Your cart is currently empty!

Do consumers in India buy anything and everything that is made available to them by the smartphone brands? The general belief considered to be the magic mantra is that engaging through the right channel along with superlative marketing results in achieving the business goals for products including smartphones, Smart TVs, wearables, etc. Over the past decade, exactly when the country saw emergence of China origin brands, this pattern can be traced to the journey of most of the brands that are in the leadership position of the smartphone market and other similar products. Does this mean there is a definite playbook for anyone to follow to become successful in this market? Does this mean that consumers don’t have much of a say?

The Conscious Cohorts of Smartphone Users in India is a first in industry analysis by Techarc developed leveraging smartphone consumer data of the past 5 years (2018-2022) captured through quantitative surveys, qualitative group discussions, customer comments and review on social media as well as ecommerce marketplaces. The cohorts are defined after analysing opinion of over 200,000 unique smartphone users touch based during the period.

The underlying pattern suggests that consumers in India do not just buy any smartphone. They are conscious buyers where the thought is triggered by a specific attribute. This behaviour is not just visible in case of smartphones, but other smart devices and gadgets also that the consumers purchase adding to their digital lifestyle.

The 5 user cohorts of smartphone users in India

Broadly, the smartphone users in India can be classified into 5 distinct cohorts. These are listed below in a random order.

- The Brand Conscious Cohort

- The Quality Conscious Cohort

- The Value Conscious Cohort

- The Trust Conscious Cohort

- The Price Conscious Cohort

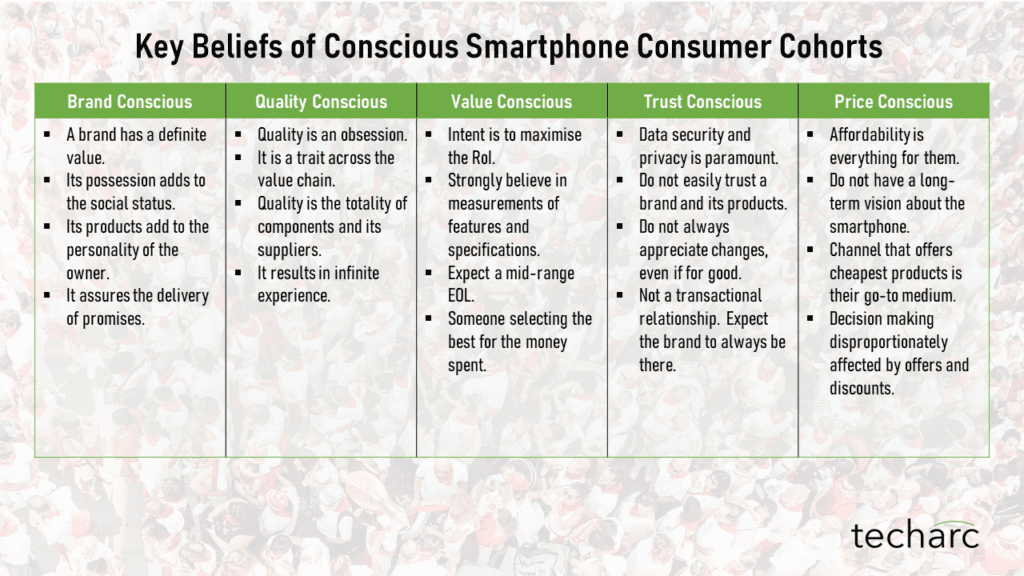

The Brand Conscious Cohort: These smartphone users develop an affinity or loyalty over time for a particular brand and do not switch to any other brand during upgrade or replacement cycles. The affinity is primarily developed due to external factors like social status, connect with the brand and other emotional factors. On the basis of experiences, the brand conscious smartphone users develop a strong loyalty for the brand. In both the scenarios, a brand has a cult level following. The perfect example of any brand in this case would be Apple. From experiential to emotional reasons, it has a strong follower base which only goes for Apple smartphone and other products.

