The report reveals that smartphone consumers in the mid-category are delighted out of post-purchase experiences even though the sales triggers continue to be specifications during the pre-purchase period.

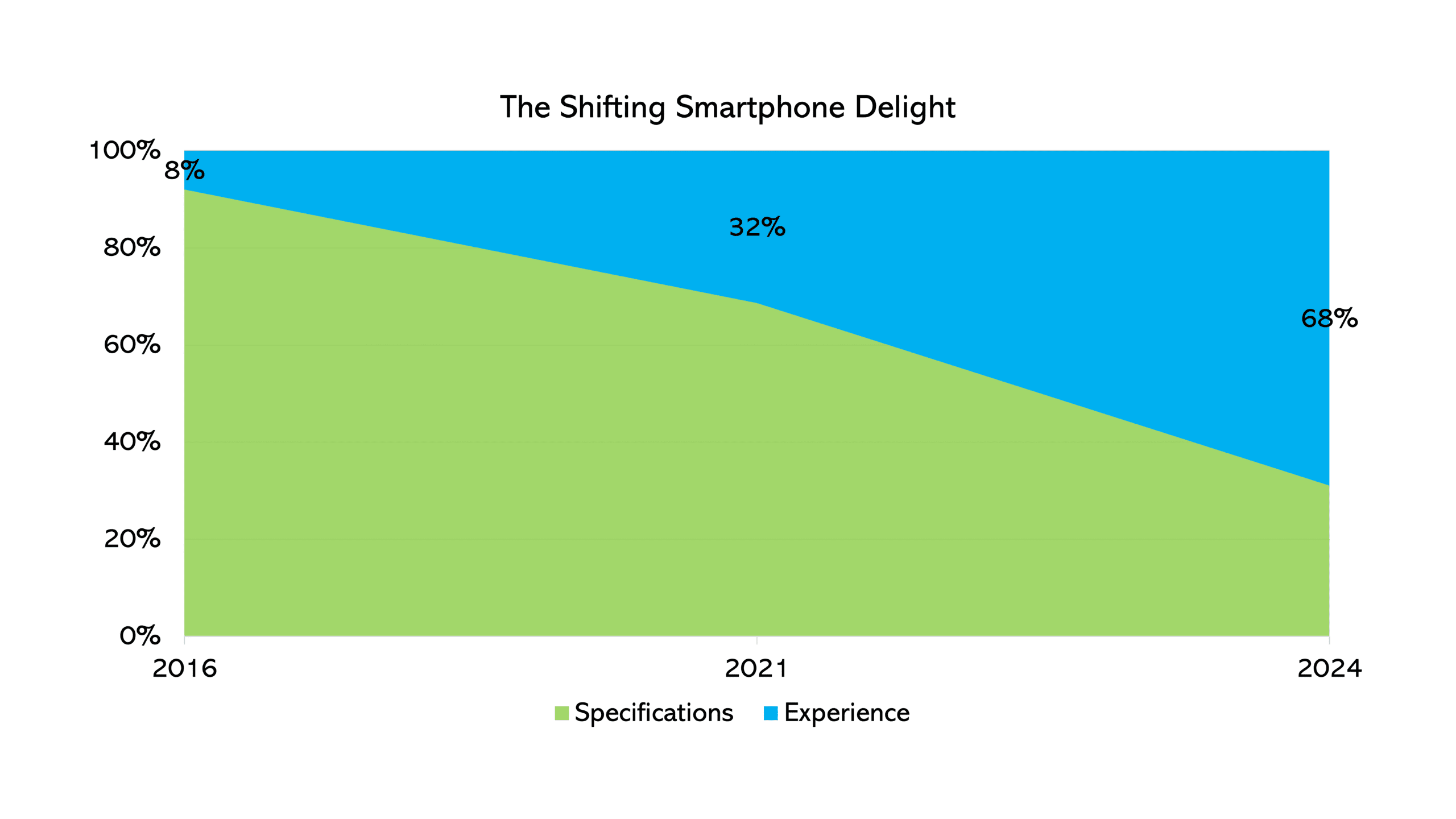

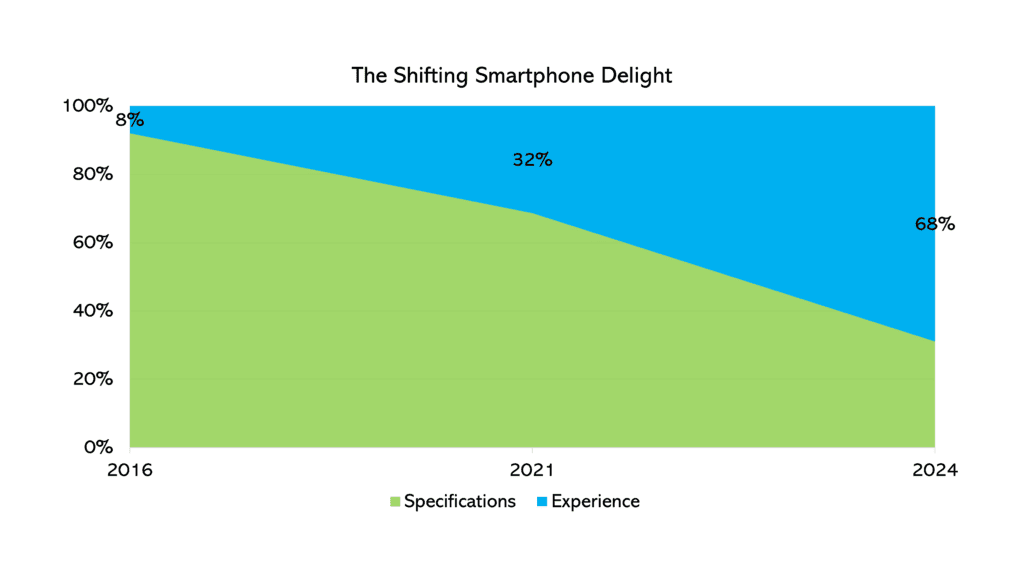

Gurugram / Srinagar – ‘The shifting smartphone delight’, a report published by Techarc today identifying the shifting consumer behaviour in smartphones (mid-segment category) reveals that post-purchase experiences are becoming important in delivering delighted experiences for smartphone consumers as against the pre-purchase specifications that continue to be the sales triggers. The gap identified by the report highlights that while smartphone OEMs continue to emphasize more on specifications of key functionalities of a smartphone, consumers are increasingly measuring satisfaction on the post-purchase experiences.

Sharing key takeaways of the report, Faisal Kawoosa, Chief Analyst & Founder, Techarc said, “For years smartphone OEMs have been expressing value proposition of a smartphone by way of listing out key specifications triggering consumer sales. While this trend still exists, consumers are shifting towards post-purchase experiences to evaluate the customer delight.”

“Examples like night photography instead of mega-pixels in a camera, battery life instead of battery size, gaming / OTT experience instead of processor cores are some of the shifting parameters that consumers measure satisfaction and delightful experiences out of a smartphone,” added Faisal.

Report Highlights

- Experience driven factors feature among top 10 consumer delight parameters in a smartphone. Factors such as battery life, design, stability, thermal efficiency, charging, software and durability seen impacting the consumer delight in recent times.

- Factors like camera, performance and battery where both specifications and experience impact the consumer satisfaction are also witnessing a change with a shift happening more towards non-specification driven satisfaction such as night photography in camera, gaming in performance, and the battery life.

- After AMOLED screens display hasn’t seen much of an innovation reducing its impact on the consumer delight.

- In 2024, the usage tenure has gone up to 3.5 years. With consumers continuing to buy pricier smartphones and the durability and longevity of smartphones improving due to the hardware quality and regular software updates, it could go even up to 4 years in 2025 and beyond.

