Barring Samsung, which was already in the scene, the new brands like OnePlus, Vivo, OPPO and others in the premium android space have created a growing feeder segment for Apple in India, bringing smartphone users closer to their aspirational brand.

We are all seeing how ‘premiumisation’ is redefining the market structure of smartphones in India. The brands that were heavily skewed towards the affordability side are seeing dip in their market shares and those having premium offerings are witnessing growth.

There was a time when the Indian smartphone market above ₹20,000 was just under 1% of the total sales and later got stagnant at around 3-4% for almost half a decade between 2014-2019. This 3x growth was also a big jump for India and much of its credit goes to the successful creation of mid-premium pioneered successfully by OnePlus. While from global parameters it was a mid-premium market, for India it was an expansion of the premium market. Soon, we started defining the premium segment as anything above ₹25,000, and in some cases ₹30,000 depending on the benchmarks defined by various market research agencies tracking the market. At Techarc we define smartphones above ₹25,000 as premium which is further segmented into luxe with a threshold of ₹50,000. So, the premium at Techarc means ₹25,000-50,000 and luxe is made by the smartphones selling at more than ₹50,000.

How Techarc segments smartphone market by pricing

Our segmentation basis pricing was done after analysing the journey of typical smartphone users in India. This was done analysing a data set of over 250 million or 25 crore smartphone users by studying their switching patterns. In this analysis we found, barring outliers who would take any route in their smartphone journey, that there were definite segments according to which users would evolve.

- Entry segment with users buying smartphones of up to ₹6,000 with the sole objective of access to a smartphone.

- Basic segment with users buying smartphones between ₹6,000 – ₹12,000 with the criteria being to experience good performance in few features and functions, primarily camera, display, and RAM.

- Mid segment comprising of users buying smartphones between ₹12,000 – ₹25,000 where factors determining purchase involve looking for enhanced features along with the phone being able to support their ‘always on’ behaviour. The battery becomes a factor here in addition to being able to take good pictures in all indoor and outdoor conditions and a good display to consume content, etc.

- Premium segment as defined by the smartphones priced between ₹25,000 – ₹50,000. The criteria here is not only the experience basis the features and functions, but also about the design, finish, materials being used and a desire to appear distinct from the masses. This is where brand also starts to become important.

- Finally, the luxe segment defined by smartphones priced more than ₹50,000. Here the expectation is to get the latest of the technology from credible brands. Of course, the desire to appear extremely distinct is highest here for which price of the device becomes a default barrier.

In India this is how majority of the smartphone users evolve over a period of time. This does not mean everyone takes this route, can also skip a few hops and it is also not necessary that everyone tread this evolutionary journey to better the experience as well as satiate the social desire of brand affinity.

