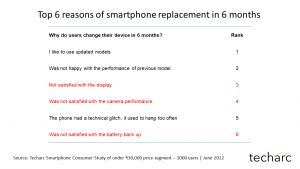

OPPO has been a pioneer smartphone brand in many ways. Unfortunately, its wavery strategy in India did not let it capitalise its strengths effectively. With regards to the core product, Oppo led several improvements in camera and battery. Even today, camera and battery performance rank as the top 2 factors influencing buying decision. Oppo wasn’t able to capitalise much on the improvements it contributed. Camera was very smartly taken over by Vivo and the battery got diluted with OnePlus, Realme, etc., also positioning around the same.

Oppo again was one of the early smartphone OEMs which believed only a UI layer won’t be enough, hence invested in developing an OS, ColorOS. While many other competing brands had developed their UI which had several experience issues, ColorOS was on the path of developing a fundamentally different experience by having a greater control on the interface. Many OEMs like Xiaomi are doing it now through HyperOS.

But these are not the things that affected Oppo’s performance much in India. These did dilute its product positioning. However, Oppo’s performance in India got significantly affected by its wavery strategy in India.

Oppo was among early OEMs to pick up CMF as a capability which it used to develop differentiations. Reno as a series was all about it. In many ways Oppo had gained mileage early on. For example, Its Reno 3 and 4 were among the sleekest smartphones that the industry has had in contemporary times. The finish and exterior of the smartphones were also very different than what was prevalent. In the offline, look and feel matters more than online channels. It’s the first tangible and visible differentiator that a seller can present to a customer over the counter. This combination of focusing on exteriors by Oppo and using offline as the primary channel was a perfect match. Oppo did gain a lot with this approach. But soon it started to sort of ‘give up’ this focus on exteriors of a smartphone. Many from the competition, especially Vivo started focusing heavily on this and today we are in a time where we perceive Vivo as a key player behind promoting CMF in the industry. Consequently, we see Vivo also grown and risen to the leadership position with a market share by volume almost double than Oppo in some quarters.

Oppo was going good till 2015-16 with this combination. But somehow it got so much distracted by the emergence of online channel that it invested all its energy in creating an online presence through a daughter brand ‘realme’ to counter Redmi. There is no denying that online was catching up fast at that time, but every industry insider knew that 50-60% of the reported online sales were cross-selling in the offline channel. Retailers were only taking advantage of the online ‘predatory’ pricing and offers to buy devices in bulk and then resell at their stores. So Oppo should not have ‘panicked’! Somewhat that Vivo did not.

Oppo soon also took the camera conversation to portrait pictures including selfies. Reno, which had established as a series of smartphones offering unique exteriors started talking about portrait camera. This was another off-road for them.

Oppo should have stayed on its course, owned the CMF narrative and continued to propel it through its strong offline presence. Today, its connect with CMF is very minimal just like any other smartphone brand, where Vivo has taken that prime place in many segments in the minds of customers as well as the channel partners in terms of being a brand that does a lot of work around CMF.

Finally, Oppo also has some kind of leadership issue in India. When I compare it with many other brands, there are several Indian faces which have been with these brands for more than 5 years or more and in many ways have become the brand representatives in India within their stakeholders. In brands like Vivo, Xiaomi, etc., there are at least 4-5 such names that I can recall. However, in Oppo the top management stickiness has been an issue. This also has its impact on the brand’s overall prospects in the market.

From Oppo’s India story that has unfolded so far, one can convincingly conclude that its strategy has been wavery. They got distracted and eventually off-the-track from the core competencies and the competition owns the narrative around many of Oppo’s strengths. With OnePlus now directly in its control, so is the case with Realme, the strategy looks even confusing. The product portfolio is overlapping at many instances. Oppo needs a turnaround in its strategy in India, drive it with consistency and build strong narrative around its strengths. It may momentarily show good results in volume market share, but this is not something that it can sustain. The brand’s think tank needs to sit across the drawing board and come up with a new India strategy with the core guiding principle of consistency in its approach as regards India.