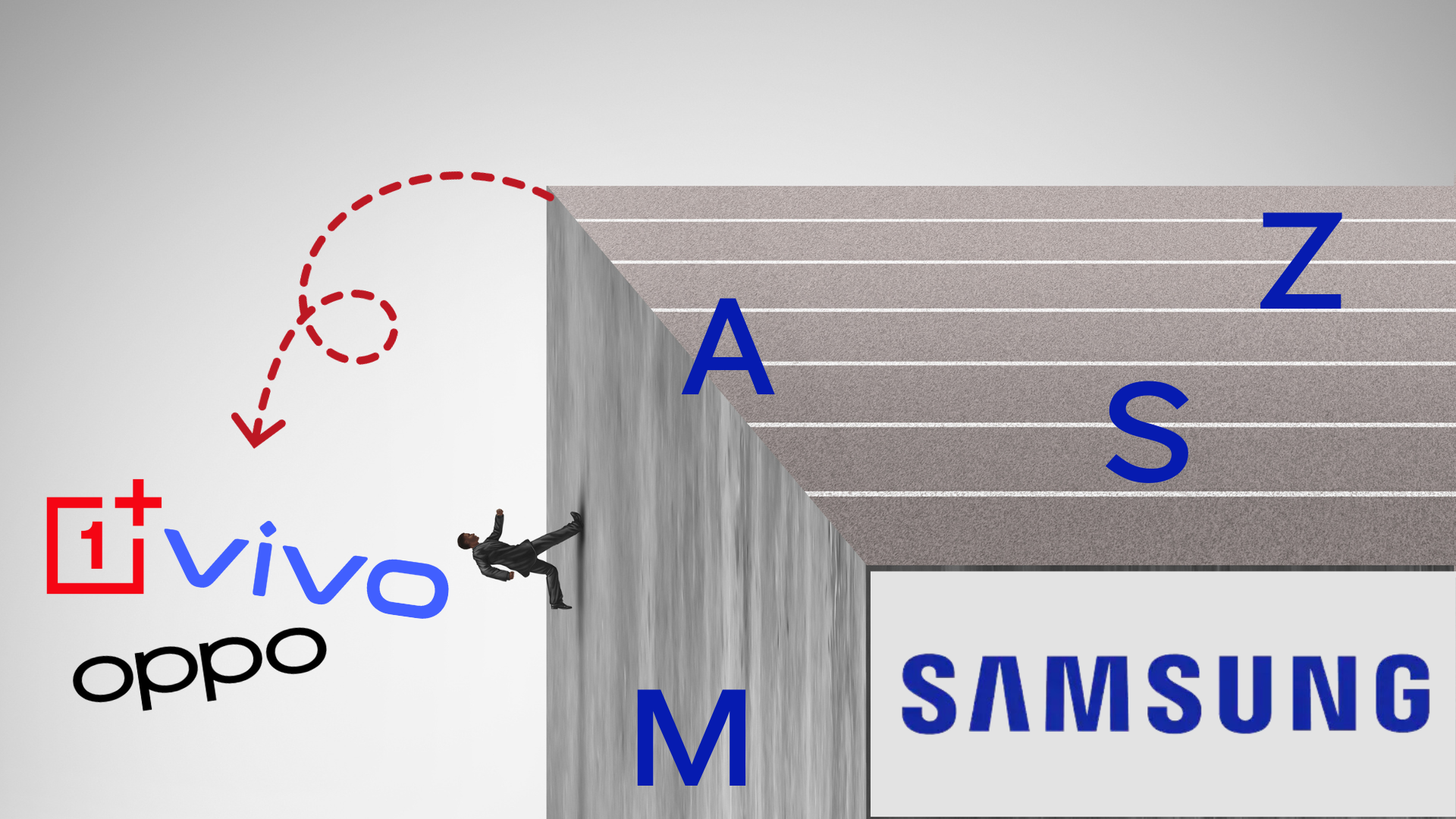

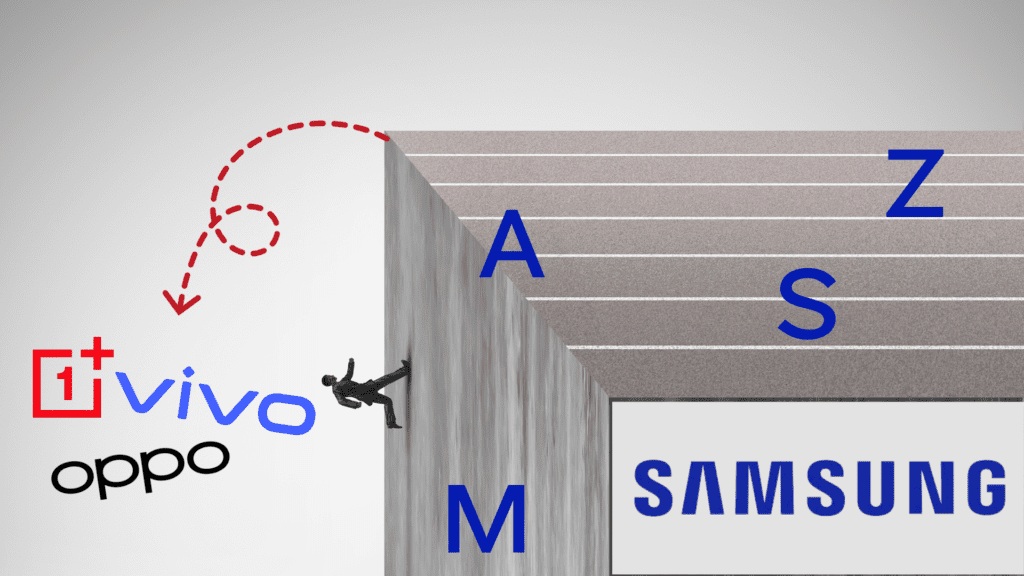

The A series is the ‘weak link’ in Samsung’s portfolio resulting in inter-brand switch in favour of brands including OPPO, Vivo and OnePlus. The M series users need to be given noticeable value in upgrading to A series who will then upgrade to S and Z series in their journey of premiumisation.

Samsung and financing of smartphones has developed great synergies. Talk to any retailer and you will learn that even customers who can afford to buy paying upfront the entire amount are increasingly showing interest in availing financing options rolled out by Samsung. No doubt it is also helping Samsung to upsell. Customers who come to purchase smartphones in the range of ₹30,000-40,000 end up buying phones at least 30-35% costlier thanks to the financing scheme allowing them to purchase on EMIs.

But this alone isn’t enough. At least for allowing M series users to upgrade. For an M series user to directly jump to S / Z series isn’t a routine behaviour. These are outlier users for the normal trajectory of premiumisation. The ideal upgrade for M series smartphone users within Samsung is A series. But this is where the weak link is! The A series portfolio of Samsung is a replica of M series with primary upgrade in RAM/ROM configurations. Well, that is not enough for users who look for premiumisation.

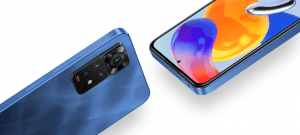

A user when considering upgrade in the premiumisation journey is looking for a couple of things. The first and foremost thing is a tangible differentiation in design, look and feel. For example, competition brands in the segment like OnePlus, Oppo and Vivo offer slimmer smartphones, curved displays and unique material finishing of devices giving tangible and visible distinctions to a consumer looking to upgrade. The feel is premium. Then of course with regards to features there is fast charging, enhanced photography, better audio experience, immersive display, among others. Samsung A series phones also have some of these elements. The colours are also trendy and in line with the expectations of the segment. But what triggers inter-brand switch is the design and looks of other brands that cannot go unnoticed in the segment. This is increasingly becoming important for youth, who are likely to contribute 44% to the smartphone sales in 2024.

