Consumers make their decision to buy smartphones and other smart devices basis brand, quality, trustworthiness, value, and price that these devices and their brands have to offer to them.

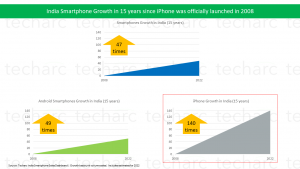

The smartphone industry in India has over 15 years history. Out of these, the last 10 years have been exciting as we saw a new breed of brands in the market that changed the entire dynamics.

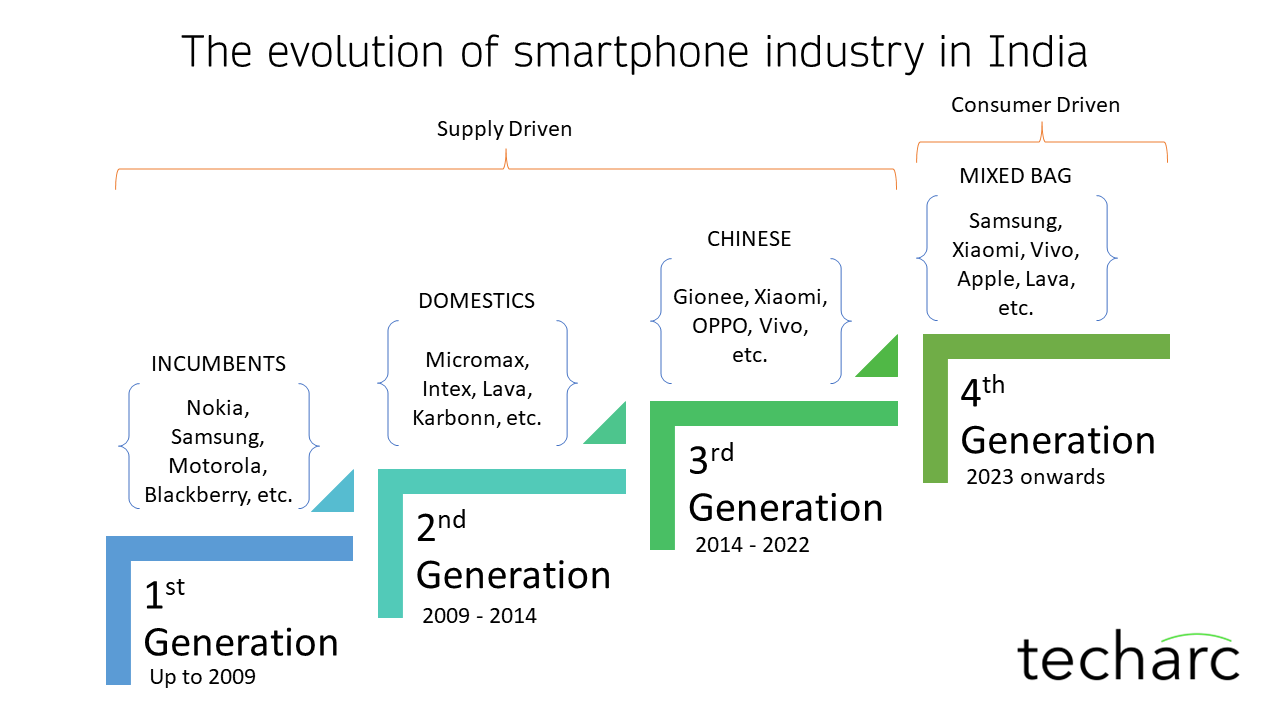

The journey of the Indian smartphone industry can be traced spanning over 4 distinct periods or eras. The 1st generation was dominated by the incumbents like Nokia, Samsung and Blackberry where the smartphone was not a mass product, and the industry was being catered to globally. This era also did not see much of innovation and the main application of the smartphone was communication along with rudimentary Internet enabled communication like emails, chat, etc. At this time, India was primarily a feature phone market with over 97% of the total sales.