The brand conscious users feel that the possession of a certain brand adds to their personality. In our analysis we found 68% of this user cohort strongly believing that its possession is a status symbol adding to their social value as well as impacting their personality positively. At the same time, a brand name gives certain inherent assurances to its users about the fulfilment of promises made. For example, 86% of iPhone users have found their smartphone fulfilling all the promises they saw the brand making to them at the time of evaluation directly over-the-counter or through various indirect communication to these users.

Apple, Samsung and OnePlus are the three brands that resonate with this user cohort.

The Quality Conscious Cohort: This is the tribe of perfectionists. The user cohort only relies on the brand which they see offers quality. They equally weigh the technical as well as functional quality dimensions. For the technical quality they evaluate deep the value chain where they capture information about the components and component makers to make an assessment. They also gather information about the brand’s strength in R&D besides gaining information about the entire value chain including contract manufacturers, etc. The functional quality is also keenly observed by this cohort of users who evaluate brand’s interactions through various touch points with them from time to time.

The quality conscious users consider quality as a holistic attribute of the overall offering by any brand. 74% of the users in this cohort strongly agree that quality should be maintained by the OEM across the value chain rather than focusing on a few. 85% of the users in this classification of smartphone owners find it unacceptable that their smartphone can stop functioning at any point of time. For them the smartphone should work for an infinite period of time. The replacement of smartphone for them should be elective rather than being forced on them due to conking of the existing smartphone.

Apple and Samsung are the two brands that are most preferred by this user cohort.

The Value Conscious Cohort: This user cohort of smartphones exhibits the traits of an economist. The users in this cohort consider buying smartphone as an investment for which they want to maximise their returns. They are very measurement driven where they check for the measurement in terms of relevant units like camera megapixels, battery capacity, processor clock speed, storage capacity, RAM, etc. 92% of the users in this cohort do make their decision basis the comparison of key specifications of a smartphone, selecting the model/variant with the highest/largest/biggest measurement. This group believes in the highest number being the best.

Value conscious users do not expect the smartphone to work perpetually. Rather they understand that there will be an end-of-life (EOL) of the smartphone, which they expect should be a mid-range tenure. That would translate to 3-5 years of lifespan. 71% of the users in this segment understand that the smartphone they are using or would use will have a definite lifetime over which they shall have to apportion the investment made on it. The economics prudence of these users drives them by numbers who assess the expected performance of the smartphone basis various measurements over a period.

OPPO, Vivo, Motorola are among the key brands that are considered most by this user cohort.

The Trust Conscious Cohort: One of the most difficult cohorts to handle which develops a degree of suspicion about the working of smartphones. They wear a detective hat doubting various smartphone elements including its hardware, OS and the apps that are loaded on it. For this user cohort, the privacy and security of data is paramount. They cannot believe in a device or the brand until they have a full view of how, when and why their information is being captured, stored, shared and analysed. They want to be in control of their smartphones.

68% of the users in this segment took a while in developing trust for the device they are using as well as the brand. They developed trust for these brands only after they did not see anything suspicious with their devices. This user group is overburdened with suspicion. 59% of the users in this group do not easily accept any change that includes updating OS and Apps with the latest versions. The doubt they have in their minds is that this change shouldn’t become a reason for adding to their mistrust. Another important characteristic of this cohort is that they do not consider the relationship with a brand transactional which gets over just by supply of the product. They want the brand to be always available to them in difficult times and unexpected situations. 83% of the people in this group want that their brands remain responsive to strengthen the relationship, hence trust.

Apple, Samsung, Vivo, OnePlus are among major brands that users of this cohort see matching their expectations.

The Price Conscious Cohort: The price of the smartphone is the decision-making factor for this user cohort. These users create a ‘wish-list’ of what they want and go with the cheapest brand offering most of them. They may not get all that they wish and have to settle down with some gap in their aspirations in terms of what their smartphone should have. Quality is not a concern at all, but they do expect their phone to deliver some level of experience if not top notch.

The price conscious users have the primary goal of owning a smartphone then having a long-term vision about the device. They do not associate themselves with any brand and do not find the smartphone as an extension to their personality. The segment is extremely influenced by the offers and discounts that are made available to them. 93% of the users of this segment look for the offers, discounts, and the accessories they get inside the box before finalising their choice.

