Your cart is currently empty!

Youth acceptability of Lava and OnePlus to further increase their market shares in 2024 and beyond. Youth are expected to contribute 44% of the total smartphone sales in 2024

Posted by

–

OnePlus likely to gain 6% market share, followed by Lava (4%) and Apple (3%). The top likely losers are Redmi (-4%) and Realme (-3%). Barring Samsung and Vivo other brands expected to lose at least 1% of market share.

Gurugram – The youth preferences are changing with regards to smartphone brand preferences in India. This is going to have an impact of present market shares with brands like Lava and OnePlus benefiting the most. Other two brands Samsung and Vivo are expected to gain equally.

Youth (up to 25 years of age) constitute an important segment of smartphone users as well as influencers. Not only do they have a very strong opinion about which brands to go for, they also play an important influence in purchase of smartphones of their parents and grandparents.

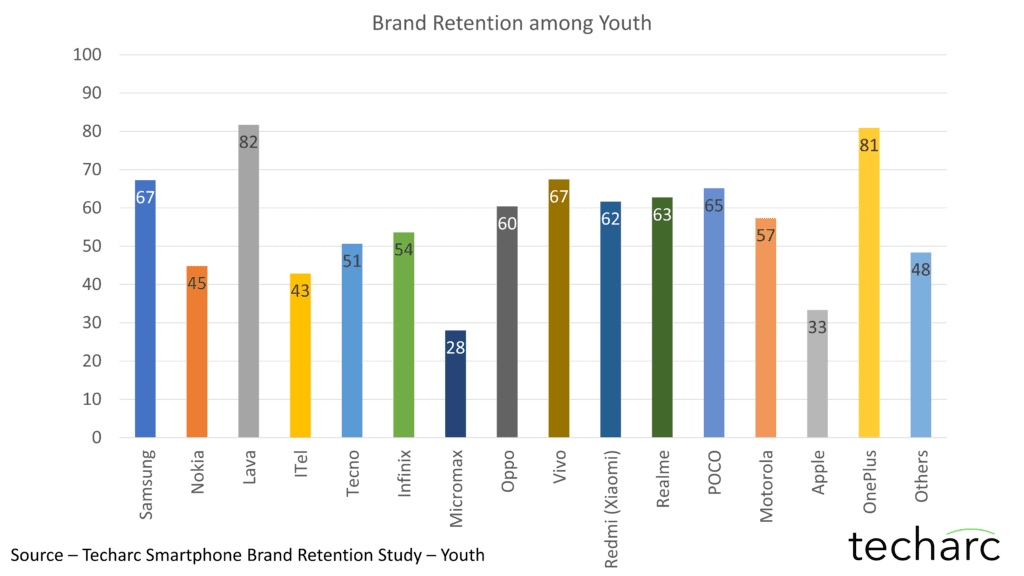

As per our findings based on a survey conducted across the country covering views of 3,600+ youth, including students, 82% of the existing Lava users are likely to purchase their next smartphone from the same brand. Recent changes in the brand by way of introducing 3 youth centric series of Blaze, Agni & Yuva which is offering youth centric designs with affordable 5G options has helped Lava in shaping this positive imagery among the youth. Lava is followed by OnePlus, where Nord series has become very popular among youth. 81% of the respondents who are currently using a OnePlus phone want to continue with the brand. Samsung and Vivo share the 3rd slot with 67% of the existing users wanting to purchase their next smartphone from the same brand.

Preferences among students are changing as well

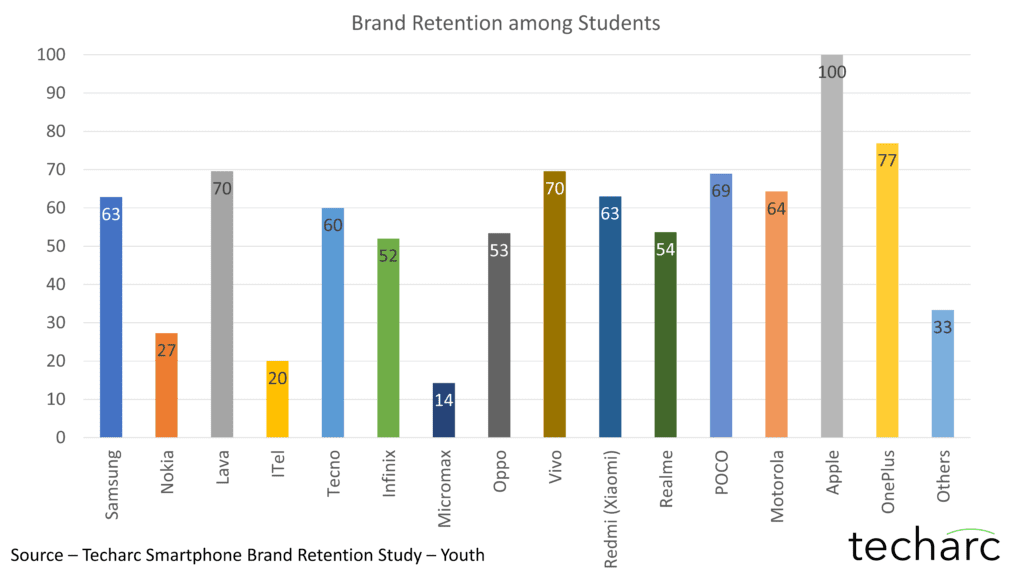

Students form an important sub-segment of the youth population. It is equally important for any brand to be popular among the students, as it is overall in the segment. Among students Apple leads the sub-segment with 100% of the existing iPhone users wanting to switch to an iPhone only. They want to upgrade within Apple. This is also driving sales of iPhones in India where we are seeing youth purchasing older iPhone models either through financing or full upfront payments. Among Android smartphones, OnePlus has the highest repurchase rate where 77% of the students want to buy OnePlus smartphone as an upgrade/replacement. Vivo and Lava follows with 70% at 3rd spot.

