Techarc’s India Smartphone Festive Season Dashboard for 2025 brings comprehensive insights about the discounts and offers that leading brands have rolled out to excite customers during this festive season, which formally kicked off with Amazon and Flipkart signing off their Great India Festival and Big Billion Days. These offers are also available in the offline channels where brands have put similar offers and discounts for consumers preferring to buy from the mainline trade channel.

In this InsightsPro, based on the analysis extracted from the dashboard, we outline some interesting insights for the consumers, channel, partners, financers, industry stakeholders, media, and tech enthusiasts.

Key Trends and Insights

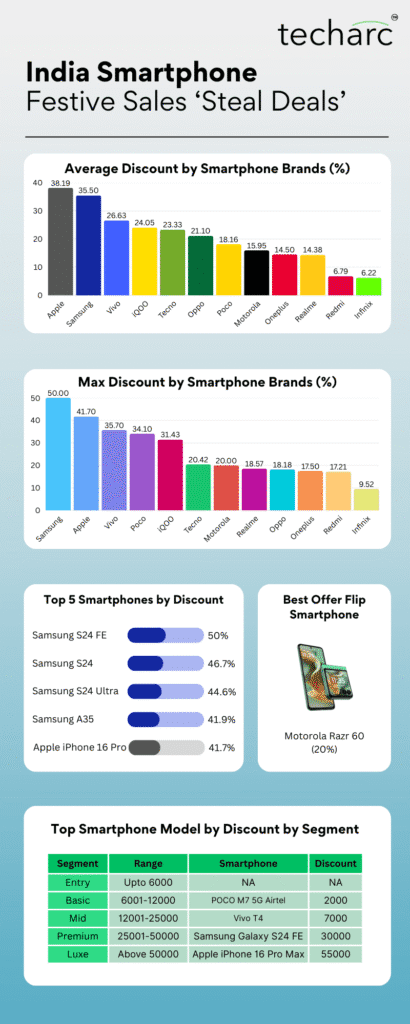

Samsung leads with aggressive premium discounts: Samsung offers a huge discount (35.55%) among market leaders, with the S24 Ultra receiving the largest festive discount of approximately ₹58,000 (44.6%). Samsung focuses on flagship models with significant price cuts, positioning them strongly to attract premium segment buyers this season.

Apple’s iPhone 16 Pro Max offers the highest discount of ₹55,000 since its launch, and iPhone 16 Pro offered a ₹50,000 cut, with average festive discounts topping 38% topping the average chart, rivaling Samsung’s aggressive tactics. Premium models, across both brands, reaped the highest absolute savings, reflecting a premiumization trend in festival promotions. This shows a strategic move to boost flagship premium sales despite traditionally less aggressive promotions.

Budget brand discounts vary significantly: Infinix offers more modest discounts averaging around 6.22%, with a maximum of 9.52% off. The GT 30 Pro is the top value proposition for Infinix customers. This indicates a cautious discount approach in the budget segment, where margins are wafer thin.

Mid-tier players offer balanced discounts: Realme’s average discount stands at 14.38%, with the P4 Pro providing a notable 19% discount, and Tecno’s Pova series, Pova 7 gets a discount of 23.33% and Pova 7 Pro 17.50%, making it attractive for premium mid-tier buyers.

Redmi and Motorola offer deep discounts on select models: Redmi Note 14 leads with a 17.21% discount, indicative of promotional focus on high volume, performance-driven models. Motorola highlights the Razr 60 foldable with a 20% price cut, catering to niche luxury foldable demand.

OnePlus and Oppo maintain moderate discounting: OnePlus averages a 14.5% discount with flagship models like OnePlus 13 receiving up to 17.5% off. Oppo offers about 21.1% average discount, focusing on their budget and mid-range series.

Poco targets value-conscious segment: Poco leads with aggressive discounts, the POCO F7 5G got a huge cut by 34.1%, reflecting its value-for-money performance-centric positioning.

Vivo and iQOO emphasize mid-range and gaming-oriented models: Vivo averages 26.63% discount, with the T4 Lite at 35.7%. iQOO focuses on gaming phones with 24.05% average discount, featuring a max of 31.43% off on Z10X.

Tecno’s mid-tier lineup holds its own against other brands, offering strong discounts on the Pova 7 and 7 Pro, and proves it isn’t lagging behind.

Key Takeaways:

- Apple and Samsung dominate with record-breaking discounts (₹50K–₹58K cuts, ~40% off), making premium devices far more accessible.

- Vivo, iQOO, and Poco lead the volume game with 20–30% cuts, targeting India’s youth and online-first buyers.

- Oppo and OnePlus maintain moderate discounts, balancing festive appeal with brand equity.

- Infinix and Redmi offer minimal discounts (~6–7%), focusing on affordability and tier-2 markets rather than aggressive festive battles.

- Market leaders maintain dominance through differentiated discount strategies aimed at expanding consumer reach while managing margins.

- This festive season highlights a competitive landscape where premium innovation meets aggressive pricing to drive consumer demand in India.

Who gains and Who Benefits?

Consumers gain significantly: Festive discounts across brands, especially Samsung, Apple, Poco, Vivo, and iQOO elevate consumer buying power, making premium technology more reachable.

Flagship and upper mid-range models gain promotional focus: Models such as Samsung S24 Ultra, Apple iPhone 16 Pro Max, Motorola razr 60, Realme P4 Pro, and Poco F5 5G emerge as key winners, receiving the highest discounts, likely to boost flagship sales volumes.

Market leaders maintain competitive advantage: Samsung and Apple sustain premium leadership with aggressive discounting; Redmi, Poco, Realme, OnePlus, Vivo, iQOO, and Oppo affirm strong presence through diversified discount strategies addressing multiple consumer segments. and the mid tier tecno maintains the

Budget segment shows restraint: Brands like Infinix adopt a conservative discount approach, possibly preserving profitability amid price-sensitive buyers.

Conclusion

The 2025 Indian smartphone festive season reveals dynamic pricing strategies where premium brands use substantial discounts to entice high-end consumers, while mid-tier and budget brands balance value offers with margin protection. Samsung and Apple dominate premium festive positioning with aggressive price cuts, reshaping premium consumer value perception. Meanwhile, brands like Poco, Vivo, and iQOO capitalize on mid-range and gaming segments with attractive discounts, driving competitive market expansion.