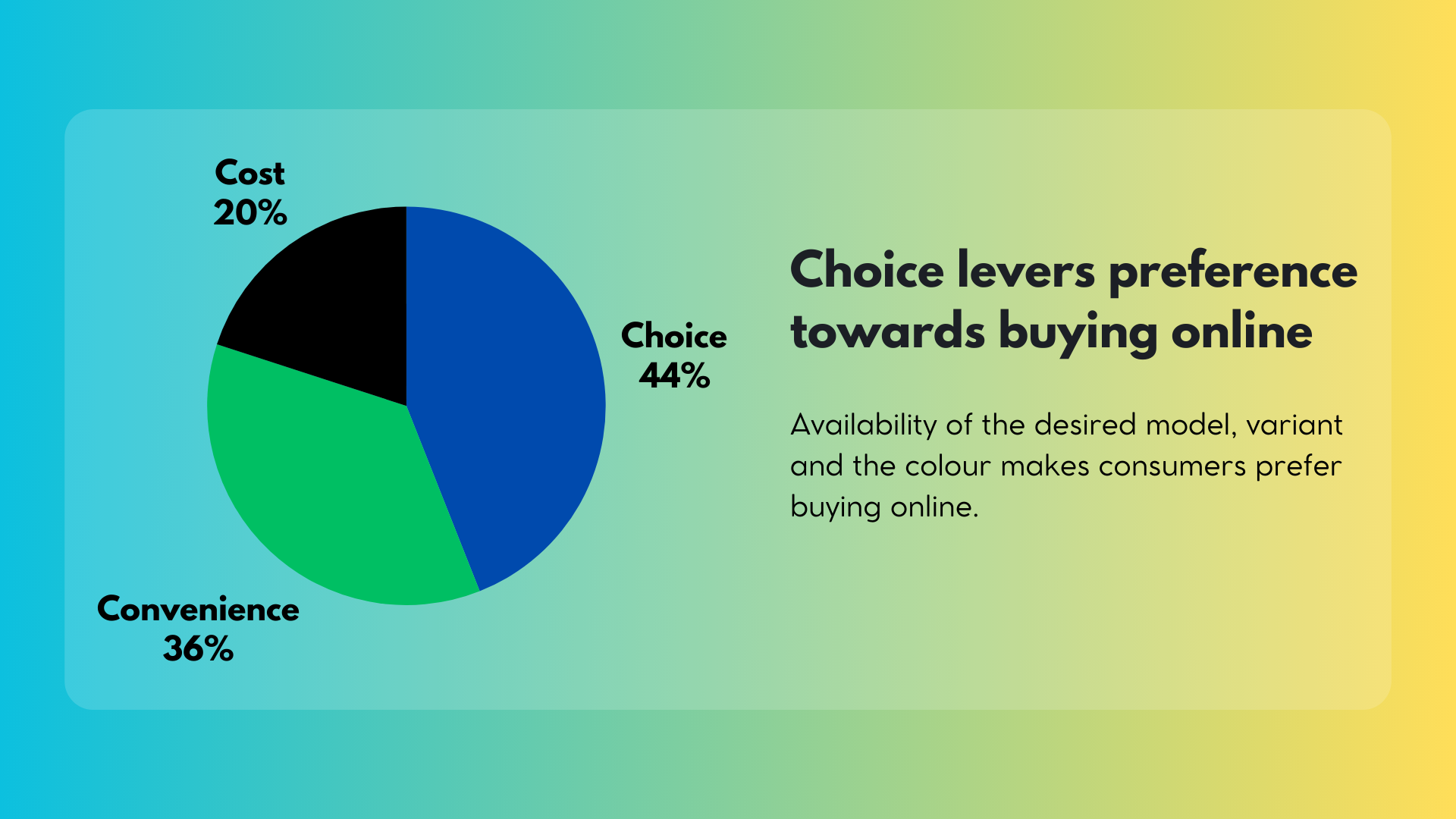

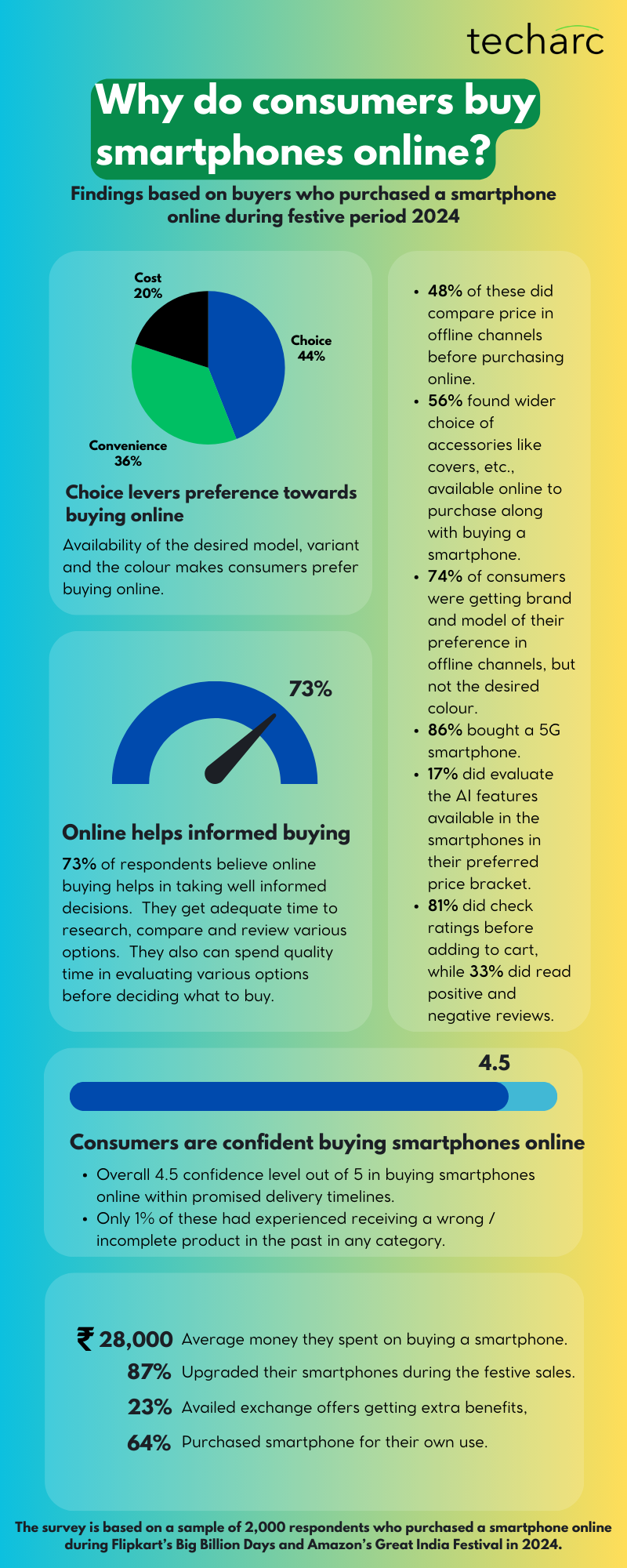

A survey based on consumers who purchased their smartphone during the festive period 2024 (Sep-Dec 2024) reveals that the main reason of them preferring the online channel is choice instead of offers and discounts. Choice is determined by the availability of any specific model with the desired variant (RAM/ROM configuration) and colour.

These consumers purchased their smartphone during Flipkart’s Big Billion Days and Amazon’s Great India Festival, the marquee campaigns of two major marketplaces that is run through the festive season in India. In India the festive season kickstarts in September and goes all through the remaining weeks of the calendar year. However, the campaigns intensify just ahead of Diwali (festival of lights), during which its considered auspicious to purchase new products. The two marketplaces – Flipkart and Amazon have been running a major campaign coinciding this period. Now many brands also run similar campaigns during the period. While Flipkart and Amazon focus on their online platforms, brands run campaigns in both the online and offline channels.

