Nord series was one of the not so good decisions of OnePlus strategically. I have opposed it then and still feel that OnePlus should call it off and recalibrate all its focus on the premium and flagship models.

OnePlus is now a decade old brand. Since inception, it took bold steps and tried to defy the conventions that the smartphone industry, especially the Android flock had set up by then. Limiting the access by invitation only, restricting one launch a year and not shying away from pushing RAM and power charging to higher limits for extracting the experience that consumers deserve are some of the things that this brand pioneered with. For that matter, even going with a custom ROM was a big bet. The other smartphone makers were happy doing custom UI.

Soon OnePlus was seen as the ‘Apple of Android’. Everyone connected with their thought that Android smartphone users also deserved a better experience and not everyone need to switch to iOS, iPhone. At that time, the mid-premium / premium was crumbling for Android with Sony Ericsson, Samsung and Motorola of that era; and others not able to make an impact. Adding to this was Nokia miserably failing with Lumia posting the dying years of Windows as a mobile OS. Blackberry was also trying to fight the rising stature of iPhone.

The market was getting polarised. We had Android brands at the entry level and Apple iPhone on the premium side. Samsung was juggling between the extremely divergent markets, which by no way was easy. We have to give this credit to Samsung here that it’s the only smartphone OEM that has lived so many years and continues to be in the leadership position making a comeback time and again. Today Samsung may have exited out of the entry level smartphone market but continues to be serving multiple segments. In my earlier note, I have already recommended what it needs to do.

Coming back to OnePlus, by 2018, when 4G hit the India market in a big way after Jio launched the services for consumers with literally zero entry barriers, OnePlus had not only been able to successfully establish as a premium brand in smartphones, but it was the only one such brand among the OEMs using Android as the OS. The other premium brand in smartphones was of course Apple. Samsung had a diluted positioning.

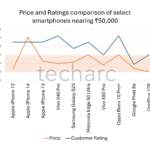

This gave a great advantage to OnePlus. People looking for a premium 4G experience within Android had just OnePlus to choose. Soon OnePlus saw great success and earned as high as 34% of the market in the segment. Not just was this something very rarely achieved by anyone in the market with too many players, but it still is a record for having this big a market share being a segment specific brand.

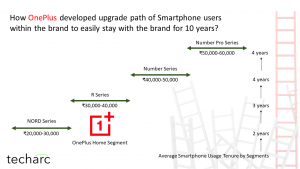

While this is a great accomplishment for a brand which had just 5 years of journey, it restricted its growth avenues as the TAM (Total Addressable Market) was still very small. OnePlus at an overall level still had a market share of 3-4% and despite its great performance, it never featured in any leaderboard! The premium thing in India was still at a nascent stage and would never reach double digits in percentage contribution.

Things started stagnating for OnePlus and this is where instead of perhaps going Apple way, it decided to foray in the volume side of the market through Nord series. In 2020, OnePlus introduced Nord series smartphones with the proposition of bringing premium experience at affordable price point. The narrative did work, and people started accepting Nord as an alternative in the segment. But it never got the love that OnePlus had been enjoying in the premier tier. Obviously being in a mass segment where millions of smartphones are purchased every year, Nord also saw its chunk of the pie. This soon became the reason of volume market share growth for OnePlus as it had now widened its TAM and was participating in the high-volume segment. This decision led to doubling of OnePlus’ market share in India. Today Nord is an ecosystem player having multiple products like wearables besides smartphones.

But we tend to forget that market share is not everything. Especially market share by volumes. In the end balance sheet matters, so revenues and profits are supreme for any brand and because of the sound and healthy financials a brand also create and continue to create value for the stakeholders, especially customers. Apple also had done this mistake but soon ejected out by discontinuing the ‘C’ series which was its attempt to participate in high volume segments in emerging markets like India. Globally we have seen in many industries like automobiles, where brands have been able to scale from mass market to premium, but there are rare success stories of brands growing from premium to mass segments.

OnePlus got distracted with Nord ‘growth’ and as a result, we have been noticing only incremental ‘innovations’ in its flagships. Otherwise, it had earned the prowess that it could popularise the ‘fast charging’ feature though it was introduced by Motorola in the industry as Turbo Charging way back in 2015. But OnePlus had that positioning, acceptance and above all technology to push this as a feature that not only became a USP but a very sought after feature among the modern-day smartphone users.

One might argue that we aren’t even seeing something substantial from Apple also. May be yes, but the point is that Apple has its strong loyal community, who don’t easily switch to another brand for a feature or innovation. They wait till that feature figures within the Apple ecosystem. As an example, while foldable smartphones have seen some good traction in the niche segments, a lot of iPhone users are still waiting for iPhone to launch its foldable phone to experience. Similarly, Apple was relatively late on 5G and AI within the smartphone ecosystem. But its users did not abandon it. They waited for these technologies to come to iPhone. This is not the case with OnePlus or for that matter any Android smartphone brand. Users just snap ties if they like a new feature or get intrigued about.

OnePlus should have gone the Apple way and waited for the premium segment to grow, which was bound to happen as consumers step-up in due course. Today India has one of the largest feeder-base available for ₹25,000-50,000 segment and this is the time when OnePlus would have seen its TAM growing exponentially even if it had confined to the premium segment.

While it still enjoys good reputation in the segment, a lot has changed since. There are brands like Vivo, OPPO, Motorola among others who have made some inroads into this segment. Google has introduced Pixel in the luxe segment and is only intensifying its operations to garner more share. So, OnePlus is not the only player out there. Also, Android to Apple switch is at an all-time high after Apple also intensified its presence and commitment to India market. Nord at the cost of contributing towards fattening the volume market share for OnePlus has diluted its premium positioning, diverted its focus on the premium category and also increased the rate of dissatisfaction of the OnePlus users. Once seen as a go-to brand by every techie, today OnePlus is just another brand. Nord has contributed a lot in this diluted positioning of OnePlus. It’s time for OnePlus to abandon Nord as a series and regain its focus on the premium where it has been able to add a lot more and pioneering value to the ecosystem, got incredible appreciation and love of consumers and been able to deliver value to partners including the channel. Yes, it may be a tough call, but ‘fail-fast’ also results in ‘sail-fast’ as one sheds the unnecessary and harmful fat that slows the racing ability of any brand.

Athar Shahab

September 13, 2024Good analysis. I completely agree. Poor strategic choices will cost them dearly.