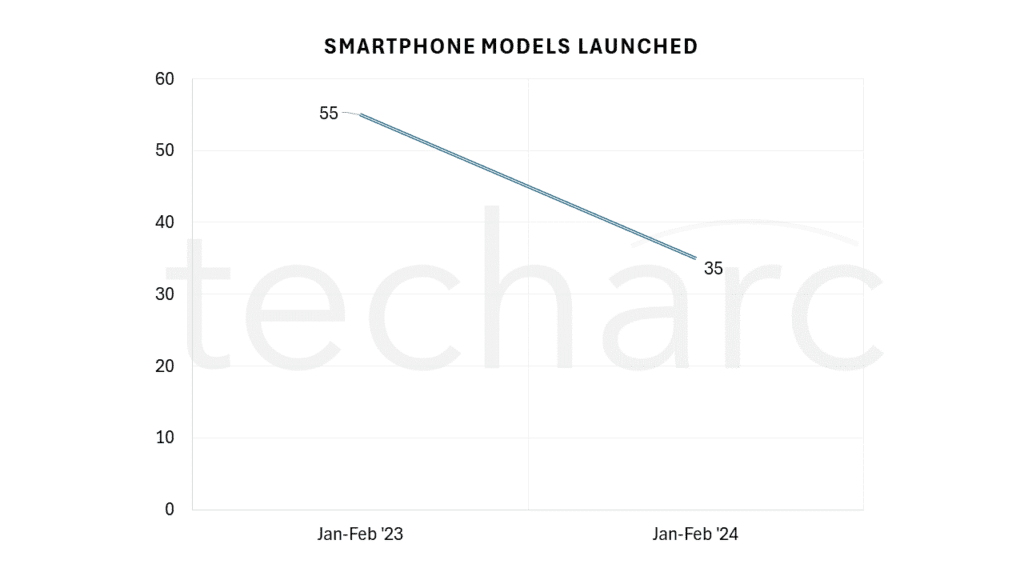

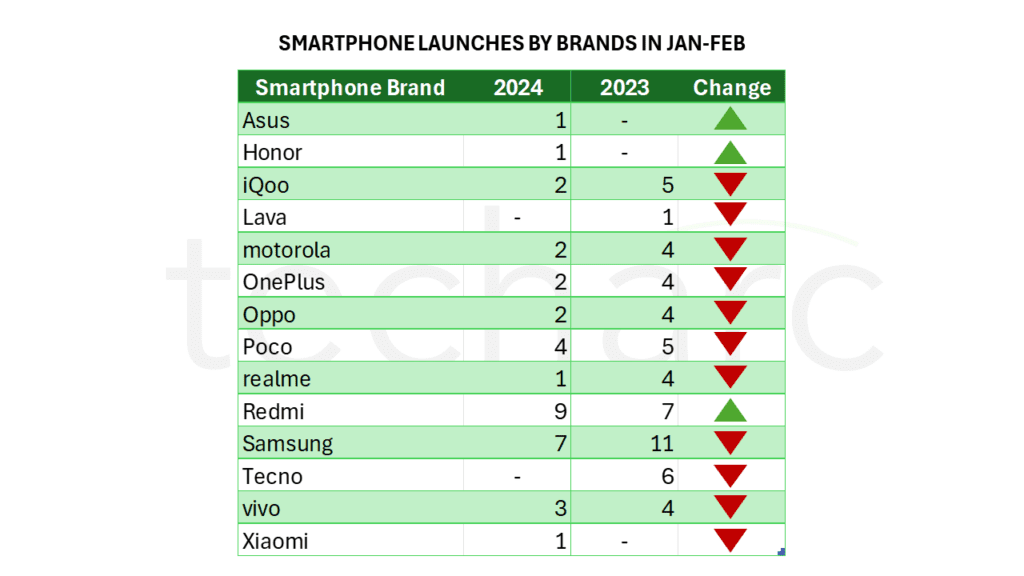

There is 36% reduction in the number of models announced by the smartphone OEMs during Jan-Feb 2024 period comparing it with the same period last year. While many brands halved the number of models announced during the period in 2024, Tecno which had launched 6 models for the same period in 2023, did not announce any launch this year. Samsung limited the number to 7 against 11 last year, while iQoo and Realme reduced the number by 3 each.

There are two reasons for brands adopting this strategy. First is to reduce the confusion in the minds of the customers. With too many models, customers would get confused especially when there wasn’t much difference in the value proposition. Also, as there is a shift towards offline channel driving the sales volumes, it becomes difficult for brands to provision adequate inventory of multiple models across the distribution networks. With lesser number of models, they can manage to provide sufficient inventory volumes to the retailers.