- 88% of users with their current device older than 3 years are still satisfied with their smartphone performance. Other than many features they continue to be happy with, 71% of these consumers also find software as a key reason resulting in this experience. The users find their smartphones receiving regular software updates that keep them high on performance.

- Consumers are increasingly interested to know about the durability and longevity that a smartphone offers. 37% of prospect buyers inquire about the number of years for which an OEM will offer the OS upgrades before deciding a purchase.

- 63% of smartphone users find the display replacement costly. 74% of the smartphone users find any kind of repairing tedious and causing interruption in usage.

- Performance as defined by the processor ranks 3rd in the list of customer delight factors. Consumers would continue their existing smartphones if performance does not drop with the passage of time. 31% of the customers believe regular software updates result in consistent or improved performance of a smartphone.

- 43% consumers consider key applications like gaming, watching OTT videos and similar resource guzzlers as it tests all the capabilities including efficiency, battery size & optimisation, and heat dissipation in a smartphone.

- AI has generated interest among smartphone users, who are exploring how it can add value to their lives. However, AI is still not a factor that delights smartphone consumers. There are 7% of consumers who expect AI to play role in camera functions. Being at a nascent stage, the AI features are still expected to continue as ‘nice-to-have’ features without having much impact on the decision criteria of buyers.

About the report

Using Techarc’s proprietary InfiSights tool, more than 150,000 reviews and questions were analysed on leading smartphone marketplaces like Amazon and Flipkart. The reviews and questions captured were regarding 62 smartphone models in the mid-range category. The smartphone models selected were a mix of new and old models. To identify the post-purchase delight factors, only the reviews that were rated 4 or 5 were selected and then themed using machine learning and AI algorithms. Some of the data points used in this report were also captured for recent surveys done by Techarc that were carried out after October 2024.