Snapshot of Festive Period Expectations

Festive season is the season of discretionary shopping. This is the time of the year when people plan their buying of various product categories including consumer and personal electronics.

Smartphone – the jewel of electronics, has not only been consciously the main attraction of festive seasons for over a decade now, but also a significant contributor to the overall sales. It has been consistently contributing over 40-45% of the shopping value during festive period excluding real estate.

Our estimates suggest that the festive season will contribute to 67% of the 2H smartphone sales. Although the bulk of these sales happen during Diwali, but there are other festivals also like Durga Puja, Dusshera, Onam, Christmas and New Year celebrations which all contribute to festive sales. The flagship festive sales events of leading online marketplaces, Great India Festival by Amazon and Big Billion Days by Flipkart also coincide these religio-cultural festivals.

A slew of measures including increasing the personal income tax threshold to Rs 12 LPA and reduction in GST of essentials and several other product categories is expected to increase the disposable income among buyers which will also benefit smartphone sales. Additionally, the recalibration of bilateral relationships between India and key global economies like America, Russia and China (ARC) is expected to bring predictability in economic and trade relations streamlining the prices of various inputs and components that go in the manufacturing of smartphones. Although rupee (₹) continues to see a depreciating exchange value against US$, which is at 1 US$ = ₹88.31 as on September 11, 2025 (1:00pm). This is going to impact the input cost of smartphones with 85-90% of smartphone components imported from different supply chain destinations.

With the economic positive outlook and lucrative offerings from smartphone industry, we estimate the total sales volume of smartphones in India to cross 153 million (15.3 crore) units in the calendar year 2025. This should translate to US$53 billion in value at US$=₹88.

The sales contributions will be primarily owing to upgrades and replacement which are expected to contribute 87% of the planned buying during the festive period.