The 2nd generation started when the trader community representing channel partners of the incumbents as well as some new age entrepreneurs who wanted to leverage the promising growth of mobile phones in general and smartphones in particular. These channel partners started importing directly from Chinese ODMs and rebranded their smartphone phones under their labels which gave rise to the brands likes Micromax, Intex, Karbonn and Lava, which later were collectively called as MILK brands after a report of mine in 2017, where I referred them as so for the first time. This is when we saw lot many features getting added to smartphones and consumers started using smartphones beyond communications. Of course, these brands were not responsible for this innovation, but they worked out with their Chinese ODM partners to supply feature rich smartphones. The brands also need to be credited with bringing affordability in the sector helping the smartphone base to grow like never before. As a result, we saw smartphones contributing to over 38% of the total sales nearing 100 mn units landmark by 2015.

However, this growth attracted several OEMs who had by now setup in China and were looking for global markets and India being an easy one to foray in. This was because the domestic brands were still mostly into trading and relied heavily on the Chinese ecosystem for design and manufacturing. There were some parallel developments which also helped Chinese brands to mark a strong entry in the India market. Notable among them was Reliance Jio foraying into the telecom market with free 4G service which caused data revolution in the country and along with that the emergence of e-commerce giving an over-the-top access to brands with customers without investing in establishing through the traditional channels. This 3rd generation saw some of the early Chinese entrants like Gionee, OPPO and Vivo growing in their market stature as well as the newcomer Xiaomi registering a wildfire growth through its Redmi portfolio. Gradually, we saw China origin smartphone brands ruling the roost marking the downfall of domestic brands as well as posing a threat to incumbents and global brands. While Indian brands should be given credit for expanding smartphone base in the country with several featurephone users upgrading to a smartphone in the affordability segment, the Chinese brands powered the data revolution giving users an affordable option to upgrade to a 4G smartphone.

The 3rd generation of smartphone industry in India spanned for over 8 years where we saw brands like Redmi and Realme pampering users with fully loaded smartphones in the affordability segment, and at the same time brands as OPPO and Vivo took on incumbents like Samsung by spreading their portfolio across all the segments. Though these brands got recognised in the mid-premium segments. The era also saw strong establishment of OnePlus in the premium segment. In fact, OnePlus pioneered a new segment for the industry which is currently seen as a driver for growth in revenue terms for the industry.

Till 3rd generation of smartphone industry in India, it made a lot of sense to categorise and classify the industry by the country of origin of the brand. The consumers were looking for maximising value on their investment and the market was primarily driven by the affordability segment. This was where China origin brands were seen as strong, and they became synonymous to growth in the industry over a period of time.

2023 onwards we are seeing a different order in the smartphone industry. Country of origin of the brands rarely matters to the consumers. In an analysis of consumer questions on ecommerce platforms like Flipkart and Amazon, we found less than 0.3% of the consumers inquiring about the origin of the brand in an analysis of over 200,000 such questions asked between 2019-2022. Even in focus group discussions and other customer interactions, we find consumers considering different brands to buy irrespective of the country of origin. For example, a consumer wanting to buy a smartphone for around ₹50,000 wanted me to recommend a smartphone from Samsung or OnePlus. Same is the case with several such queries that I receive from different sources. In the Luxe category it is mostly choosing between Samsung and Apple. But we cannot say that they are being compared because customers are only considering a global brand. As we see the China origin brands making their inroads stronger in the segment, customers will definitely start considering them as well.

This 4th generation of the smartphone industry is the first generation to be led by consumer preferences and choices rather than the supply side approach. Consumers will no longer accept anything and everything from smartphone brands, however strong a brand may be in its market standing. This is where the brands need a strong understanding of the consumer preferences for which they need to establish strong and direct connect with them. Strategies like community building and D2C could be very helpful tools in establishing this direct connect to understand the consumers. But these will also give only a limited view confined to the customers. For the larger smartphone user understanding, brands will have to engage with the larger universe for continuous feedback and opinions.

Read our recently published Insights Pro identifying the 5 cohorts of smartphone buyers in India.