Having too many models was also impacting the manufacturing cost of the smartphones. With the sales volumes remaining flat for some time now, manufacturing too many model batches would result in production inefficiencies affecting the economies of scale. It is easier and economical to produce a million unit of the same model against 200-300k of multiple models. This also helps optimise other costs including marketing, packaging, etc.

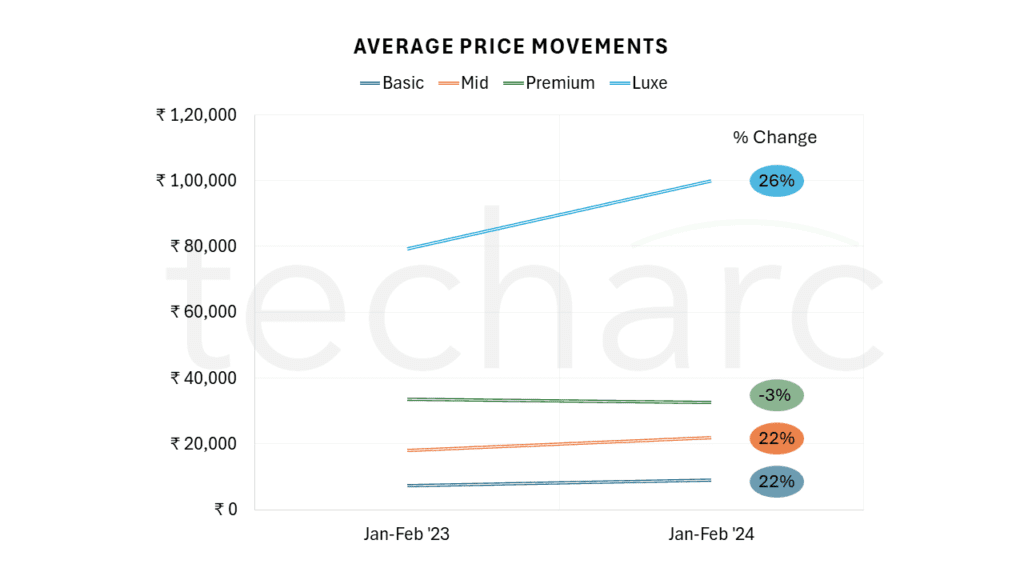

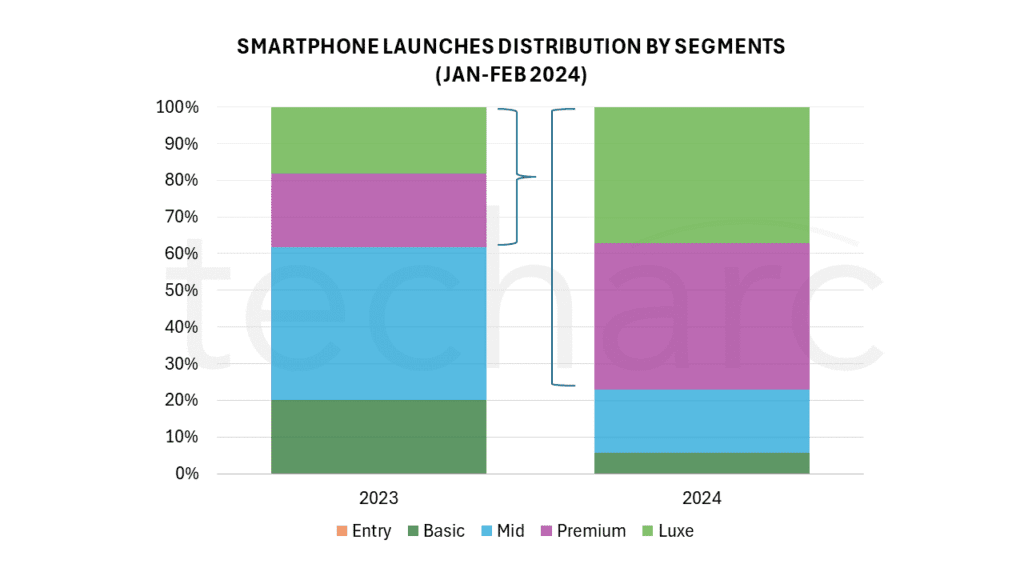

Capturing the pulse that the volume sales are not moving much, the OEMs, which have portfolio in the luxe segment are seeing this as a strategy to hedge the revenue growth. The ASP in this segment have gone up 26% y-o-y. Similarly, the brands operating in basic and mid segments have pushed the ASPs by 22% for the period, while there is a small dip of 3% for the premium segment. OEMs are pushing ASPs by at least 20% to compensate the expected decline in revenues by selling less or same volumes in 2024. The portfolio announced by various OEMs during Jan-Feb months of 2024 is all skewed towards premium price segments. In 2023, only 40% of the smartphone models launched in Jan-Feb were of the premium and luxe segments. Contrast to this in 2024 for the same period, the number of models launched in these two premium segments makes up over 75% of the total launches during the period. This again is a reflection of the change in strategy by OEMs to have bigger proportion of portfolio in the premium segments to secure revenue growth in times when the volume sales are likely to remain flat.

