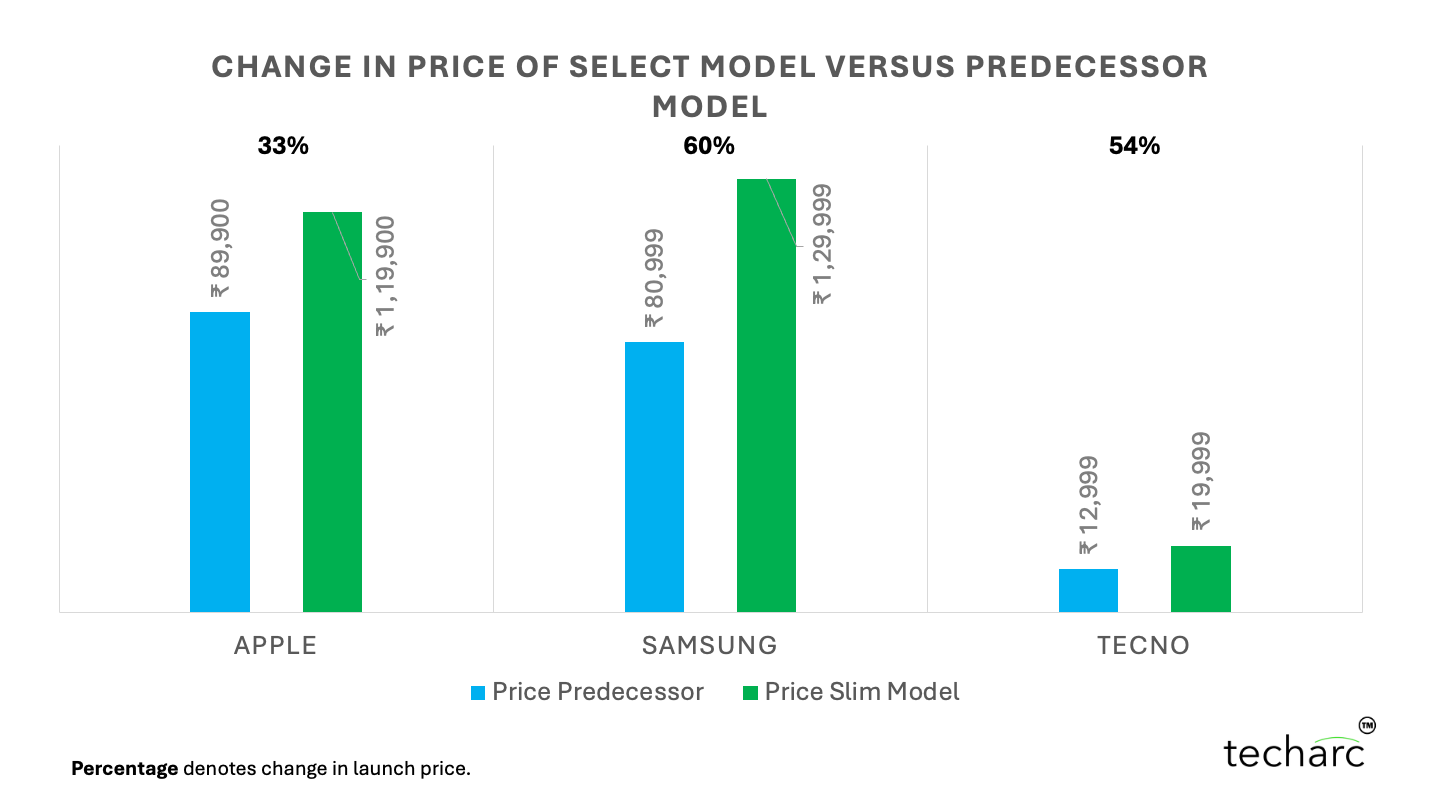

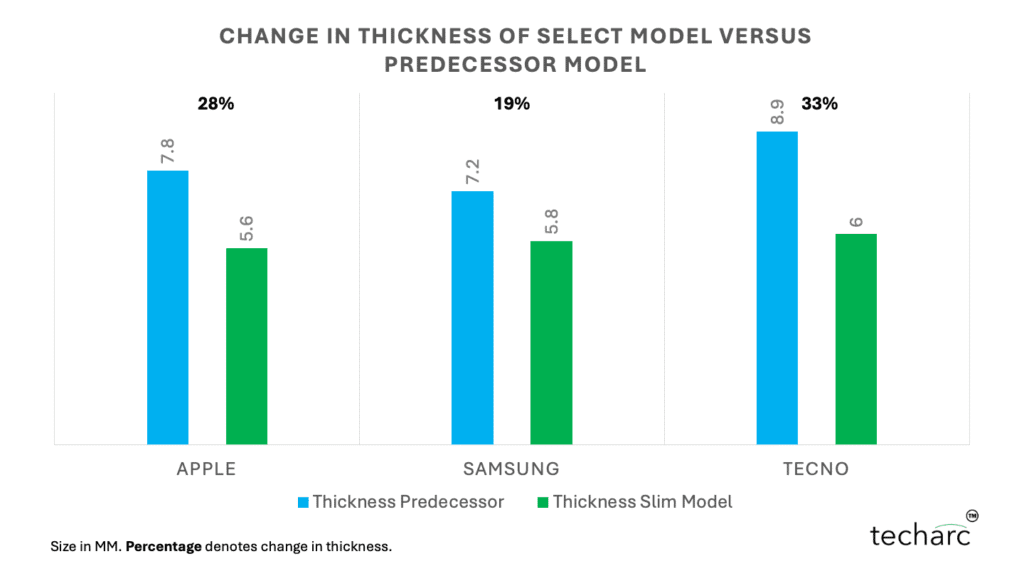

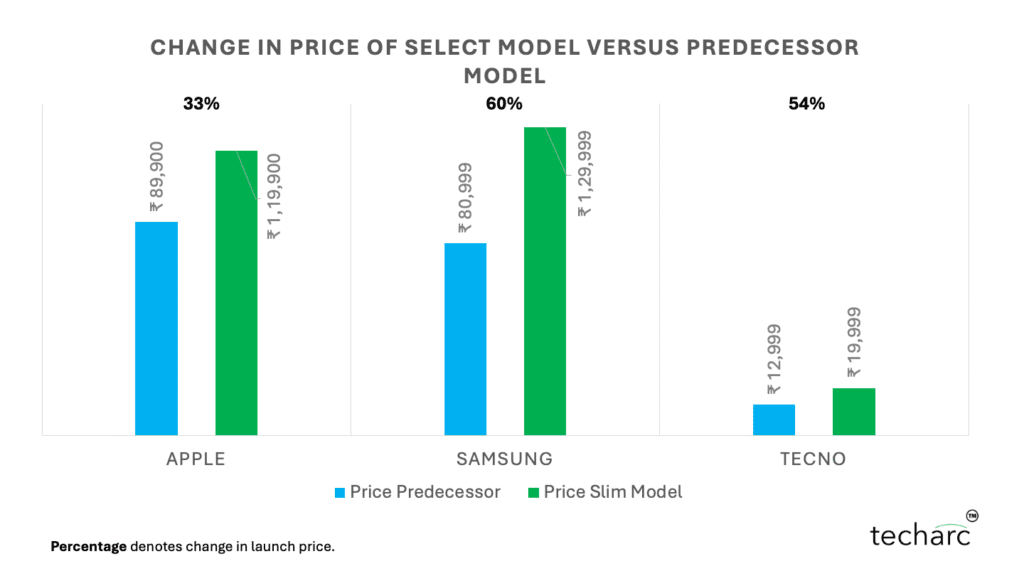

In this analysis we picked up 3 brands that are strongly advocating for slimmer smartphones. These are Samsung, Tecno and Apple, in order of their commercially available slim smartphones in respective segments. The slim smartphone model were compared with their predecessor model for change in thickness as well as the change in respective launch prices.