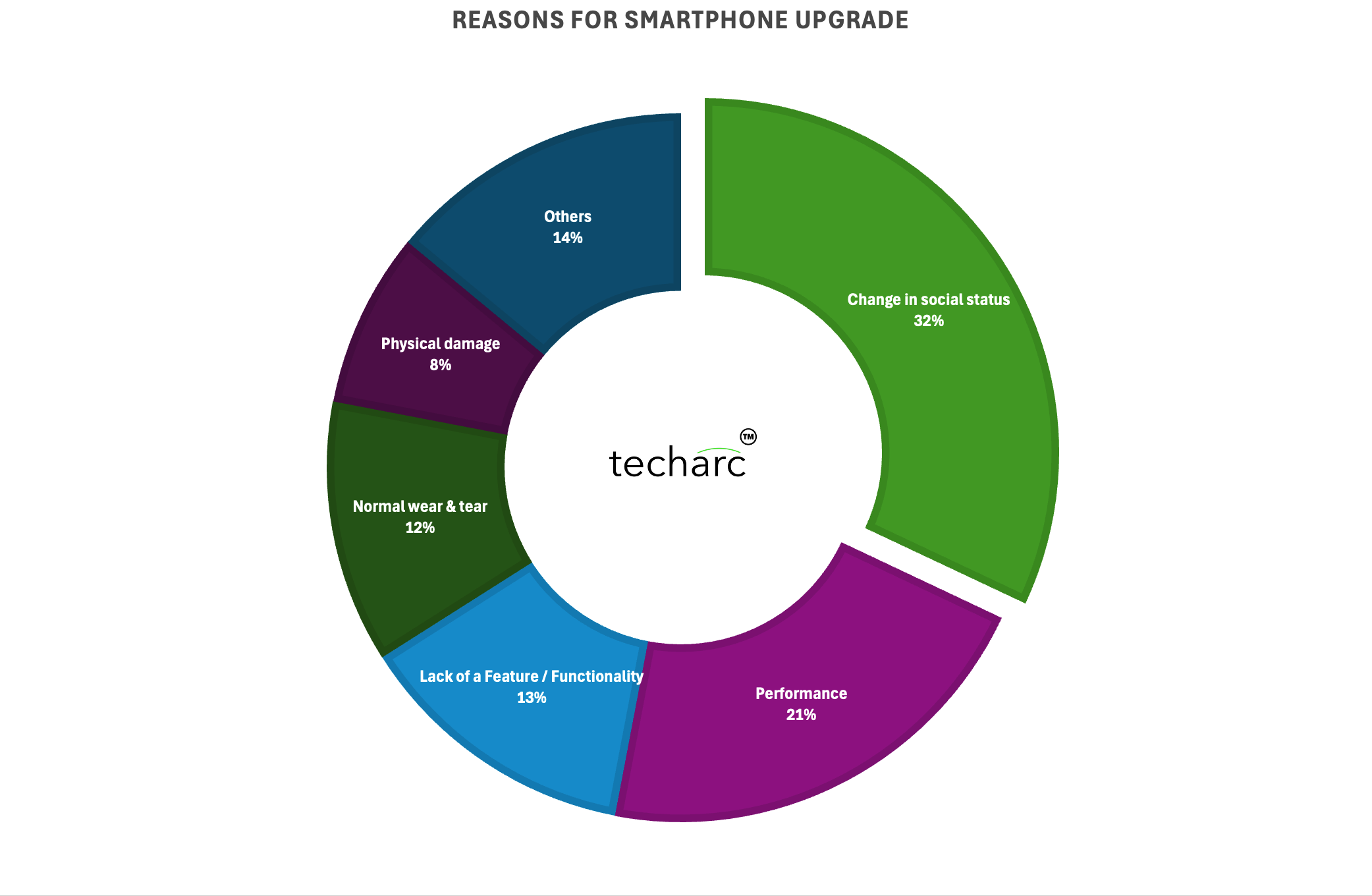

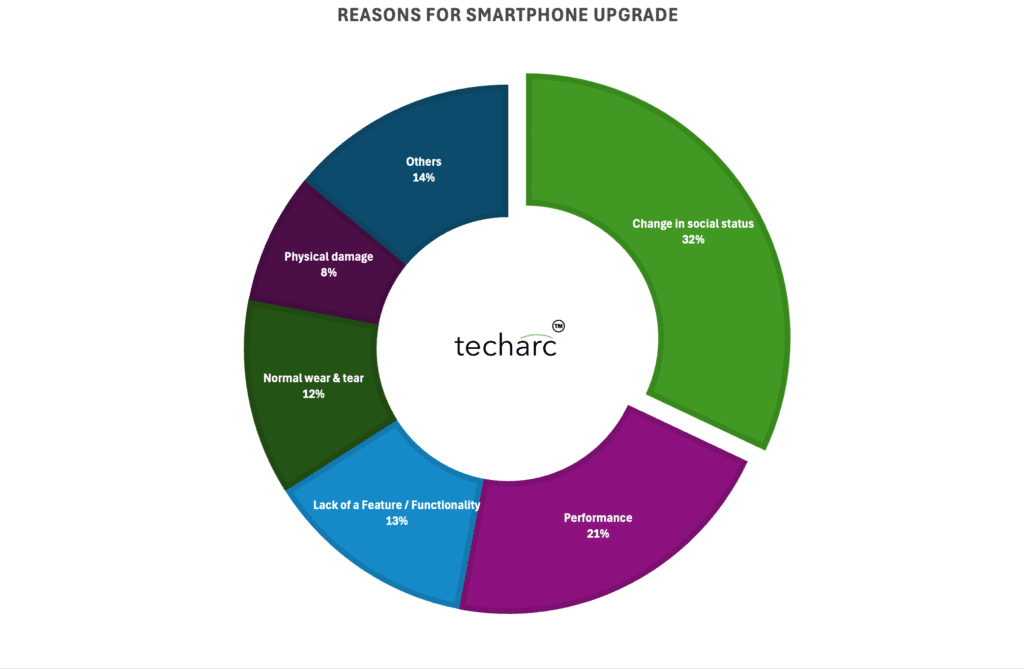

Upgrade Triggers

Change in the social status leads among the reasons to upgrade a smartphone with 32% of the users attributing to this as their trigger for upgrading their smartphone during this festive period. This change in social status is due to career progression, rise in income or change in a life-stage that results in a change in the social status. These users feel the current smartphones they own do not resonate with their new social status or they need to upgrade to a new model from a higher segment which could align with the change. The key factor for the selection of a smartphone for these users is the brand name. Brands directly are reflective of a change in social status as they help in automatically establish the affinity.

This user segment is also open to experiment unique form factors like foldable smartphones giving them a distinct visible novelty. However, among these, only 8% of the users would consider buying a foldable smartphone while evaluating different options to elevate their social status by owning such a niche smartphone.

While many may see the top reason as an outcome of a socio-economic behaviour, the topmost logical reason triggering an upgrade is performance. 21% of the users are likely to go for an upgrade because they are facing performance issues with their existing smartphones. The common performance issues include reducing battery life, slower battery charge, lag in usage as well as experiencing slower connectivity speeds in relation to what the users discover in smartphones of their friends and family, who have a relatively newer smartphone. This could be because of the older generation of Wi-Fi connectivity in their smartphones.

