In a consumer study done by Techarc, it was revealed that Camera quality, Battery performance and Audio quality are the three important factors determining the expectations of users wanting to buy a smartphone in Rs 6,000-12,000 price segment. The study was conducted surveying 2,000 smartphone users in Tier 2 cities and towns of the country. These users were using the phone for over 6 months and made up a clear perception about the experience their smartphones were delivering against the expectations for which they had chosen specific brands. The study was done among a mixed sample of new as well as existing smartphone users.

Releasing the report, Faisal Kawoosa, Founder and Chief Analyst Techarc said, “Users across segments are approaching towards buying a smartphone with well-defined expectations, and the brands which deliver it or have the least of gap are perceived as a gift or reward purchase.”

“The push approach is fading in smartphone industry, and brands will have to make products that are in line with the already demarcated expectations in the minds of customers.” added Faisal

The report is based on respondents owning all major smartphone brands in the segment including Redmi/Xiaomi, Samsung, Nokia, OPPO, Vivo, Tecno among others.

Sharing more on the report, Amit Sharma, Senior Analyst Techarc said, “Smartphone has to complement the lifestyle of users and for that each compartment / functionality of the phone has to be flawless. Tecno as a brand has been able to deliver on major factors like camera and battery which makes them lead in the segment. There is scope for improvement for the brand in other functions to further reduce the gap.”

Report Key Takeaways:

