Gurugram – Qualcomm introduced its first sub $99 chipset Snapdragon 4s Gen 2 in India that will stir drive towards helping featurephone users to join 5G. From operators’ standpoint this helps Jio to add millions of subscribers to their market share as the chipset supports SA or standalone architecture of 5G communications, which has been implemented by Jio in the country. Airtel has NSA or Non-Standalone architecture, but it has also made public announcement towards adopting SA in due course of time as tariffs pick up. It has also announced its FWA will be on SA.

For India to have a complete digital user base 5G adoption across all tiers of mobile users is extremely important. With Digital India being a marquee initiative, its critical that a substantial, if not entire, population of India is digitally connected. At least every household of India should have one digital user, which means a smartphone user. As 5G is fast replacing 4G, it makes a lot more sense to have 5G as the default smartphone communications generation in India for which 5G smartphone access across all customer tiers is a fundamental requirement.

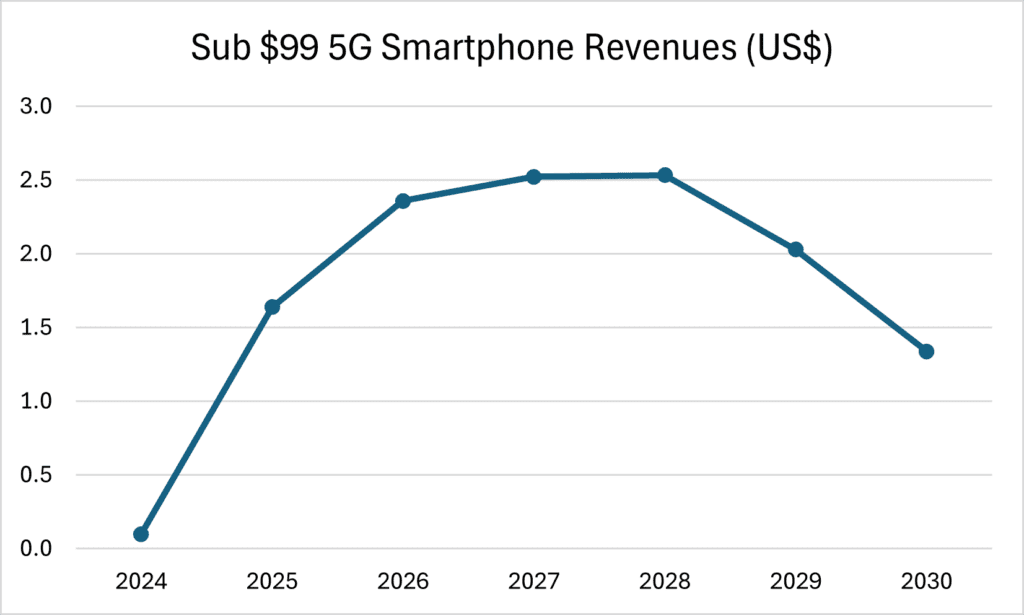

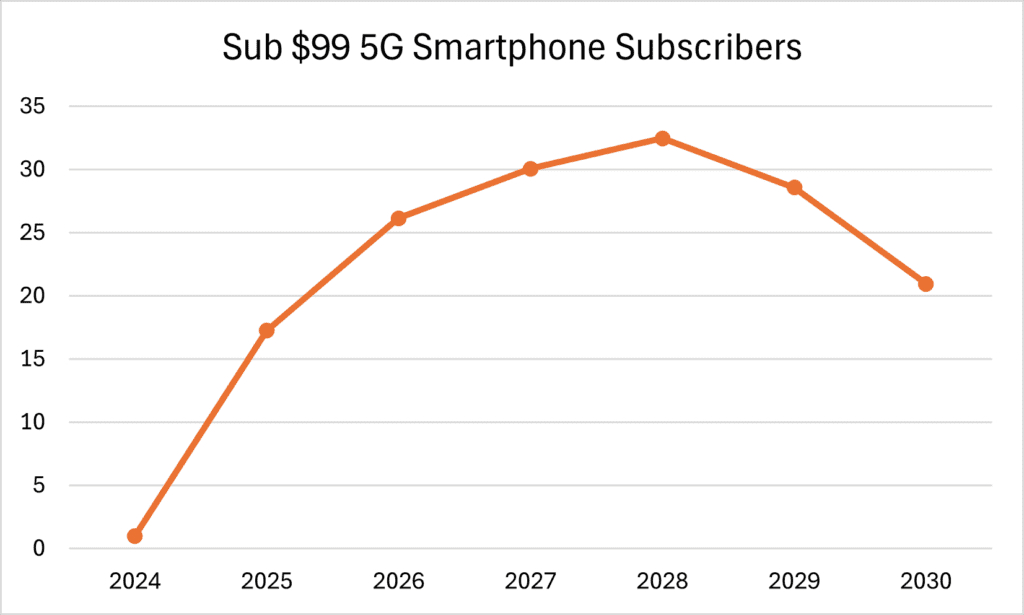

Analysing the impact of this event which will be joined by other chipset makers like MediaTek and UniSOC in due course of time, the smartphone industry in India could see a much-required expansion both in value and volumes. Between 2024-2030 period, we estimate the 5G widening into sub $99 segment to add $13 billion cumulatively in revenues for the smartphone industry. This would be earned by potentially adding 158 million featurephone users to 5G during this period.

