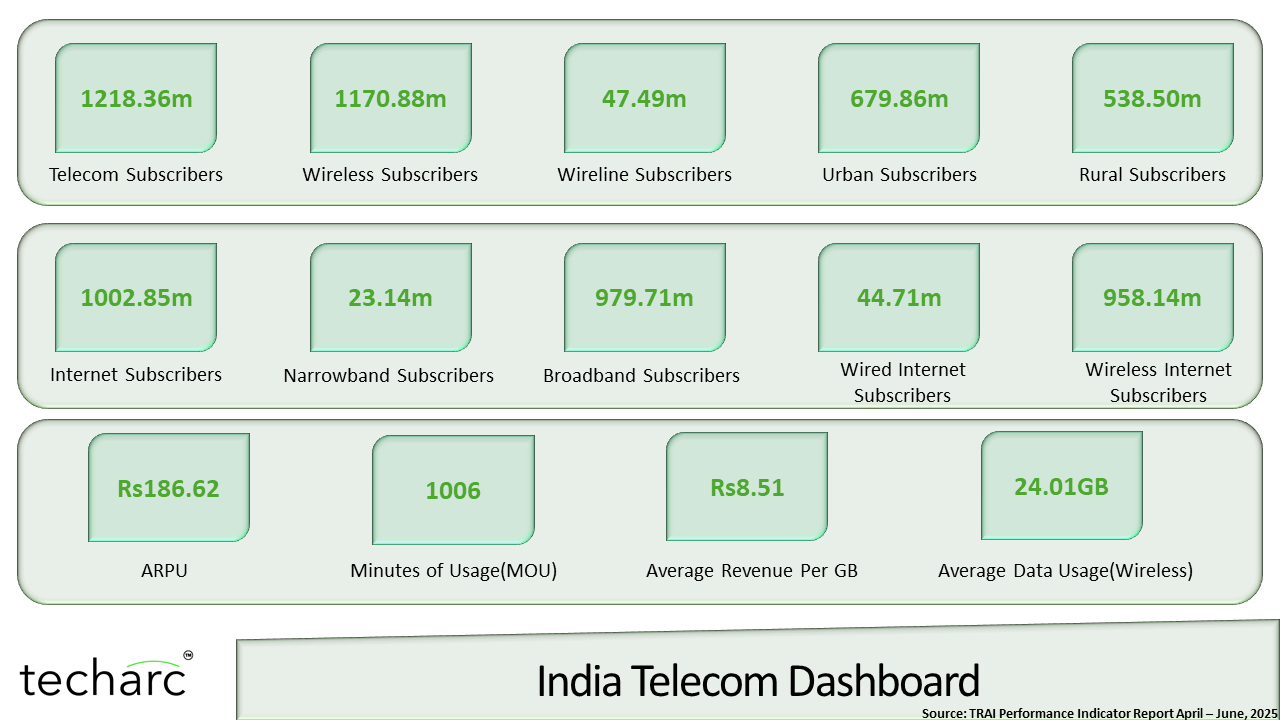

An analysis of latest quarterly performance indicators report of TRAI published for reporting quarter April-June 2025, reveals the resilience of telecom sector in India along with the rising stature on the global map. While India has had the 2nd largest internet subscriber base since many years, it’s now the only country after China having more than a billion subscribers for internet.

Key Insights

- The Billion-User Barrier Shattered: Broadband Drives India’s Internet Scale.

India has firmly transitioned to a broadband-first market, reaching massive internet scale.

India’s total internet subscriber base crossed the 1 billion milestone, reaching 1.002 billion in the April–June 2025 quarter, representing a 3.48% quarter-on-quarter (QoQ) growth. Crucially, broadband subscribers constituted 979.71 million, confirming their dominance and demonstrating a higher growth rate of 3.77% QoQ. This shift is underscored by the continued decline of narrowband, which now accounts for only 23.14 million users, placing its share at roughly 2.3% of total internet users.

- Fixed Lines See Explosive Growth While Mobile Reaches Saturation Plateau.

While the core wireless market demonstrates maturity with incremental growth, wireline services are experiencing a sharp, material step-up due to infrastructure developments.

Wireless (Mobile + 5G FWA) subscribers grew modestly by 0.61% QoQ, totalling 1,170.88 million, consistent with a mature market environment. In contrast, wireline subscribers surged dramatically by 28.20% QoQ to 47.49 million. This rapid rise is attributed to fibre rollouts and a specific reporting change. Despite mobile-only subscribers showing a year-on-year (YoY) decline of 0.64%, the overall tele-density continues to increase, supported by the strong fixed broadband growth, particularly in cities.