Take any A series smartphone of Samsung, it won’t look any different from an existing M series smartphone that a user would have at the first sight. This is what triggers a switch-out of users from the Samsung ecosystem. Some of them do rejoin later when they look for a luxe experience and purchase S or now Z series foldable smartphones. But by that time, the user would have experienced another Android smartphone brand widening the competition for Samsung in the luxe category. The user then gets confused whether to switch back to Samsung to purchase S or Z series, or upgrade within the existing brand, which could be Oppo, Vivo or OnePlus in most of the cases. In one of our Insights Pro, we have already explained how these brands are helping create a feeder base for Apple in India.

Samsung’s S series smartphones are undoubtedly best in Android, and in some cases I would say better than iPhone as well. But the biases that users develop after experiencing A series get carried along and do impact S series prospects as well. So apart from the rising competition from Apple, this hampers the intra-brand switching where existing Samsung users could be retained all through their premiumisation journey.

A series is a very pivotal series for Samsung, which has most of the times remained unaddressed. We have seen in the past as well how A series did not result in a strong competition to brands like OnePlus when they were exponentially growing after successfully having created the mid-premium segment within Android. Once a user moves to S or Z series of Samsung, it’s a different plane of user experience and M remains the launch pad. Samsung would want every potential M series user to taste the penultimate experiences delivered by S and Z series flagship smartphones. But for that its equally important that the pivotal A series is able to do an efficient handoff. It is here when the ‘gravitational pull’ of other brands like OnePlus, Vivo and Oppo start attracting users towards them and takes a user, whom Samsung would have nurtured by then, out of the Samsung ecosystem. This is something Samsung needs to plug in and stop this pilferage minimising the inter-brand switch. In times when we don’t see markets expanding the growth will only come from retaining the existing customers as well as acquiring the customers of competition brands. Premiumisation will help to increase revenues from the same sales volume.

The A series has to be a precursor to the flagship experiences of Samsung offered through S and Z series. For this Samsung will have to have a relook of the entire portfolio and see A as a strategic midpoint where they can give a glimpse of S and Z series to users rather than only adding to the performance for M series users. For this, Samsung will also have to narrow the span of the series which is spread through a very wide range of price bracket serving several user cohorts. The offering has to be pointed and sharp.