2024 onwards the smartphone industry will need to change the way it sells smartphones. The brands selling smartphones will have to put what their phones can do rather than what they have as the key selling proposition or KSP.

AI is transformative in many ways. There is no ambiguity about it. We all understand its all-pervasive and has already started impacting lives of millions of people across the world. AI is already in our lives one way or the other. We may already be aware that we are using AI or yet to realise it. The big bang of GenAI in 2023 was a turning point. The next big thing is going to be AI on device. This will consumerise AI and millions, eventually billions of people will start using AI in their daily lives.

Mobile – the primary man-machine interface for decades

For over 25 years now, mobile phones have become the primary man-machine interface. It has been the key enabler of massifying several empowering technologies transforming the way of living. After enabling so many technologies and applications, the smartphone is all geared up to bring AI to the masses. Tracing the evolution of mobile phones, we can say this marks the start of 4th major revolution that will bring AI to billions of people over next 3-5 years. The first era was of communication, where the mobile phones made communication accessible. The access to communication was the key selling point, when we could do the unimaginable! We could simply connect with anyone from anywhere by making a call or by sending an SMS. This was a big revolution that eventually led us to present times where almost everyone today on the planet earth is connected. The next big revolution was of bringing Internet, later BWA (mobile broadband) to the masses. This unleashed infinite possibilities and led to real empowerment as well as disruption. Businesses, governments and societies started with a digital first approach. Accordingly, the smartphone industry worked relentlessly on enhancing the capabilities and functions of a smartphone. The idea was to allow users get connected to the internet highway and feel empowered. The third era was of content (including commerce). People started creating, consuming, sharing and selling content through smartphones. We saw the emergence of app-economy, and everything became digital. Perhaps for the first time in the history of mankind, we learnt and understood a lot about human behaviour and preferences and data analytics became a reality. Now organisations – governments, businesses and other institutions could connect directly with the audiences and share / sell their content, which could be in the form of information, entertainment, services and even products.

With AI the smartphones are all set to enter into 4th era where they will naturalise the companionship of technology for masses. Technology will no longer be something that people will need to connect or engage with. It will be just a buddy or companion allowing users to consume technology and the value it brings very naturally and effortlessly. The very first impressions of Samsung S24 Ultra, gives us a sense of how the smartphones of the future will look like as it is the first such smartphone bringing AI to life. Though there has been AI implementation by Google also in its Pixel 8 edition, but it’s mainly to help content creators.

Samsung S24 Ultra – First AI smartphone in true sense

The Samsung Galaxy S24 Ultra presents AI in the way and stature that it deserves. Though the industrial uses of AI have been more serious and directly impacting the future of businesses, the consumer side of AI was so far portrayed as more of a fun enabling technology. It was mostly shown as a technology helping people to remove or change backgrounds in photos and videos, as well as create some more variations in the existing content.

With GenAI becoming the focus in 2023, people started seeing AI as a serious enabler in the form of creating content, as well as solving some of the complex problem statements ranging across a spectrum of sectors and backgrounds. However, to the masses it was still at a conceptual stage with a sketchy interpretation in mind.

The Samsung S24 Ultra helps tangibalise AI, including GenAI for the masses. Although, it will remain niche for a while. With this launch users will see AI as an enabler of productivity, adding focus to their work, and getting more organised by finding great hacks to a work-life balance. AI is to be seen as the technology friend or buddy of people, which at the moment is productised as Samsung S24 Ultra.

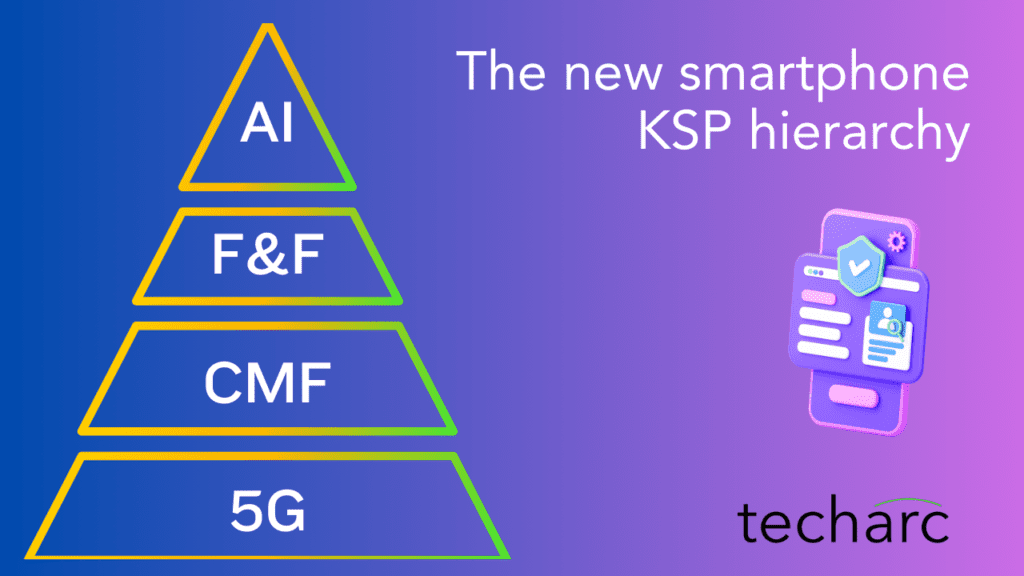

The new KSPs of smartphone industry

Sometime back we had identified the conscious cohorts of smartphone buyers in India. The smartphone OEMs have been consciously or unknowingly addressing these cohorts. However, there have been still gaps as the emphasis has mostly been on the specifications versus price. There has been almost negligible cohort driven selling, which is need of the hour for the smartphone industry.