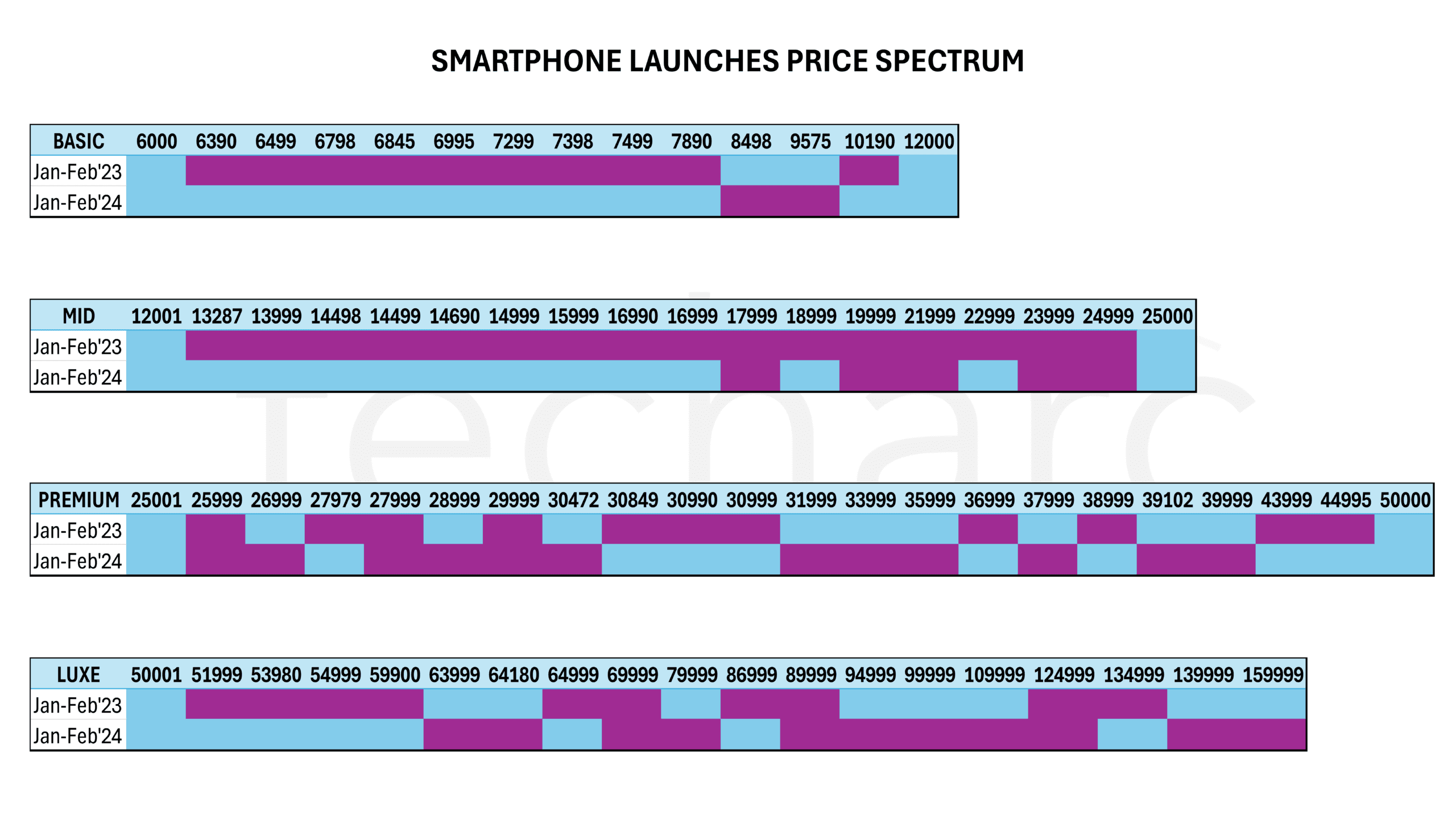

Its now several quarters to see a smartphone being launched in the entry (₹0-6000) segment. Consequently, this has further slowed down the 2G to 4G/5G transition. Now we are seeing OEMs also losing interest in the basic segment as well. Compared to 10 smartphone models launched in the same period in 2023, there were only 2 models launched in 2024. However, we do expect OEMs to introduce some more smartphones in the segment during the rest of the period in 2024, the focus from the affordability markets is diminishing.

