Foldable form factor of smartphones has been a recent innovation that has triggered excitement in the luxe segment emerging as a visible differentiator than the rest. It is also giving the Android premium smartphone makers a reason to stand distinct from iPhone, which is still the aspirational smartphone premium brand for most of the users. Foldable smartphone is a differentiator in two key ways. Firstly, it is offering a visible differentiation for few smartphone brands than the rest as they are able to put across a new value proposition in the premium segment before their customers. Secondly, it is also a statement of maturity and expertise for any OEM exhibiting that they have the technology wherewithal to manufacture such a complex smartphone system.

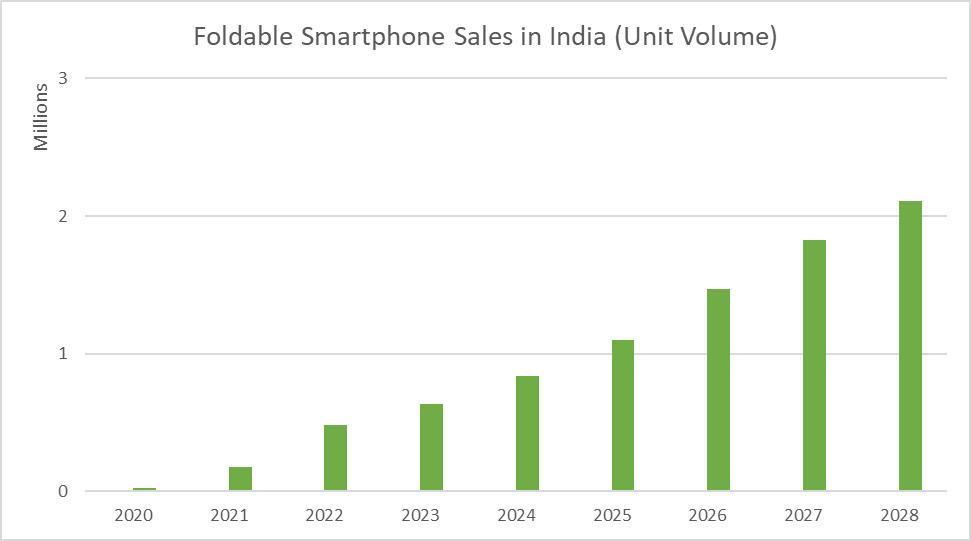

However, the form factor is going to remain a niche but promising offering. As per our estimates, the foldable (including flip) smartphones will contribute over 1.8% of the total smartphone revenues for 2023. This will be achieved by selling over 6.35 lakh foldable smartphones during the year. This translates to less than 0.5% of the total sales by volume estimated for the period.

The form factor is expected to cross 1 million mark of annual sales in 2025, which will double in 3 years by 2028. ‘Affoldables’ (affordable + foldable, as defined by Techarc priced at less than 80,000) will be a key factor driving this growth in coming years. In 2023, these are already expected to contribute more than half (52%) of the total sales in unit terms.

The market is divided in two variants of H-fold (flip smartphones) and V-Fold (fold or book fold smartphones). As per our estimates, 64% of the sales during 2023, will be flip smartphones. The current options for customers in India to buy include:

- Motorola Razr 40 Ultra

- Motorola Razr 40

- Oppo Find N2 Flip

- Tecno Phantom V Fold

- Samsung Galaxy Z Fold 4

- Samsung Galaxy Z Flip 4

Out of these, Samsung is soon launching its refresh of Fold and Flip smartphones with the 5th generation of foldables giving customers option to choose from the pioneers in this segment.

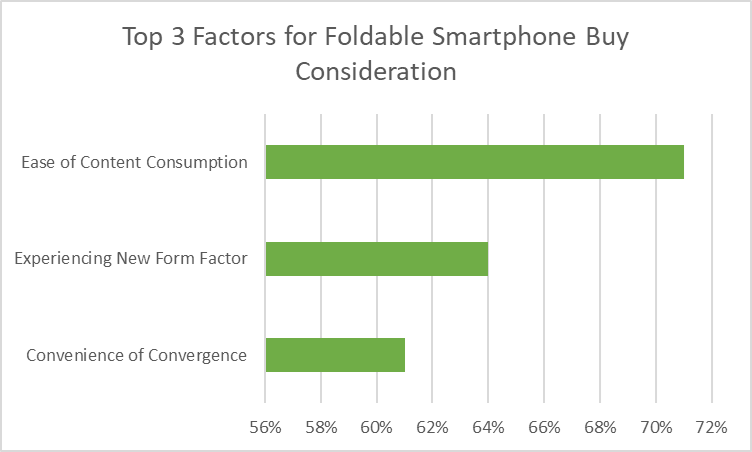

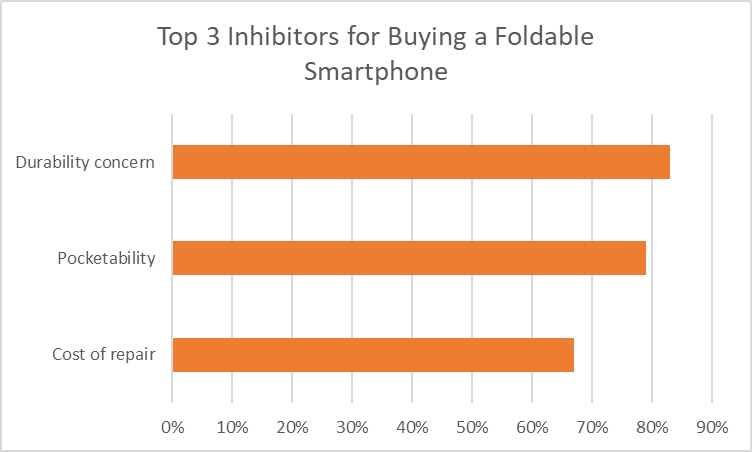

Basis feedback from a dipstick survey done with 650 high end smartphone users who are currently owing a luxe category smartphone (smartphone of more than Rs 50,000) and potential customers for a foldable smartphone, we found ease of content consumption as the top reason for them to consider this niche form factor for purchase. Among the inhibitors, durability remains the top concern that makes them doubtful about purchasing one.

While all the foldable smartphone makers have showcased the quality checks and measures implemented to address the durability concerns of potential buyers, there is a need to increase the awareness and spread more information about the making of and engineering behind the foldable smartphones. The brands shall also have to look at exclusive content strategies to delight foldable smartphone buyers by offering bundled content subscriptions adding to their significance.

The inevitable ‘i-threat’ for Vivo, OPPO, Xiaomi among other android brands wanting a pie of the premium smartphone buyers - Techarc

July 28, 2023[…] will be seen high on maturity by the consumers than from other brands who are foraying in the foldable smartphones niche. On top of it, Samsung has additional points to score like premium retail stores, after sale […]

Are foldable phones an expensive fad - or the next big thing in handsets? - playcrazygame.com/india

August 4, 2023[…] to India-based technology analyst Faisal Kawoosa from TechArcfold and flip phones combined will contribute to 1.8 percent of smartphone revenue by 2023. About […]

Are Foldable Phones A Pricey Passing Fad — Or The Next Big Thing In Handsets? - FindBerg

August 4, 2023[…] to the India-based technology analyst Faisal Kawoosa of TechArc, fold and flip phones together will contribute to 1.8 per cent of smart phone revenues in 2023. […]