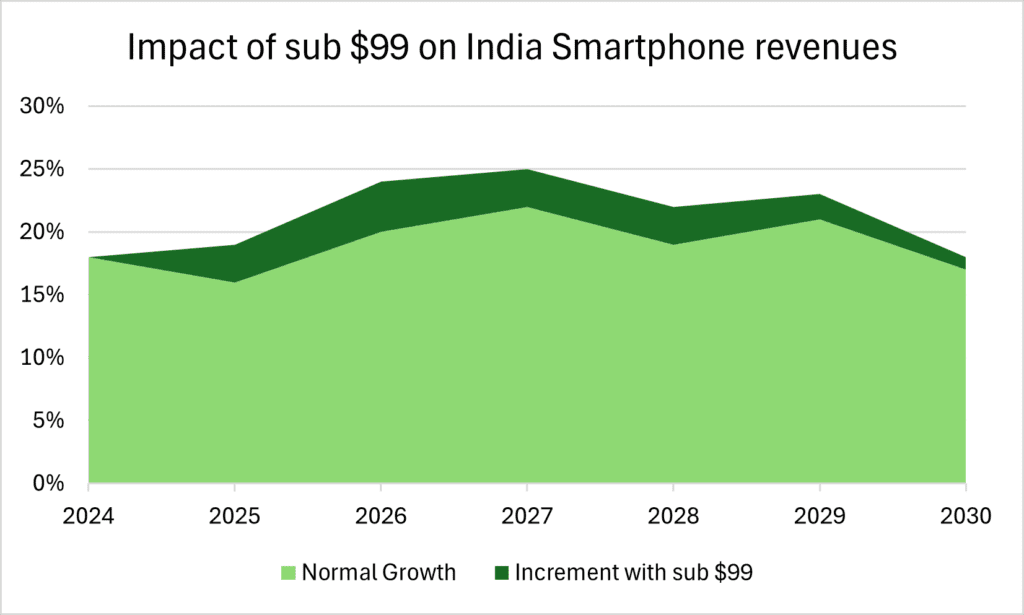

Beginning 2025, we expect to see 2-3% contribution of the smartphone revenues in India coming from 5G smartphones sold in sub $99 segment. During the period our analysis suggests there could be addition of 17-32 million subscribers every year to the 5G smartphone base.

Strategic Implications

While the revenue and subscriber addition may not be significant looking at the overall smartphone base and the normal 5G progression, focus on this segment could potentially help 45% of the featurephone base to eventually join smartphones, specifically 5G. Without this, our estimates suggested that we could only bring one-third of existing featurephone base to smartphone over these years with natural price-waterfall of the 5G smartphones. So, there is a likely addition of 12% points with this intervention led by Qualcomm and likely to be joined by other chipset makers in course of time.

Even with this intervention, we may not see 2G completely switching off. But the base will significantly reduce and then government can intervene to help others also move to smartphones through a scheme along with support of operators, OEMs and component makers. With both things in parallel, we can set a target to see India 2G free by 2030.

Stakeholder Challenges

This journey is not going to be easy. There are certain challenges that need to be addressed to achieve this promising and extremely critical objective for India’s holistic digital economy dream.