Redmi, Realme, Tecno are among prominent brands of this user cohort.

Distribution of conscious user cohorts in India

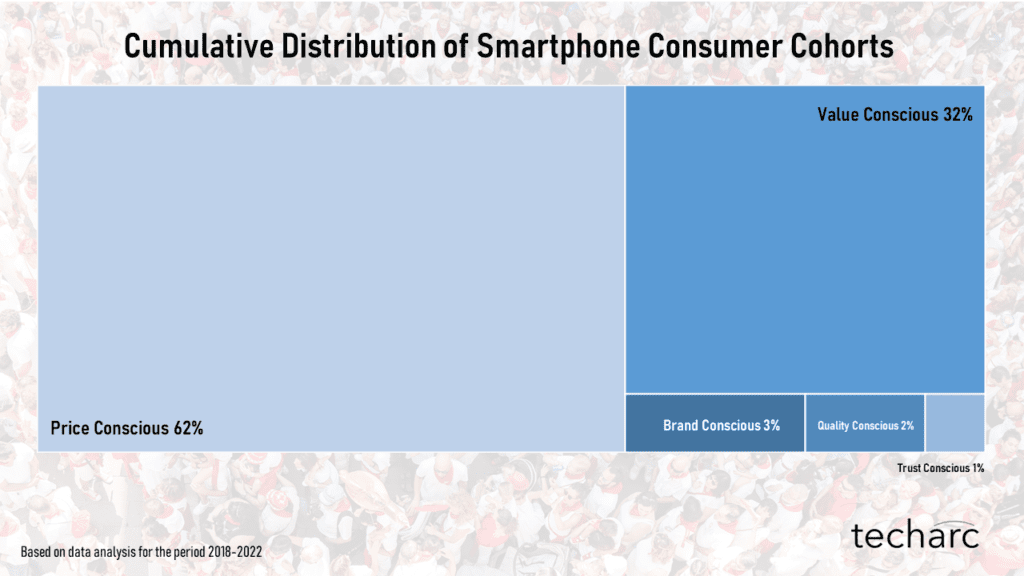

The smartphone market of India in the past 5 years has been primarily driven by price conscious consumers. This is an extension of what we have been seeing in the past decade where the major segment of the consumers was price conscious.