- The Urban-Rural Divide: City Additions Widen the Utilization Gap.

Digital expansion is being disproportionately driven by urban uptake, leading to a persistent utilization gap despite modest gains in rural reach.

Urban telephone subscribers increased from 666.11 million to 679.86 million, outpacing the smaller absolute gains seen in rural areas (534.69 million to 538.50 million). This reflected stronger urban adoption of fibre, Wi-Fi, and Fixed Wireless Access (FWA). Consequently, the rural subscriber share marginally decreased from 44.53% to 44.20%. The disparity in penetration remains significant, with urban tele-density reaching 133.56% (supported by multi-SIM use) while rural tele-density only inched up to 59.43%.

- Profitability Pivot: Core Earnings Strengthen as Pass-Through Costs Drop and ARPU Rises.

The telecom sector exhibited improved core earnings quality and strong annual momentum, even when facing sequential top-line pressure.

While Gross Revenue (GR) declined 1.63% QoQ to ₹96,646 crore, Adjusted Gross Revenue (AGR)—a measure of healthier core earnings—rose 2.65% QoQ to ₹81,325 crore. This positive divergence was primarily supported by a substantial drop in Pass-Through Charges (−19.45% QoQ). Furthermore, Wireless Average Revenue Per User (ARPU) increased by 2% QoQ to ₹186.62, consistent with the uptake of premium plans and expanding 5G usage, reinforcing the strong annual growth momentum observed across GR, ApGR, and AGR (YoY growth of 12.34%, 11.03%, and 15.26%, respectively).

- The Duopoly Tightens: Legacy Services Fade Amidst Accelerated Digital Shift.

Market growth has solidified into a de-facto duopoly, coinciding with the rapid and structural collapse of legacy access mechanisms.

Net additions were heavily concentrated in the two scaled operators: Reliance Jio (+7.79 million wireless subscribers) and Bharti Airtel (+1.75 million wireless subscribers). Meanwhile, Vodafone Idea (Vi) and BSNL continued to contract, reinforcing the duopolistic competitive structure in mobile. This consolidation parallels the fading of legacy segments; Public Call Offices (PCOs) are in structural decline, with the installed base halving year-over-year (−56.0%). Pay DTH subscribers also fell 1.49% QoQ, reflecting the ongoing migration of users towards personal mobile access and OTT/IPTV platforms.

Other Insights

Legacy segments continued shrinking: Public Call Offices more than halved year‑on‑year, and Pay DTH subscriptions fell to 56.07 million, highlighting the shift to mobile and OTT/IPTV consumption.

Overall tele‑density rose from 85.04% to 86.09%, with urban reaching 133.56% and rural 59.43%. Wireline tele‑density strengthened to 3.36% from 2.62%, reflecting the fixed‑line surge.

Market expansion is led by Reliance Jio and Bharti Airtel, while Vi and BSNL saw declines; a one‑time Tata entry lifted total connections without altering the core duopoly structure.

एक अरब मील का पत्थर, हनीवेल का प्रभावशाली ट्रैवल टेक स्टैक और भारत में रिवोल्यूट (एचटी टेक) — snappress.i

October 16, 2025[…] फर्म द्वारा बताई गई आशा की किरण टेकार्क का नवीनतम इनसाइट्स प्रो रिपोर्ट, जिसमें […]

A billion milestone, Honeywell’s impressive travel tech stack and Revolut in India (HT Tech) - IsmailBD

October 16, 2025[…] base (1,170.88 million) that relies on 5G/4G/3G. A silver lining, pointed out by research firm Techarc’s latest Insights Pro report, which notes, “wireline subscribers surged dramatically by 28.20% QoQ […]

A billion milestone, Honeywell’s impressive travel tech stack and Revolut in India (HT Tech) - mobiledell.com

October 16, 2025[…] base (1,170.88 million) that relies on 5G/4G/3G. A silver lining, pointed out by research firm Techarc’s latest Insights Pro report, which notes, “wireline subscribers surged dramatically by 28.20% QoQ […]

A billion milestone, Honeywell’s impressive travel tech stack and Revolut in India (HT Tech) - OpBharat

October 16, 2025[…] base (1,170.88 million) that relies on 5G/4G/3G. A silver lining, pointed out by research firm Techarc’s latest Insights Pro report, which notes, “wireline subscribers surged dramatically by 28.20% QoQ […]

A billion milestone, Honeywell’s impressive travel tech stack and Revolut in India - republicdiary.com

October 16, 2025[…] base (1,170.88 million) that relies on 5G/4G/3G. A silver lining, pointed out by research firm Techarc’s latest Insights Pro report, which notes, “wireline subscribers surged dramatically by 28.20% QoQ […]