With the launch of Tecno Phantom V Fold, we could see it becoming another important brand for smartphone offline retailers to partner with.

Whenever I see anyone using a flip or fold smartphone anywhere in the market, public places, etc., I have a couple of questions for them. Why did they buy this form factor? How is the experience? Did they buy offline/online? I’ll some other day, explain the answers I get to the first two questions. Only third question has relevance to what I want to explain today.

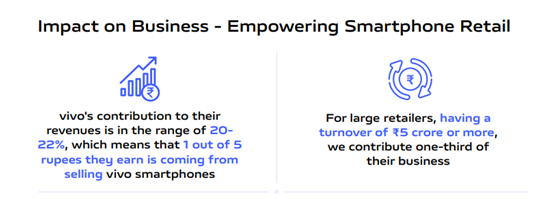

While working on the Vivo India Impact Report 2022, we extensively interacted with the offline retail channel. These were multi-brand retailers across metro and non-metro cities of all sizes – some had less than ₹1 crore annual turnover, some ₹3-5 crore annual turnover and few had even ₹8-12 crore turnover per annum. So, the sample representation was fairly distributed to have views of all shades of the channel.

As the market is primarily driven by upgrades with over 60% of the smartphone users now using their 3rd smartphone; we at Techarc are expecting that in 2023, around 25% of the smartphone users in the country will go for purchasing 3rd or 4th smartphone of their lifetime usage, which will also be 1st 5G smartphone for most of them. The retail channel has also aligned their portfolio of inventory accordingly. A few years back we would see racks stocked with Redmi and Realme, while other brands would also find a few racks. But now the face of shops is changing. Today offline retailers are giving preference to stocks of Apple, Samsung, Vivo and OPPO. These brands not only bring them more revenue per unit sold, but also are the brands which have the acceptance of the consumers in mid-premium, premium and luxe segments.

In the retailer impact segment of Vivo India Impact Report 2022, we have already seen how the smartphone maker has become an important partner of offline retail contributing a good chunk of their revenues. However, this does not mean others are not important. In fact, for mid to large scale retailers, Apple is a ‘must-to-keep’ stock and the number of units of iPhones these shops sell in a month simply surprises sometimes. Like, one of the iconic ads of India about santoor soap, a line of which became as popular as any Sholay movie dialogues, “Aap ki twacha se aap ki umar ka pata nahi chalta”; one simply is astonished to know the iPhones such stores sell versus their size and ambience. Similarly, Samsung and OPPO are also very important for the offline retailer partners. The farsighted outlook towards offline retail, consistent investments and overall development by these brands has started to pay them dividends which could emerge as a strong sustainable differentiator than other over-the-top brands.

Tecno has taken a leapfrog jump foraying into the fold smartphones. The brand has been so far seen as a basic smartphone brand (₹6,000-12,000) and now all of a sudden, its target base will see it in a segment which is 7-8 times than where it has been associated with for all these years. There are two important factors that could result in making Tecno another strategically important brand for retailers to stock, especially the fold phone. The first one is trusting Tecno for this price point. Even a staunch loyal customer of Tecno will attempt to satisfy itself to the 100th percentile before deciding to invest in Phantom V Fold. This reassurance can only come by experiencing the phone and having it touched and felt it with hands. The second factor is it being the fold form factor. Basis my interaction with the fold / flip users, none of them has bought it online. Even the fold / flip phones coming from its pioneer Samsung, which is now in its 4th generation of foldable smartphones, customers do not buy them without experiencing them and holding them in their hands.

While this holds true for other foldable smartphone makers as well including Samsung and OPPO, the brand association for Tecno has been predominantly in the lower affordable segment. For this reason, the users wanting to consider Phantom V Fold would definitely want to catch hold of the device and experience it before making a buy decision.

We have seen in the past also, whenever there has been an introduction of a new form factor, for instance when the touch screen phones got introduced, users would rarely buy them without getting the touch and feel assurance. Similarly, fold / flip phone has brought the smartphone industry at a juncture where experiencing the device is critical for helping customer to decide. For a brand like Tecno, as I explained earlier, it becomes extremely critical while there might be very few potential buyers who could risk buying online in case of Samsung and perhaps OPPO.

As we will see more unboxing of foldable smartphones in 2023 and beyond, I don’t foresee in near future consumers buying this form factor through online channels. This is a good product-channel fit and both brands as well as the channel should gear up for this.

Tecno has a good opportunity to leverage Phantom V Fold and bolster its position in the offline retail. With all the apprehensions about the fold form factor, it still is an interesting proposition that rejuvenates the interest of consumers in smartphones, who have been finding them boring for some time. However, the opportunity still remains niche with us estimating that in 2023, the total sales of foldable smartphones should be in the vicinity of 350,000 units. Assuming Tecno is able to garner 5% of it, which will be a challenging target to capture, it should be able to sell some 17-18k units of Phantom V Fold.

I would say it’s a good move by Tecno to venture in the ‘affordable’ foldable segment ushering the era of ‘affoldables’!