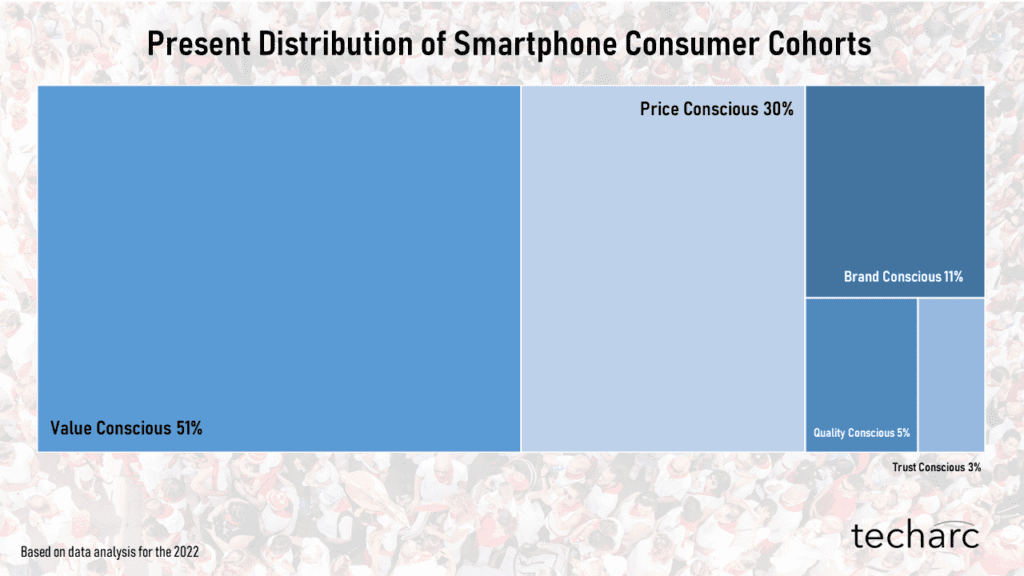

62% of consumers representing the period (2018-2022) would go for the most affordable smartphone that would be loaded with the desired specifications and features. Value conscious consumer cohort emerges as the 2nd largest user segment with 32% representation. Other segments are seen as very niche segments when taking a cumulative view of the period. However, when one looks at the previous year 2022 on a standalone basis, the distribution flips with value conscious cohort contributing 51% of the users. Price conscious segment represents 30% of the users for year 2022. An interesting and important change to note is that while brand, quality and trust continue to remain niche cohorts they see more than 3 times growth in their contributions.

Going forward, while India embraces 5G as a mass smartphone user technology, the contribution of brand, quality and trust cohorts will continue to grow. This is a good sign for brands who have been investing heavily in terms of investment and other resources in brand building activities, achieving new heights in quality standards and create a trustworthy equation between them and the consumers.

We expect price conscious cohort to gradually continue to decline settling at around 20% of the representation. Value conscious cohort will also start to show a declining trend with flattening around 30% contribution. The remaining 50% of the users will represent the brand, quality and trust cohorts which will keep on increasing their contribution as users in India will look for more reliable options in terms of brands offering total quality as well as building a trust factor between consumers and the brand.

Market implications of changing cohort distribution

The biggest takeaway of this shift in consumer preference is that the future is not about enabling but delivering the desired experience. The experience could come by simply associating with a particular brand, or through getting the desired quality of products and the ambience around them, or by establishing a trustworthy connect with the consumers.

There cannot be a simple play book for smartphone brands to tread this transition. However, each brand will have to have a brand story to share that outlines the brand values, goals and the very reason of existence for the larger audience to form an opinion and identify the brand that they could resonate and connect with. The brands will further have to create an end-to-end quality framework that not only takes care of the product but the environments in which it is delivered as well as how the brands interact with the customers. Finally, brands will also have to increase their transparency towards customers and other stakeholders. If brands are making certain additions to the overall offering for business benefits, it will have to be transparent to the consumer about it. A good example of this could be brands being transparent about why they pre-load apps rather than creating a story that these are the recommended apps for our users. This may also extend to brands sharing profits with end users which they earn through such arrangements. Similarly, brands shall have to fulfil other promises as well to build this trust equation.

Looking back at 2010-2020 decade, it was all about enablement of a smartphone to millions of Indians. Consumers were primarily and predominantly interested in possessing a smartphone so that they could connect with the digital ecosystem and start a digital lifestyle. 2020 and beyond is a different market reality. While we will continue to step-up our technology upgradation to 5G and may be 6G by the end of this decade, the expectation of consumer is not about enablement. Its about experience for which product remains the core but it also needs to be layered with attributes that will come from brand, quality and trust factors.

The industry has got stuck at 145-150 million smartphones annual sales in India for the past 3 years. External factors aside, the industry has also to look at the consumers and understand their patterns of conscious thoughts that are triggered by definite attributes which define the conscious consumer cohorts as outlined in this research. Only then they can expect an expansion in the market by unit volume.

We have had 3 uncommon years at the beginning of this decade where external factors played a larger role in defining the market dynamics. With the result there was very little for brands to experiment. 2023 is shaping as the 1st year of this decade where reigns of the market are coming back into the hands of smartphone brands. The opportunity is now in the hands of the brands to shape the remaining years of this decade so that they see favourable tides in the medium to long horizon of this decade. Meanwhile, the immediate future (2023) will continue to show similar performance as we have noticed so far in the decade of 2020-30. But this does not mean that brands cannot do anything to create favourable and friendly business environment. The buck stops with them!

2 responses

[…] our elaborate research note on identifying the smartphone user cohorts in India, we defined the Trust conscious users which […]

[…] our recently published Insights Pro identifying the 5 cohorts of smartphone buyers in […]