Findings on Slimness

- Apple achieved a 28% reduction in thickness. While iPhone 16 Plus, which is now replaced by iPhone Air, was 7.8mm thick, its replacement model, iPhone Air is just 5.6mm in thickness. This makes iPhone Air the slimmest iPhone ever.

- Samsung which introduced an Edge variant of its S series, achieved a 19% reduction in thickness when Samsung S25 Edge is compared with Samsung S25. S25 Edge is 5.8mm thick while Samsung S25 is 7.2mm thick. Excluding the foldable form factor, this also is the slimmest Samsung smartphone ever.

- Tecno introduced a slim form factor to its Pova series, which is a mid-range series of the brand. It had last introduced Pova 7 before launching Pova Slim in the market. Tecno achieved 33% reducing in thickness comparing the two models. Pova 7 was 8.9mm thick while Pova Slim is 6mm in thickness.

While iPhone Air is slimmest of all the three smartphones, Tecno was able to change the thickness by 33% which is 5% points more than iPhone Air.

Findings on Pricing

- Apple’s slim iPhone Air is priced 33% higher than its predecessor (₹89,900 to ₹119,900).

- Samsung’s slim S25 Edge commands a 60% premium over its predecessor (₹80,999 to ₹129,999).

- Tecno’s slim model experiences a 54% price increase (₹12,999 to ₹19,999).

The change in pricing clearly shows more than usual price increase across all the three brands. Usually a successor model is priced anywhere between 5-20% higher than its incumbent. The price is increased due to normal enhancements in key specifications like increasing the megapixels of camera, increasing the RAM, enhancing the battery capacity or upgrading the qualitative aspects like upgrading the RAM type, changing the display quality, adding durability, etc.

Samsung S25 Edge not only is the costliest of these three but also has the highest change in the launch price.

The pricing trends clearly show that the brands are positioning slimmer phones as a premium offering and expecting consumers to pay more for owning the novelty factor. It is likely that the smartphone brands should be able to convince customers pay more for this as the smartphones are increasingly getting positioned as lifestyle products and consumers will be ready to pay more for novelty over innovation, unless it is a breakthrough!

Key Takeaways from the report:

- Ultra-slim models are a premium trend: Brands market slim form factors as premium, novel features responding to changing consumer habits favouring lighter, pocket-friendly phones.

- Significant thickness reductions: Apple cut thickness by 28%, Samsung by 19%, and Tecno by 33%, showing a strong industry push towards sleeker devices.

- Price premiums accompany slimness: Slim models cost 33% (Apple), 60% (Samsung), and 54% (Tecno) more than predecessors, reflecting a premium for novelty.

- Consumer comfort meets design innovation: Slimness balances comfort-convenience, improving pocketability without compromising flagship features.

- Samsung commands the highest price premium: Despite the lowest change in thickness, Samsung priced its S25 Edge 60% more than the predecessor model.

Conclusion: Who Gains the Edge?

All the three smartphone brands who are currently pioneering slimmer phones in their respective consumer cohorts are likely to gain owing to increasing their launch price that will eventually increase the ASPs. In market conditions, where increasing the volume share is extremely challenging and the market size by volume likely to remain flattish adding novelty to the portfolio through slimmer form factor appears to winning strategy helping OEMs to push the ASPs further.

Tracing the past trends of technology introductions and incremental innovations that OEMs have been contributing to the smartphone industry for the past 3-5 years, they have not been able to generate proportionate rewards – be it at the time of introducing 5G or very recently AI. Till the time, the ecosystem is able to find breakthrough in technology innovation for smartphones which does not seem to be around in near future, the promising route to premium and higher ASPs is novelty.