Ever since the online marketplaces gained popularity among consumers, especially for electronics category, specifically smartphones, it has been observed that the main crowd puller for these marketplaces has been deep discounts and jaw dropping offers for which they have also faced criticism and allegations of predatory pricing. In the past, there used to be a significant difference in pricing between online marketplaces and the offline retail channels which resulted in declining contribution of offline channels. However, owing to a slew of measures taken by the government at the policy level, and the brands along with partners the offline-online parity has been blurring.

In this research finding, which is summarised in an infographic, we highlight the key insights based on the survey run among consumers who purchased a smartphone during the festive season 2024.

Key Insights

- 44% of the online smartphone buyers during festive period, opted for online marketplaces for the choice of mobile phones they offered. Only 1 out of 5 preferred online marketplaces for price offered.

- 48% of these buyers did compare the price with an offline retailer before making the purchase decision. They did not find any difference between the prices. In some cases, where the consumers found online prices lower, they were able to get matching deal from the offline retailer.

- 73% of the respondents opined that buying online allows them to do proper research and spend good time on finding the ideal product. As per them they were able to pause their purchase journey and look for more details before resuming the transaction. This flexibility they don’t enjoy always in the offline channel, where sometimes the promoter motivates them for instant purchase, and they are not able to reconsider if they want.

- The reputation of online marketplaces has also improved over these years. Overall, consumers scored 4.5 out of 5 to confidence levels in buying from these platforms. They do not find any concerns regarding product quality, counterfeit products, used products or mismatch in the product contents while buying from these platforms. In case of Amazon, they expressed comparatively higher confidence level of 4.7 against Flipkart with 4.3 rating. Only 1% of these consumers had ever faced issues like receiving a wrong item or incomplete delivery in any category from these platforms.

- 17% of the consumers did evaluate the AI features in the phones in the price range under their consideration. While AI features were not the decision triggers, but it did have a positive impact on the selection.

- 81% of the buyers did check the customer ratings before making a buy decision, while 33% did read through positive and negative reviews selected randomly. Consumers are mostly looking for any ‘red flags’ that existing customers might have raised.

- The purchases during the festive season were primarily led by upgrades with 87% of consumers upgrading their smartphone experiences. The remaining 13% replaced within the same price range. 23% customers also availed the exchange benefits available on these platforms.

- The average money spent by consumers buying smartphones during the festive period from these online marketplaces was ₹28,000.

Future guidance

Although the channel contributions in terms of online versus offline mediums have leveled, the online medium still has advantages that are challenging for the offline retailers to offer. The primary two factors being choice and convenience. While there are hybrid models being experimented taking the best of the two together to make the mediums equal in terms of customer experience and benefits, it is unlikely that the offline will be able to exactly offer same level of choice and convenience matching the online marketplaces. Further, a very high degree of confidence in online marketplaces gives them an advantage of being the first preference of customers, even comparing with the D2C mediums owned and operated by brands.

In 2025, consumers will continue to show their preference and confidence in purchasing from online marketplaces. Overall, we estimate the online sales contribution by volume to be in the range of 53-55% out of which 85% is likely to be fulfilled by the online marketplaces with D2C brand marketplaces taking the remaining of the share.

About the Survey

- The main objective of this research activity was to understand why consumers continue to show interest in buying smartphones online. Since, festive season is the peak purchasing season across channels, the survey was limited to consumers who had purchased a smartphone online during the 2024 festive period.

- The survey was done with a sample of 2,000 respondents who had purchased a smartphone during festive period 2024 through an online marketplace. The sample was distributed evenly between metro and non-metro cities/towns.

- The survey was conducted in the first fortnight of January 2025 using an online survey method. The age group covered was 18-60 years, which included male and female respondents (55% and 45%), with educational qualification of a graduate or higher. The survey included both working individuals as well as homemakers.

- Equal weightage was given to two platforms of Flipkart and Amazon with 1,000 respondents representing each marketplace.