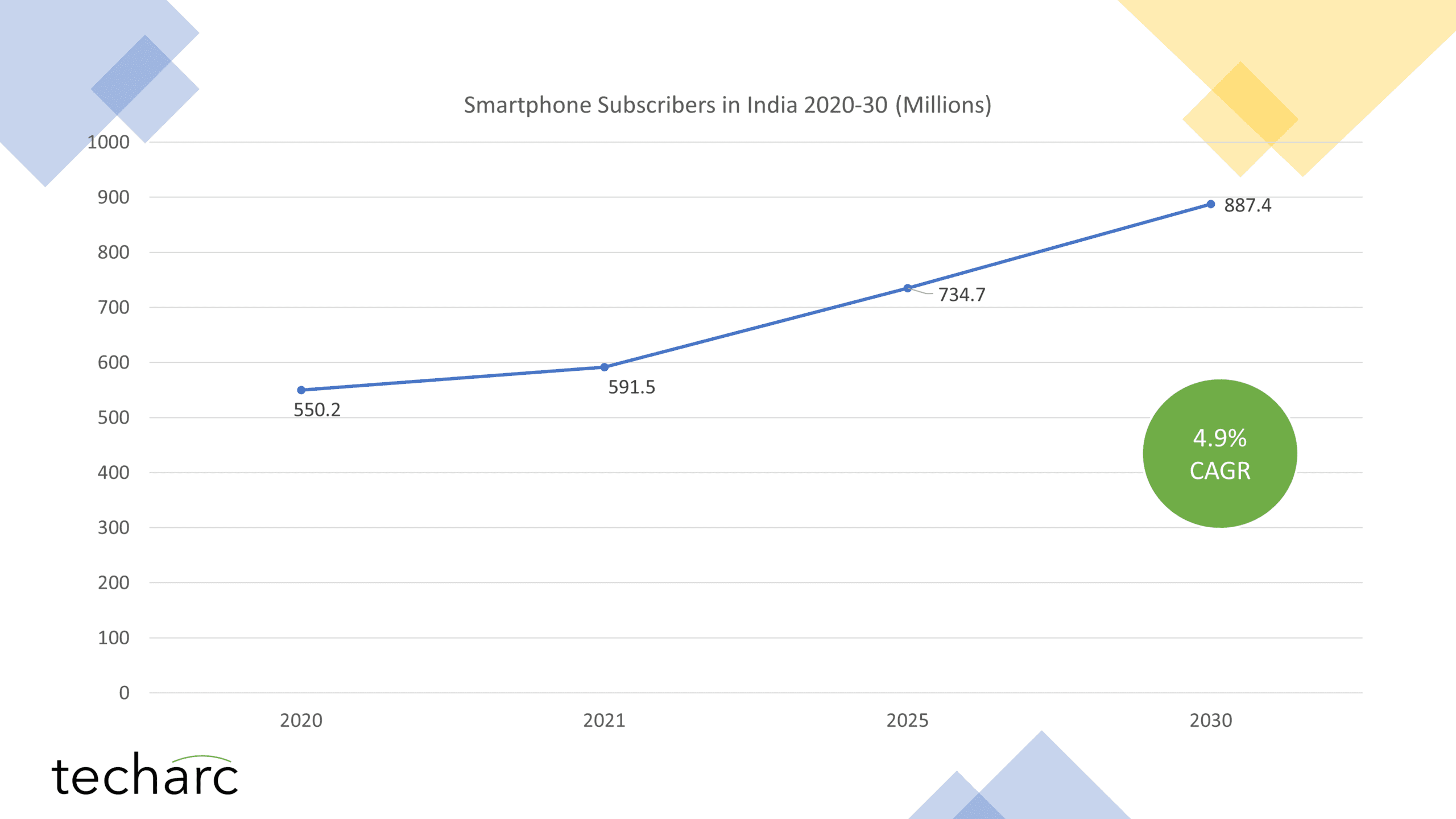

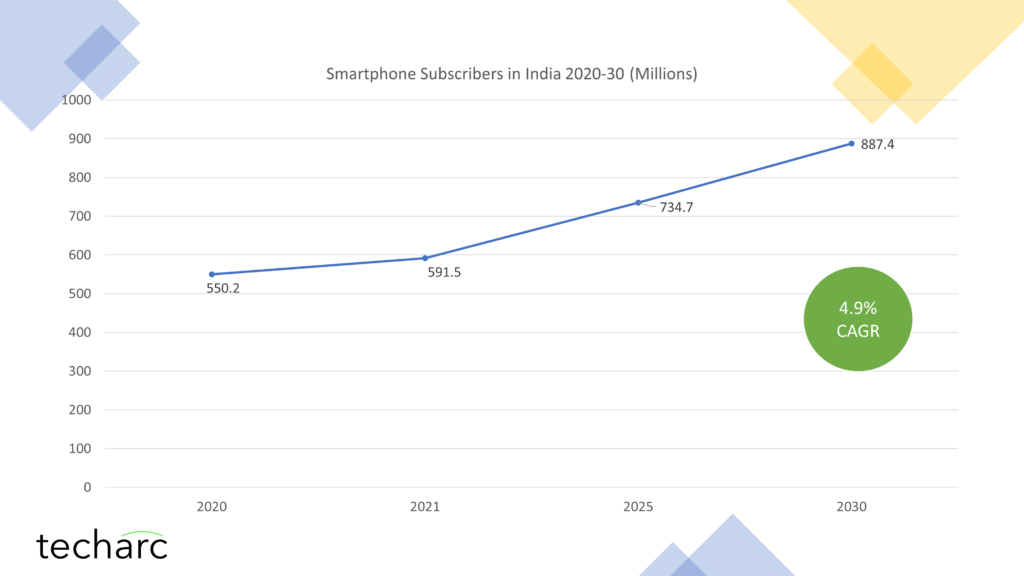

With the shrinking addressable base for smartphones, India likely to have 887.4 million smartphone users by 2030. Government needs to have a 1 billion smartphone module in Digital India mission.

India is already a country of over a billion people. It also has over 1.2 billion wireless subscribers as of July 31st, 2021. However, the dream of having over a billion smartphone users does not seem to be achievable by the end of this decade.

The new smartphone user acquisition has been on a decline since 2018, after 4G drove switch to smartphones as it ushered several new use cases forcing featurephone users to upgrade. This, however, is not the case with 5G, which can substantially bring out a new use case for the mobile users compelling the featurephone users to move to a smartphone. 5G smartphones will push the existing 4G smartphone users to upgrade for superior and immersive experience of the existing use cases that are driving the usage of smartphones.

The challenges of hitting a 1 billion smartphone users by the end of 2030 are many. Below are the key issues that are hampering achieving this milestone in this very important decade when India ushers into the 5th generation of cellular connectivity.

- Affordability is the main concern even if users would discover their own use cases. This is on account of both – investment in the device and the recurring data cost. We are moving away from the insane data pricing that we saw till 2019, and since then operators have been adding a cost to the data and/or increasing the data prices. Even to own a device, it’s a substantial increase in the outlay for around 200-250 million users who cannot spent more than Rs 1,500 on a mobile device.

- There are no models that could self-subsidise the smartphones for this potential audience, who are on the other side of the fence waiting to join the smartphone arena. Advertising based revenue and value-added driven revenues are negligible for such audiences where advertisers would not be ready to spend much as this is not their target audience. So, OEMs cannot work out any model of recovering partial cost of the device upfront and then realising the gap in due course through other streams.

- The OEM ecosystem is gradually moving away from the entry segment. All major OEMs have disinvested out of the entry segment (less than Rs 5,000) where the first-time smartphone user would fall. Rather OEMs are moving to higher ASPs as consumers are willing to spend more (15-35%) on their next upgrade/replacement of smartphones. We have already started seeing the shift of opportunity from lower segments of the market towards more premium segments. In the festive quarter of Oct-Dec 2021, we are expecting users to buy smartphones averaging a little over Rs 20,000, instead of the annual average of Rs 15,000 plus.