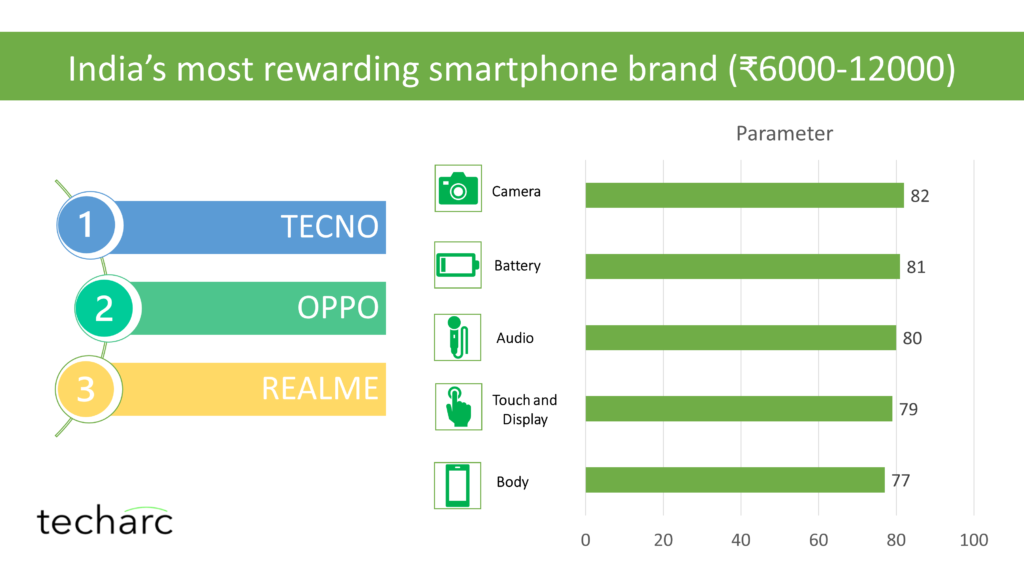

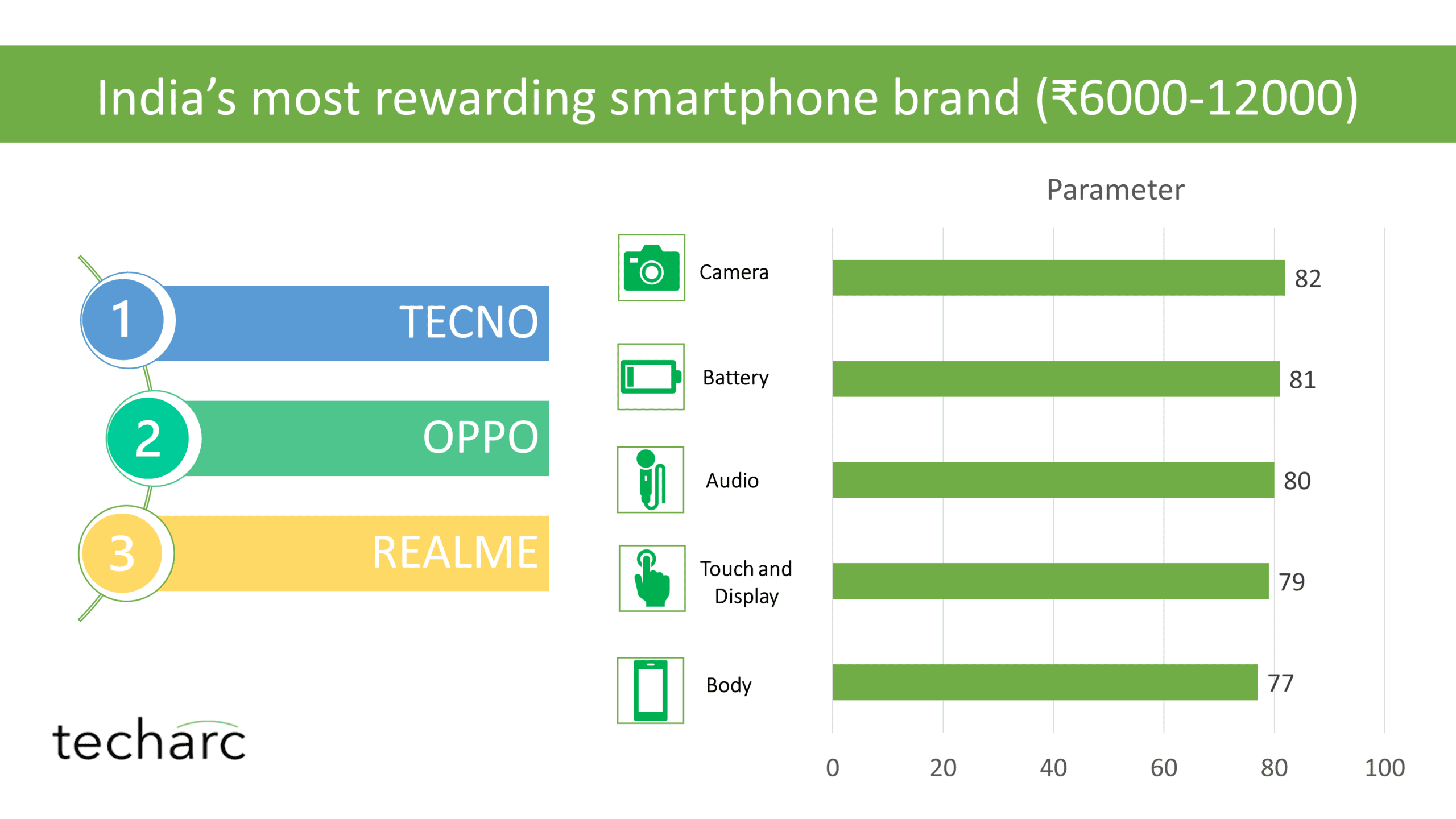

- The performance and quality of Camera, Battery, Audio, Touch and Display and Body are the top 5 factors defining the expectations of users looking for smartphones in the range of Rs 6,000-12,000. This segment caters to both – first time and upgrade smartphone users.

- The segment is very fragmented with key smartphone brands having strong presence in it. Xiaomi, Samsung, Vivo and Tecno are 4 key players in the segment, with each having more than 15% users using these brands as their 1st smartphone.

- The segment is still offline heavy with 6 out of 10 respondents having bought their smartphone from offline channel. A concern here in buying online is the physical inspection and feel of the phone before making the decision.

- The segment users, though clear on their expectations rely heavily on seller solicitation in choosing the brand of the smartphone. It is very important for the brands to educate and train the promoters not only about their products but also point out the distinctions with the competition.

- 82% of the respondents find camera quality and performance as the key parameter defining the expectation from a smartphone. The main functions of the camera performance they are concerned about include indoor and outdoor picture quality.

- Battery performance, audio quality, touch and display and body are the other 4 important factors determining the expectations. 81%, 80%, 79% and 77% of the respondents find these 4 factors very important for making the decision respectively.

- Even though Camera leads in terms of expectations, its stands last in terms of experience that users get out of it. Against 82% of users ranking it No. 1 in terms of expectations, only 66% of the users find their brands being able to deliver to their expectations. This wide gap is owing to the new features and functions that are added to camera in higher segments which sets a new benchmark every time.

- Tecno leads in camera performance with 70% of its users finding the brand meeting their expectations about camera quality and features. In the segment it is followed by OPPO with 69%.

- Within camera, outdoor photography tops camera functions followed by indoor photography, macro pictures, zoom function, wide angle mode, night mode and AI/software optimisations in that order.

- In terms of battery performance, Realme leads in the segment followed by Tecno. 72% of respondents using a Realme smartphone felt that the brand meets their expectations about battery performance. Duration of a charge and the speed at which battery is charged are the two important factors for users in this segment.

- Within touch and display, Xiaomi takes the lead in the segment with users finding it meeting their expectations with regards to size, picture quality and durability of the screen. 78% of the Xiaomi/Redmi users find the brand performing well on expectations regarding display.

- On the quality of the body, Xiaomi users are again leading in terms of finding the brand meeting their expectations. Be it ergonomics or built material, the users of the brand find these in line with their expectations.

- In terms of audio and sound clarity, OPPO users find the brand meeting their expectations best in the segment. Be it the audio output or input, OPPO users feel that the brand is best within the segment in offering the required immersive experience.

About the study:

The study was carried out during July-August 2021, with a sample size of 2,000 smartphone users owning a smartphone in the price range of Rs 6,000-12,000. These smartphone users were owning the device for more than 6 months. Some of the brands that the respondents were owning included Xiaomi/Redmi, Samsung, Lenovo, OPPO, Vivo, Tecno and Nokia. The study was conducted in Tier 2 cities across the country. Some of the cities covered included Ludhiana, Indore and Jaipur.

The study was based on a GAP analysis done among smartphone users between the expectations they had from a smartphone as a segment and the experience they were getting from the smartphone brand they chose against their expectations. The brand with the least gap between expectations and experience delivered was adjudged as the ‘most rewarding smartphone brand’ in the segment.

Why Most Rewarding Brand? Smartphone is a very personal device and if a user gets a smartphone which exactly meets the expectations or reaches very near, the feeling is very fulfilling or rewarding. The user feels maximum value derived from the purchase and develops an emotional bond with the brand. Techarc, basis GAP analysis of expectations at an aggregate level of the segment, and comparing it with the experience that each brand delivers, found out the most fulfilling or rewarding brand in the segment.

For industry queries, please write to research[@]techarc.net

For media queries, please write to media[@]techarc.net

Camera and Battery two key parameters determining the smartphone choice in Rs 6,000-12000 segment in India. | Techarc - We follow the arc of technology!

September 20, 2021[…] per a recent GAP analysis (Expectations versus Experience) in Rs 6,000 – 12,000 segment, in which 1 out of every 2 […]