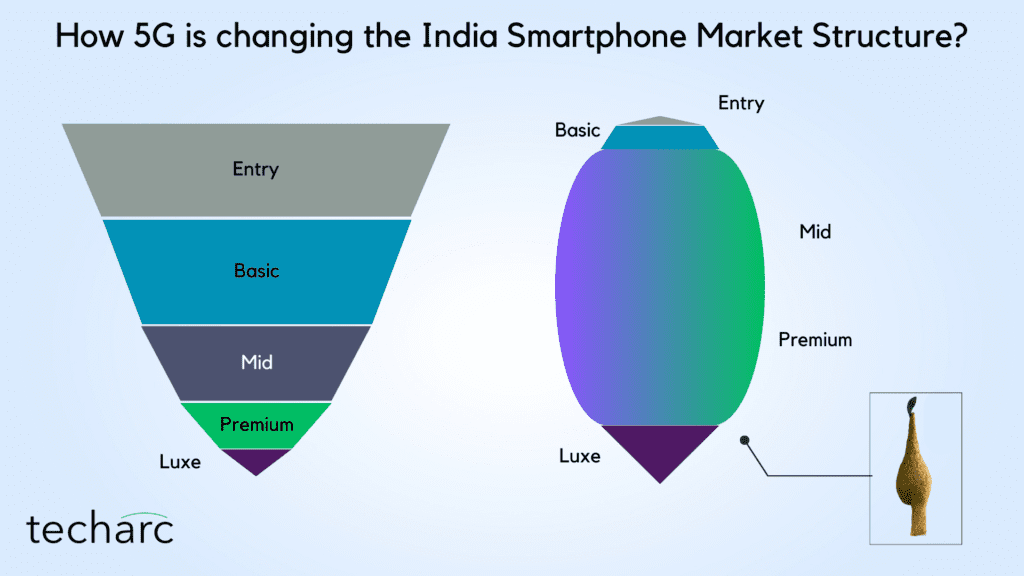

The India smartphone market would show a pyramid like structure where a typical consumer would up the ladder over a period of time with upgrades. It was not necessary that the consumer would always join at the entry level and go through all the levels of the hierarchy. However, 80-85% of the market would fall under Rs 15,000. So, essentially India was all for affordable segments. The reason was simply because millions of consumers wanted to go digital by owning a smartphone. The market was all about making smartphones accessible to millions of consumers. As a result, today we have 650+ million smartphone users in the country.

After releasing the India Smartphone Trends 2023, I have been receiving questions about different trends identified in the report. One among them is what do we mean when we say that the pyramid structure of the industry has fallen, and it has bellied out in the middle? So, let me answer that here.

In the pre-5G era, though the mid-segments of the smartphone industry had already started seeing increased interest among consumers making it one of the fastest growing segments, the sales would still primarily be contributed by the entry and basic segments in terms of unit volumes. Yes, it is a fact that after the introduction of 4G, we saw the entry segment (sub ₹6,000) almost washing out, but the basic segment (₹6,000-12,000) was still holding the honours of being one of the significant contributors of volume sales. This is where the mass market was with some spill over to the mid segment especially in the range of ₹13,000-15,000. Somehow, unfortunately, though there was always a latent demand, we never saw ₹15,000-20,000 growing big. Even OEMs introducing smartphones in this range, would discount the devices sooner to be in the vicinity of ₹15,000.

While one of the key reasons of divesting from the entry segment, which has also slowed down the featurephone to smartphone migration, has been OEMs traditionally strong in this segment have been cautious about Jio’s strategy in the segment of acquiring millions of customers potentially available. During the period, in my conversations with the C-suite of these OEMs, the fair of how Jio will playout was always there. Obviously, no one among them had the resources to ‘fight’ a war with Jio, hence they gradually decided to defocus and look for upper segments. But they could never do that with conviction as they had fears of acceptance in the upper segments, where consumers had several pampering options available which were coming from now ‘better-known’ brands who had spent millions on marketing and advertising during these years creating an acceptance for them.

Covid-19 came as a great opportunity for these OEMs as well. The global supply chain constraints resulted in unprecedented rise in the input cost, making smartphones dearer by 30-35% in one go. We saw ASPs seeing a record increase! Along with this came 5G in the ultra and high-end premium segments resulting in some more price rise in those segments.

However, this involuntary price rise did not see the OEMs losing consumers. Yes, the volumes did decline or stagnate in some cases, they were still able to register revenue growth in the range of 15-18% while all this was happening. This encouraged the entry and basic segment smartphone makers as well and they understood that the trade-off between losing customers by volume versus the increase in revenues by value is a sweet deal. Thus, we saw the realignment of portfolio by these OEMs including Redmi, Realme, Lava, Tecno and others who started now focusing on mid and above ranges. Gradually, 5G chipsets also started to get affordable which has resulted today it being a hygiene factor in smartphones of ₹12,000 and above.

Consequentially, the shift towards 5G has shot up and we are seeing the growth in 5G smartphone sales. Against, earlier expectations that 5G sales will be more than half of the total smartphone sales in 2024, we are already achieving this milestone and expect that 6 out of 10 smartphones to be sold in 2023, will be 5G.

While the entry segment looks deserted today out of Jio fear, the basic segment is also thinning with the changing focus of OEMs to look for value than volume coupled with the changing consumer preferences, who are no longer looking for accessibility to the device. The consumers across segments are looking at enhancing their experience. We have been selling 80-85% of the smartphones in the past for ₹15,000 or less, which translates that over 80% of the smartphone base in India owning these devices are due for upgrade over next couple of years. This is what is bulging out the mid and premium segments, not to talk of some straight away jumping to the luxe segment and buying iPhones and Samsung S Series kind of smartphones.

The supply side and the demand side of the market are both in tandem with this shift in the market structure. For any smartphone OEM that has a portfolio across segments, 80% of its SKUs fall in the mid and premium segments attempting to pamper the rising ‘middle-class’ of the smartphone industry. The change in the structure is irreversible and first time we are seeing the market structure taking a new shape. So far, the pyramid was always maintained, with each segment having different opportunity size. But now, there is a squeezing capillary at the bottom of the market, a bulged-out belly in the middle and a wider pipe at the upper-end of the market structure. Something which comes very close to this in nature, is weaver bird’s nest, and that is how the market will look like for coming few years.

5G may not have yet excited consumers as they don’t find any use case in their daily lives, other than getting faster speeds, at times patchy. However, it has already restructured the smartphone market and resulted in a permanent change. I expect this change to be there at least till 2026-27, when we might see a new pattern of the market. Till then we need to align all our resources as per this structure that can bring in higher dividends in terms of profitability for the industry players who like several unicorns out there have been burning money to have a mass adoption of their offering. But this leaves us open with a big challenge of how can we bring in millions of citizens on to the smartphones?