- OEMs are adding more features and functions to their smartphones to facilitate paying users leverage more from the device by consuming content and other services, which are subscription based. The interest of OEMs is gradually moving in this direction, where they could increase the LTV per smartphone user by getting a pie of the services that the users are paying for.

- Attempts, such as a hybrid smart-featurephone haven’t paid off well. Though it has got in additional 80-85 million users into the digital ecosystem using fundamental digital services, majority of the featurephone users haven’t accepted this ‘workaround’ wholeheartedly. Hence, the proposition has not gone that well with the intended target audience.

- Globally, we are witnessing prices of components going up on the one or another pretext. This is only forcing the OEMs to increase the cost of the devices and in a very hypersensitive market like smartphones, it is very challenging for the OEMs to frequently trade-off between input costs and the market opportunities.

- Lastly, the entire smartphone ecosystem is interested in investing in opportunities which are rewarding. For example, when we compare education and gaming as two areas of immense opportunity, the entire smartphone ecosystem has preferred to make considerable investments in gaming than education. There is hardly any OEM focusing on making devices affordable so that more and more students could benefit from digital means of education. But over the past 2 years, we have seen several OEMs making gaming smartphones in the affordable segments.

Smartphone is very important and a central device in the entire digital lifestyle. While other smart devices are catching up, but there are no two opinions about no device reaching the scale and penetration of a smartphone. Hence, it is very important that a device like smartphone is made accessible to every possible hand in the country.

There are very little hopes from the smartphone ecosystem working on this very important agenda. What is required is perhaps the government intervening and exploring ways how the penetration of smartphones is expanded at the bottom of the pyramid. We may never achieve 100% smartphone penetration, but our endeavours must be to make every potential user of a mobile as a smartphone user. This is also in the interest of our telecommunications sector where we are now becoming globally a unique nation which will have a 2G and a 5G network working concurrently.

Smartphone access needs to be an important part of the Digital India programme and unless we have the end-users empowered through a smartphone, the benefits of such an important mission will not trickle down to the last mile and last man standing in the queue. The need of the hour is to have a 1 billion smartphones module by 2030 under the larger mission of Digital India, which only can make it inclusive, sustainable and reachable.