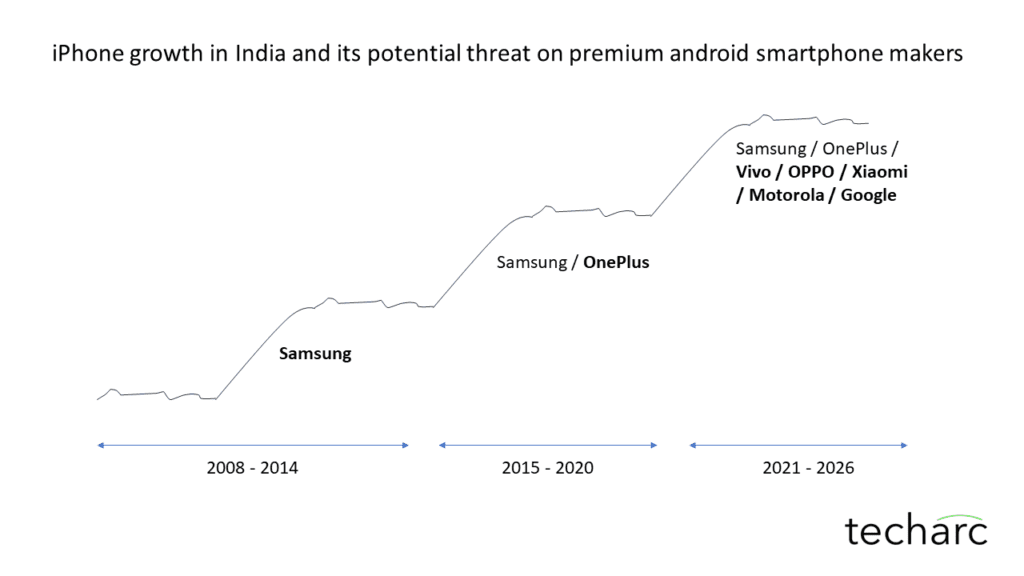

Samsung has quarantined its premium market space through S series and now the Z foldable smartphones in this segment. OnePlus has also been able to create a strong presence in the target segment. The other android based smartphone brands still have iPhone threat hovering over them with Apple expected to register 10 times growth in sales in a decade by 2024.

In recent years the premium and ultra-premium [which we define as Luxe segment (>₹50,000) at Techarc] has got as exciting as it could be. A decade ago, there was almost nothing for a premium consumer wanting to stay within the android ecosystem and had to invariably move on to iPhone to get that premium experience. In fact, many of these consumers might be okay with the present luxe smartphones available from the brands using android OS. However, they have now got used to iOS so much that they are not ready to try out something new. By now they are a part of Apple ecosystem owning multiple devices giving them a ubiquitous experience. Moreover, Apple has consistently worked on enhancing its brand identity satisfying their socio-emotional need of associating with a luxury brand.

Within android, Samsung was the pioneer in this segment with the introduction of its S series. Very honestly, up to S5 the smartphones were no different in experience than other Samsung smartphones in other segments. S6 onwards we started to see some improvements and by the time it introduced S10, the series had shown us a stable, smooth and an ultra-experience within android smartphones. By this time, OnePlus had disrupted the premium android smartphones setting up a new benchmark, and consumers started to accept android in the premium segment. Google must thank and acknowledge the contribution of OnePlus in saving the OS’s future!

However, the times have changed especially when we talk in the Indian context. Today, the iPhone sales are increasing in India, almost doubling every year. This is happening without Apple requiring doing some special intervention for India like creating an affordable iPhone, etc., as was believed in the past that could give a breakthrough to Apple in India. Apple crossed the 1 million mark a decade ago in 2014 when its sales crossed the milestone in India. Back then also, the sales were primarily contributed by its 5S model, while its affordable 5C did not see much acceptance. In a decade’s time, in 2024, I expect Apple to cross the 10 million milestone meaning in a decade its sales will grow 10 times in India. All this selling primarily luxe (>₹50,000) segment smartphones.

Apple took almost 10 years to double its market share in India in smartphone sales. However, it should not take the same looking at the macro-economic factors that are favouring India and fueling its growth comparing global markets. Looking at how the premium segment is growing along with the economic conditions as indicated by GDP forecasts, Apple should be able to double its market share in a span of next 3-5 years. This means by 2026, its market share in India should be 10% of the smartphones and by 2030, we can expect it to be more than 15%. However, we might again see a stagnation for iPhone sales by then and wait for the next wave for Apple in India. Apple’s growth in India will continue to be this way where we will see it stagnant for 5-6 years and then for next 3-4 years doubling to take the market share up.

Now who should be worried of this growth of iPhone in India especially in next 3-4 years when Apple double’s its market share crossing 10%. There are a bunch of smartphone brands from the android stable who could get impacted. There is Samsung which has its unique position in the android premium segment followed by OnePlus which also has consolidated its presence in the target group and then there are brands like Vivo, OPPO, Xiaomi, Motorola, Google and others who are wanting to take a pie of this promising and profitable segment.

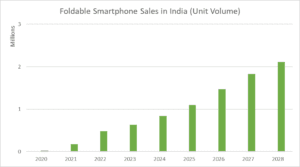

Samsung seems to be getting less impacted as it has sort of quarantined itself with S and Z series smartphones. Z series obviously has a unique fold form factor giving it a visible and tangible edge over iPhone and with the launch of 5th generation of Z Fold5 and Z Flip5, the products will be seen high on maturity by the consumers than from other brands who are foraying in the foldable smartphones niche. On top of it, Samsung has additional points to score like premium retail stores, after sale service, Knox security suite and other aspects for its long pedigree of selling premium smartphones. On the other side, consumers already are seeing it as the de facto brand when they decide to buy a smartphone costing more than ₹100,000. This positions its S series, especially the S Ultra in a unique advantage where consumers prefer to buy it when they decide to go for an android only option while upgrading. Even when it comes to users looking to buy a smartphone within android for more than ₹50,000, majority of them go with Samsung as we can see from the market share analysis of android only brands in the luxe segments. Other brands except OnePlus have a very thin presence in this segment. Despite some of the smartphones like Xiaomi 13 Pro and Vivo X90 Pro being impressive smartphones, these brands have not yet been able to make an impressive hold of the segment. Oppo has Find X series in the segment, which I am yet to find in the market or with any consumer.

While Samsung and OnePlus will keep making their luxe offerings better to get the best out of their equity in the segment, Vivo, OPPO, Xiaomi, Motorola, Google and others need to rekindle their product strategy for this segment. The main issue I see is that these brands are trying to replicate the play book of mid and lower segments in this segment as well expecting to see similar results. At the same time, Google might also need to revisit their approach where they are going across the market with same variant of Android. Though in the entry segment they did try out with Android Go, etc., they never thought of creating a variant of the OS that caters specifically to the needs of the premium and ultra-premium users.

In disguise ‘premium’ android brands have developed a promising feeder market for iPhone in India - Techarc

August 24, 2023[…] our recent InsightsPro we have explained how Samsung is quarantined to a certain degree as it has successfully established […]