At the same time, there is a new hierarchy of KSPs or key selling propositions structuring in the smartphone industry. The brands in 2024 will have to align depending on the tier of smartphone users they are targeting. AI will be the top tier anchor feature that will drive attention of the potential buyers who are ready to pay a premium for the value they already see in AI. Also, these include the tech evangelists who love to stay ahead of the curve. In 2024, this will remain the ‘creamy layer’ of smartphone users forming a niche segment. All the smartphone brands who want to position and focus on this segment will need to accelerate their AI on device endeavours, especially after the launch of Samsung S24 just at the beginning of 2024. Right now, we only have Google which has shown the capabilities but its equity among the smartphone users is minimal. Apple on the other side pioneered neural computing but has not been very explicitly talking about AI and is yet to showcase its AI smartphone. No other brand has done anything around AI except for may be making some media announcements here and there about them working on AI. Looking at the market dynamics, Samsung has created a sustainable differentiation through AI mapping with this niche that will drive value sales for the smartphone maker.

The next in the hierarchy comprises of the brands that will foray and/or enhance their play in the foldable and flip form factor of smartphones. We already have Samsung, Motorola, Oppo, Tecno and OnePlus offering their foldable / flip phones in India. Other than these, Vivo and Xiaomi are two key players in the Indian market who have the form factor available in other markets. The F&F (Flip and Fold) segment will be a bigger opportunity compared to the AI tier; however, it will also interest a niche segment of users. Concerns around durability, use case and convenience (pocketability) still hover in the minds of potential buyers. These buyers have the capacity and to some extent willingness to buy, but they are fence-sitting only to see what the existing consumers experience about the fold and flip smartphones. In 2024, the second half should see some pickup in fold/flip smartphones by when it will be more than a year’s use for majority of existing users of this form factor. Though brands are trying their level best to educate and convince the potential buyers about the durability and the overall value proposition, the hesitation is quite visible in the market. Irrespective of this hesitation, the opportunity to sell fold/flip smartphones will be greater than the AI smartphones, especially after we saw some of the OEMs introducing ‘affordables’ widening the market potential.

Not by design, C-M-F (colour, materials and finish) has become a key focus in the mid and premium range. It has become more of an unavoidable necessity for the OEMs to excite potential buyers in this segment. Incidentally this is the segment where we have the maximum opportunity. This is the segment where maximum number of smartphones will be sold in 2024. The challenges here are many. Firstly, there is nothing that can be powered by a fundamental technology which could be offered to the buyers. The natural hardware-software progression continues in this segment, which has been the playbook of the smartphone industry for years now. This will continue to be the practice in this segment where we will see OEMs launching smartphones with higher value of pixels, RAM, ROM, battery capacity, etc. 5G is no longer an appealing sell for this segment. Many of the potential buyers are already on 5G in their natural upgrade / replacement journey, while others will also join 5G as their replacement / upgrade stage arrives. There has been nothing so far developed for consumers using 5G, so why will a user prepone the replacement or upgrade only to get hold of a 5G smartphone? One of the things that the brands in these segments, which they can also do through collaboration and partnering, is to focus on how 5G use cases for masses can be developed so that 5G remains a sales trigger.

As an alternative, the smartphone makers operating in these segments have adopted the automobile industry strategy, which is to deviate from the core technology offering and drive attention towards the exteriors of an automobile – the more visible things of the product. The smartphone industry has been innovating and experimenting with different materials, colours and the finishing techniques, patterns and coatings to creating a palette of permutations and combinations to offer choice to consumers. So, while consumers do get the given and must haves of a smartphone including 5G, they also get something that soothes their eyes. To enhance the aesthetic appeal of a smartphone has been the core focus of the brands offering smartphones in this segment, and this will continue in 2024 as well. There is not a clear-cut winner yet, or something that consumers have shown strong preference for. But the acceptance of pastel and sober colours is on the rise. Similarly attempting various patterns on the body as well as jacketing it up with grainy vegan leather is also something that the users are liking. On the premium side, we may see some brands experimenting with some elements of titanium in the body following the Apple and, now Samsung path.

The final and the lowest tier of the hierarchy is the opportunity driven by 5G. While the upper segments won’t get impressed with 5G as a KSP, the budget consumers will be wowed with their next purchase enabling them to user faster internet speeds. Fundamentally, though this won’t make any difference in their existing satisfaction, use or value derived from an already owned 4G smartphone, but they will not be seen as an ‘outcast’ to the next generation of cellular technology tribe. After CMF, and F&F tiers of the KSP hierarchy, this tier will comprise most of the opportunity for the smartphone makers in 2024. However, it goes with a rider of how many 5G options will be there in sub ₹10,000 price range, and that too without compromising the overall proposition by toning down other elements defining the experience.

The last take

The smartphone industry needs a ‘hit refresh’ of strategy and execution. The existing rules of the game have been over utilised and don’t have now the capacity to deliver. Be it cascading of features to the lower price segments of the market, increasing the specs-price value or driving cellular generation adoption, these cannot continue to be the main triggers propelling sales. The new KSPs proposed here could be one of the new ways refreshing the business of smartphone business. This also means that everything has to change across the customer journey during pre-sales, sales and the after sales. When the sales triggers or in other words the motivation to buy a smartphone is going to be different for these buyers plotted across this hierarchy, everything else also has to align. So, the KSPs!