All the performance related issues are based on the post-purchase experience derived from the usage of existing smartphones as well as basis discussions about gadgets among friends and family.

Lack of a feature or functionality present in the existing smartphone is the 3rd reason triggering an upgrade among users. These could range from basics like switching to a 5G smartphone to acquiring faster battery charging functions. Upgrading for a 5G smartphone is more prevalent factor in lower tiers of smartphone users. Some of the other reasons also include upgrading for a better camera smartphone, display feature or premium audio experiences. 22% of this cohort also would like to explore upgrading for AI features, not present in their current smartphones.

20% of the users are considering upgrade during the festive season because of a physical damage or normal wear and tear of their existing smartphones. These include users whose smartphones are in working condition and have planned to leverage offers during the festive period to maximise their returns on investment. Durability aspects of a smartphone will remain a key factor for them while considering a new smartphone to upgrade.

14% of the users have very fragmented reasons to upgrade which include dissatisfaction with the after-sale service of existing smartphone brand, influence by a friend or family member who is also planning to upgrade, taking benefit of the expected offers and discounts on the Credit/Debit cards in possession, to simply ‘just like that’.

Brands to Gain

The reasons outlined above will benefit every smartphone brand. However, owing to their existing strengths and weaknesses, as well as how they have been positioning over these years in the minds of consumers, there are some brands which are going to be the primary beneficiaries of these upgrade triggers.

| Upgrade Trigger | Brand(s) to Gain |

| Chage in Social Status | Apple, Samsung, OnePlus |

| Performance | iQOO, Redmi, Lava |

| Lack of Feature or Functionality | Vivo, Motorola, Tecno |

| Normal Wear & Tear | Nothing, Infinix, Poco |

| Physical Damage | Oppo |

| Others | Other Brands |

NOTE: The brands shown against each upgrade trigger are not the sole brands to gain. However, these are the prominent brands to gain owing to these reasons of upgrade. Some brands are likely to benefit due to multiple upgrade triggers. In the above table the brand has been shown only in the cohort where its likely to gain most.

Recommendations for brands

The analysis specifically identifies different cohorts that offer very unique opportunities to specific brands based on their strengths and weaknesses. The brands can make the most of the upcoming festive season with the following recommendations

- While brands do promote KSPs or key selling propositions of every smartphone model, they will have to identify different KSPs for separate cohort of buyers to maximise the attractiveness of a smartphone. For instance, if Tecno smartphones have some unique features and functions to offer to a segment of users, it can also identify KSPs around durability to address opportunity in other cohort as well.

- The brands need to have very specific cohort-specific communications based on the identified KSPs. For example, while Vivo continues to communicate its camera performance appealing camera enthusiasts, it could also communicate its brand values to the cohort looking for a smartphone upgrade owing change in social status.

- The brands must not confuse the potential cohorts with multiple features and functions, many of which may not be of interest to them at all. This will not only overload the potential buyers with the unnecessary information but also dilute the ‘crystal clear’ positioning of a smartphone or brand aligning with their specific need. For instance, if a brand wants to position AI capabilities before a segment of users in the cohort looking for an upgrade due to features and functionalities, the brand must avoid highlighting camera superiority.

Conclusion

It is likely to be the first festive season post-covid where the positive consumer sentiment owing to some of the measures taken by the government during this year is going to vitalise demand, and at the same time, the macro diplomatic-economic situation is favouring a stable trade equation stabilizing supply side of the market. We are expecting a 5-7% growth in smartphone market by value which is likely to come by selling 14-16% more volume of smartphones in this festive season comparing previous year’s festive season.

The government has acted its facilitating role, supply side has leveraged making a wider choice along with latest innovations available, the channel has geared up to be the frontline interface between customer and the brand, and the customer is charged with positive sentiments that will trigger a sale.

About this InsightsPro: The analysis is based on a consumer survey of 3,200 smartphone users in India who are planning to upgrade / replace / purchase a smartphone during this festive season. Besides the survey, we also analysed over 30,000 reviews from leading marketplaces using InfisSights, our proprietary platform of consumer insights including trigger analysis, cohort analysis, etc. InfiSights leverages ML and AI to generate insights from large data sets.

The analysis and findings were triangulated / cross-verified by indepth interviews with the stakeholders including smartphone brands, channel representatives and key component suppliers.

For any query regarding this InsightsPro, please write here.