- On a global canvas sub $99 looks very promising breakthrough. However, it needs to be seen how it translates in ₹ (INR) terms. That will be extremely critical to decide its adoption and success. Initially, we are expecting these smartphones being offered in ₹7000-8000 range, which will not drive huge adoption. Gradually it should come down in a couple of years where it could be priced ₹5,000-6000 range, which can drive volumes and faster adoption.

- The experience of the sub $99 smartphones will be defining. Past consumer preferences have shown that they don’t mind waiting to save around ₹10,000 to own a smartphone offering relatively better performance than the ones available at ₹6,000-7,000. The needs and desires of aspirational users even at entry level are many. They want to create content, consume videos, play games and do social media besides other use cases of a smartphone. Also, the conditions in which they operate their smartphones are sometimes harsh and extreme. So the smartphone must endure such conditions.

- The initiative needs wider participation of the OEMs. The sub $99 will have role of central and state government to help in adoption. There could be government programmes and schemes introduced to enable 5G smartphones in lower tiers of socio-economic ladder. Government has been averse to any collaboration with China brands. So, we need to see more local and global (non-China) brands participating in this endeavour.

- In a couple of years from now availability of 5G smartphones in the 2nd hand market will increase. Smartphones selling in ₹15,000-20,000 range in first hand markets will be available in ₹5,000-8,000 range in a couple of years from now. Many consumers will prefer them because of having better specifications than what we are expecting in sub $99 5G smartphones developed using Qualcomm 4s Gen 2 and other equivalents that other chipset makers will offer in future.

- OEMs have got ‘carried’ by the false premiumisation trend and have put in a lot of investments and efforts to align their portfolio accordingly. It will be a U-turn for many of them to focus back on sub $99 segments. Will they be ready to take this bet, and how many? The fact is that there is no premiumisation. It is only stepping-up where consumers are wanting to step-up their experiences to next segments and willing to pay more for that. Premiumisation on the other hand is when consumers are looking for things beyond product, elements which essentially define luxury and not necessarily quality and performance.

- There is still not a very convincing 5G use case for consumers. Even after owning a 5G smartphone how will consumers derive value remains a question. Many consumers might prefer to go for a better specification 4G smartphone in sub $99 segment and derive more value.

- The tariff plans of 5G have gone up and they might again go up as operators focus more on improving their financial health. Though there is a precedence of operators using differential pricing for different subscriber segments, it has not effectively yielded much. While users may get a 5G smartphone in their hands, will they be able to afford 5G services?

- The affordability plans with the introduction of financing through NBFCs and other financial instruments by smartphone industry has helped consumers step-up. In view of that, some OEMs might want to focus on bringing some base within sub $99 actually out of it so that they can purchase $120-150 5G smartphones on EMIs.

Conclusion

The drive initiated by Qualcomm with 4s Gen 2 will only strengthen in coming times. The entire ecosystem is likely to respond collaboratively, and we should see greater participation of the entire value chain in focusing on building the sub $99 opportunity for India. This is the 3rd attempt where the ecosystem is trying to do something for this segment and is fundamentally technology driven than business and finance.

To make it a success its now time to build additional layers of business and commercial viability to realise the visible opportunity. The potential estimated in this InsightsPro is not a very difficult to achieve, but we shall have to go collaboratively along with looking at it with a strategic intend.

Assumptions and Notes to Editor

- The purpose of this InsightsPro is the neutrally measure the impact of opening up of sub $99 5G smartphone opportunity after the introduction of Qualcomm’s Snapdragon 4s Gen 2 platform.

- The adoption of sub $99 5G smartphones has been estimated taking adoption factor of affordable smartphones into account, derived from the analysis of past 10 years data.

- The revenue estimates have been calculated basis the price waterfall analysis of affordable smartphones over past 5 years.

- The affordable segments accounted for in this analysis as defined by Techarc include Entry (up to ₹6,000) and Basic (₹6,001-12,000) price ranges.

- The impact of replacements has not been factored as its unlikely that a customer buying a 5G smartphone in sub $99 segment will again buy a 5G smartphone in same category. The customer will either go for a higher segment, which is already accounted in the normal revenue estimates for the smartphone industry or buy a 2nd hand smartphone which in not in the purview of this analysis.

- The analysis expects the macro-economic conditions of India to remain at present state or improve further.

- US$-IN₹ conversion rates are of July 2024.