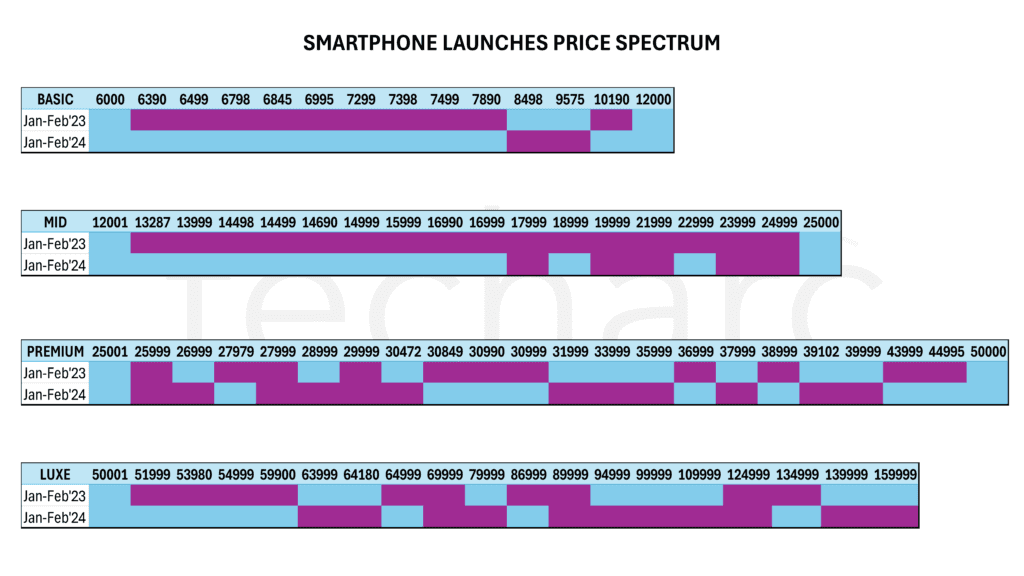

Already, we have seen that there has been at least 20% increase in the ASPs when the launches are compared year-on-year for the same period. But for the basic and mid segments, the OEMs have straight away jumped to the higher side of the spectrum in 2024 vacating the lower price brackets of the segment. Compared to this in the premium and luxe segments, there has been a step-up in price brackets this year over Jan-Feb 2023.

The OEMs are trying to stay with a thin portfolio for the lower price segments where they could economise the scales and maintain profitability in a very price sensitive and conscious customer base. Compared to this, in the premium and luxe segments, the OEMs are stepping-up the customers to next bracket along with a wider range to choose from.

What it means for 2024?

The Jan-Feb 2024 launch strategy compared with that of the same period previous year clearly indicates to the shifts that the smartphone industry is adopting. These shifts are motivated by the sole objective of ensuring revenue growth. This is not exactly what premiumisation means. In that case the OEMs would completely desert the lower segments and create a portfolio only for the premium segments. Here, the proportion of premium segments has grown significantly though. But as we move along in the year 2024, OEMs having focus on the lower segments, will definitely have more launches in the segment balancing the proportions. As 5G has become a hygiene factor in smartphones, and the value chain is also optimising the costs of key components like chipsets, the affordable 5G smartphones will get introduced in the remaining period of 2024 allowing millions of existing 4G users to upgrade to the latest cellular generation.

Some of the priorities for 2024 basis this comparative analysis and other inputs we have from the OEMs, partners, channel, and the consumers are: –

- Lean and clean portfolio to minimise consumer confusion and economise on production scales.

- Step-up to next price bracket in every segment present to compensate for flat or declining volume sales assuring revenue growth.

- Minimise focus on 4G portfolio. Collaborate with the entire value chain to increase 5G accessibility helping faster migration.

- Create and reinforce brand identity to develop natural differentiators. Brands will be seen balancing focus between product innovation and the brand imagery.

- Product and feature planning to be done with offline distribution channel as focus. So far it has been online where specification measurements were critical to appear as a compelling proposition upon comparison. Now it will brand, servicing along with the product.

- AI to remain at the top of the value hierarchy, while 5G becomes a must essential.