For students, the entire CMF (Colour-Material-Finish) factor is an important decision maker. All these smartphone brands have introduced smartphone models targeted at youth with CMF aligned to their preferences and choices. Other than camera and battery, smartphone brands are emphasising a lot on the CMF, to increase their acceptability across segments, including students.

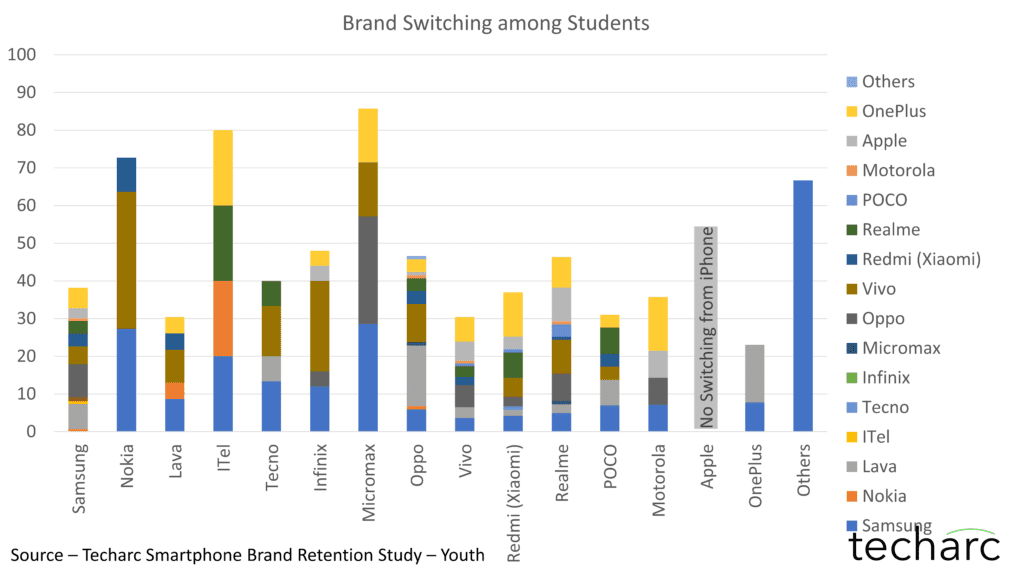

The inter-brand switch is not favouring any single brand

Among the prominent brands, OnePlus users are likely to switch to very few other brands. For other brands that are in currency at the moment, users are planning to switch to 8-10 different brands. This implies that youth see almost every brand operating in the segment having an appeal for them. Students using iPhones, however, want to stick to the brand.

There is not a single clear winner brand which is expected to substantially benefit from the inter-brand switch pattern among the youth. Basis their own preference, choices and other factors, youth show very distinct switching patterns that is also influenced by their socio-economic background. This means that no smartphone brand can afford to ignore youth and should continue to have youth centric portfolio in terms of dedicated series or specific models.

Also, there is no such trend to note that users of any specific brand are switching in favour of another particular brand. So, no brand is clearly eating up another brand’s share.

Interactive chart showing possible brand switching among youth

Significance of the analysis

This insight showing the analysis with regards to brand retention and switching trends among youth will have a significant bearing on the market shares of smartphone brands in 2024 and beyond. It is likely that over 4 out of every 10 smartphones sold in India will be purchased by youth (people less than 25 years of age) in 2024. The changes in the market share in this segment will have a cascading effect on the overall market standings. Apart from youth representing a significant market segment, which is likely to grow at 12% in volume sales in 2024 compared to 2023 as per our analysis, they will also influence selection of smartphone brand by their parents and grandparents. So, the market share changes in this segment can be extrapolated to the entire market and is a reflection of the impact on the overall market shares of the smartphone brands over next 12-15 months.

The analysis also shows how certain brands can expect growth in volume market share in a scenario where the overall market is unlikely to grow in 2024 as well. As per our preliminary analysis, we expect 2024 to remain flat with a nominal growth rate of 3-4% in volume sales of smartphones comparing 2023.

About the study

The study is basis a survey conducted by Techarc among 3,631 youth, including students. This represents statistically significant sample of youth including students across regions of the country. The study was conducted in mixed mode (Offline and online), where youth were asked about the present smartphone brands they are using and their likeliness to retain the brand or switch in favour of some other brand. Basis this survey, the likely impact on the market shares for 2024 and beyond was also ascertained to understand the market share movements for different brands. The market share changes are likely to occur in next 12-15 months. For queries regarding this analysis please contact us. To know more about Techarc, please visit www.techarc.net.

3 responses

[…] (Via) […]

[…] گزارش Techarc براساس نظرسنجی بین ۳,۶۳۱ جوان هندی حداکثر ۲۵ ساله منتشر شده است و نشان میدهد اکثر آنها به گوشیهای لاوا و وانپلاس علاقه دارند. […]

[…] A user when looking to upgrade in the premiumisation journey is looking for a couple of things. The first and foremost thing is a tangible differentiation in design, look and feel. For example, competition brands in the segment like OnePlus, Oppo and Vivo offer slimmer smartphones, curved displays and unique material finishing of devices giving tangible and visible distinctions to a consumer looking to upgrade. The feel is premium. Then of course with regards to features there is fast charging, enhanced photography, better audio experience, immersive display, among others. Samsung A series phones also have some of these elements. The colours are also trendy and in line with the expectations of the segment. But what triggers inter-brand switch is the design and looks of other brands that cannot go unnoticed in the segment. This is increasingly becoming important for youth, who are likely to contribute 44% to the smartphone sales in 2024. […]