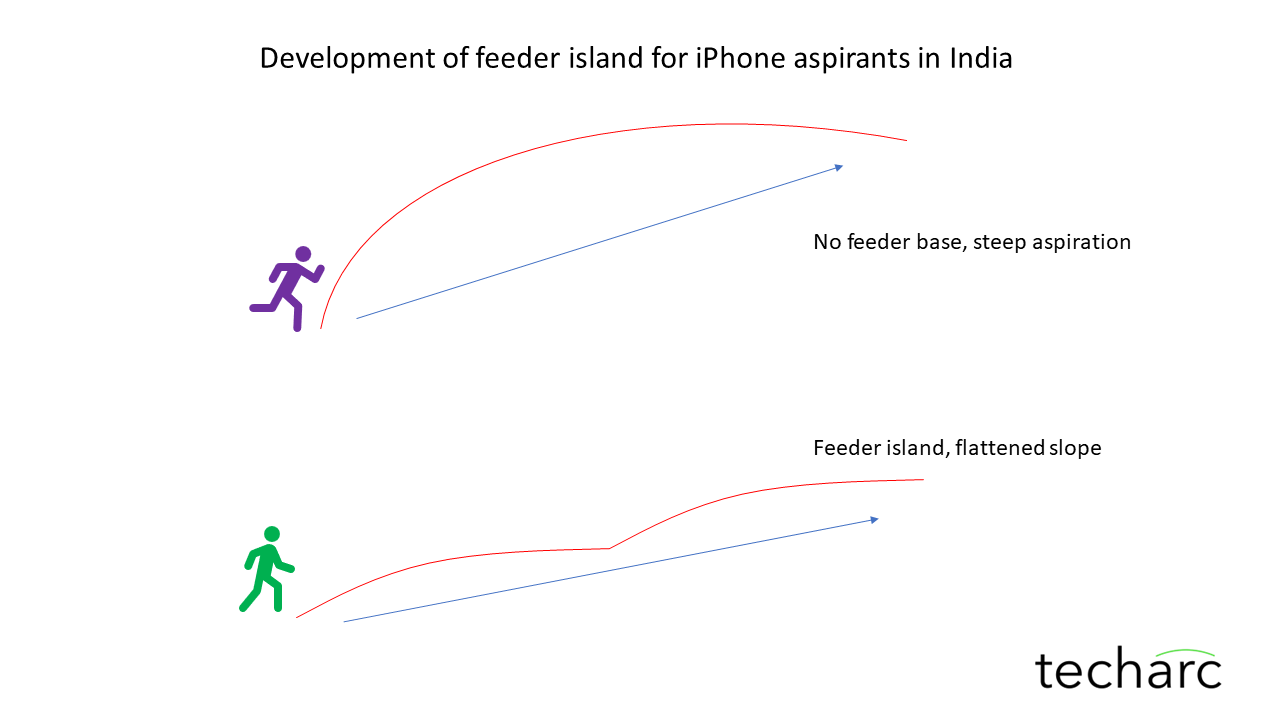

Creating a hop – Feeder Island for iPhone

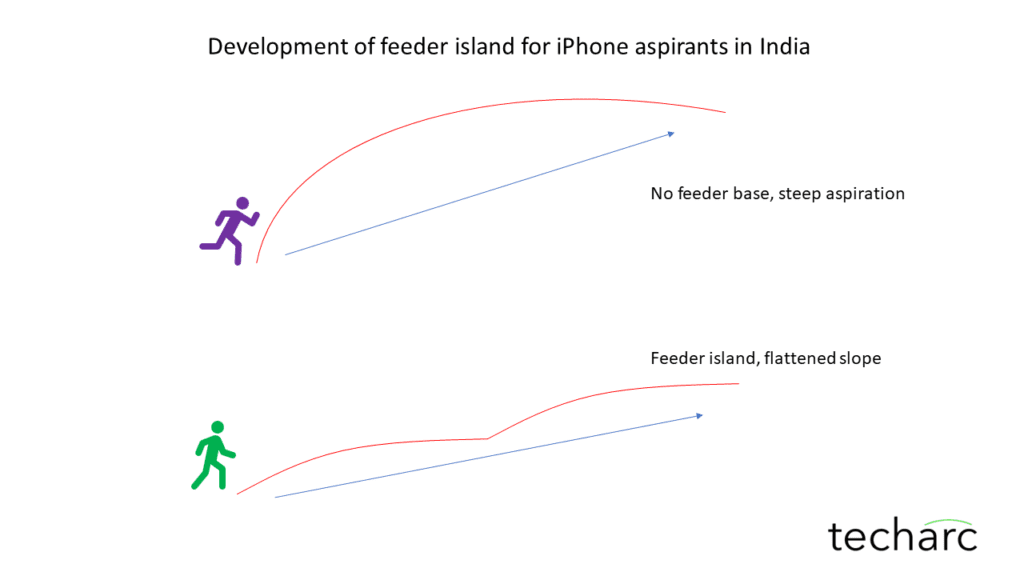

The premium focussed android smartphone brands of OnePlus, Vivo and OPPO have created a hop for the smartphone users making their journey for owning their aspirational iPhone easy. In India predominant smartphone purchases have been taking place in less than ₹20,000. Over 90% of the smartphone sales would land within this range. This meant for anyone aspiring to buy a smartphone, there was a big decision to be taken to spend more than 4 times of the present smartphone range to get the coveted iPhone ownership.

However, after the emergence and strengthening of premium segment in Android there is a hop – an island full of promising users created by OnePlus, Vivo and OPPO potentially created for iPhone. This feeder segment has already crossed the most difficult part of the journey to decide spending at least double of what they were used to. Today, close to 20% of the smartphone sold in India are priced ₹25,000 and upwards. Out of this, 75% of the sales fall in the iPhone feeder base of ₹25,000 – ₹50,000. With the ₹25,000 – ₹50,000 segment growing for the past few years in India the potential feeder base for iPhone is only expanding. Many of these users now do not need to spend double of their present range to own an iPhone. They might at best need to spend somewhere between 25-30% more than the present levels to get iPhone ownership. In some cases, this would mean they will need to spend the same amount considering they will get the resale value of their existing smartphone upon the switch.

Isn’t Samsung the part?

In our recent InsightsPro we have explained how Samsung is quarantined to a certain degree as it has successfully established its reputation in the luxe segment through S series. Also, with pioneering of Foldable smartphones through Z series, it has created a tangible and noticeable niche in the segment where it will benefit from the brand reputation and graduating up in the foldable smartphones as a form factor. This gives Samsung a differentiation to play upon in the segment. So at least Samsung has a roadmap for its users, in fact any user who wants to upgrade the experience as well as fulfil the social desires but remain within the Android ecosystem.

Further, Samsung has not been a significant contributor in creating a feeder segment for iPhones. In the mid-tier, consumers explore for other brands like OnePlus, Vivo and OPPO, which has led to their strong growth in recent years. Samsung has still a gap as its A-Series does not have a similar recall as for the offerings by these competition brands.

Moving ahead

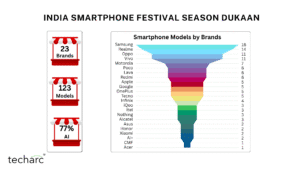

Since 2022 we are seeing the ₹25,000 – ₹50,000 premium segment selling over 20 million smartphones a year. This will further grow with a lot of brands foraying in the segment adding to the choice, as well as owing to the natural evolution of the feeder segment for this (₹12,000-₹25,000) moving upwards with their replacements. Out of over 650 million smartphone users in the country, nearly 550 million own a smartphone of less than ₹20,000 which means there is already a huge feeder base for the premium segment. This makes premium segment a hotspot of growth in the smartphone market in India. In turn it is adding to the feeder base for iPhone, creating a feeder island making the next hop to the aspirational iPhone easy for potentially millions of users in years to come.